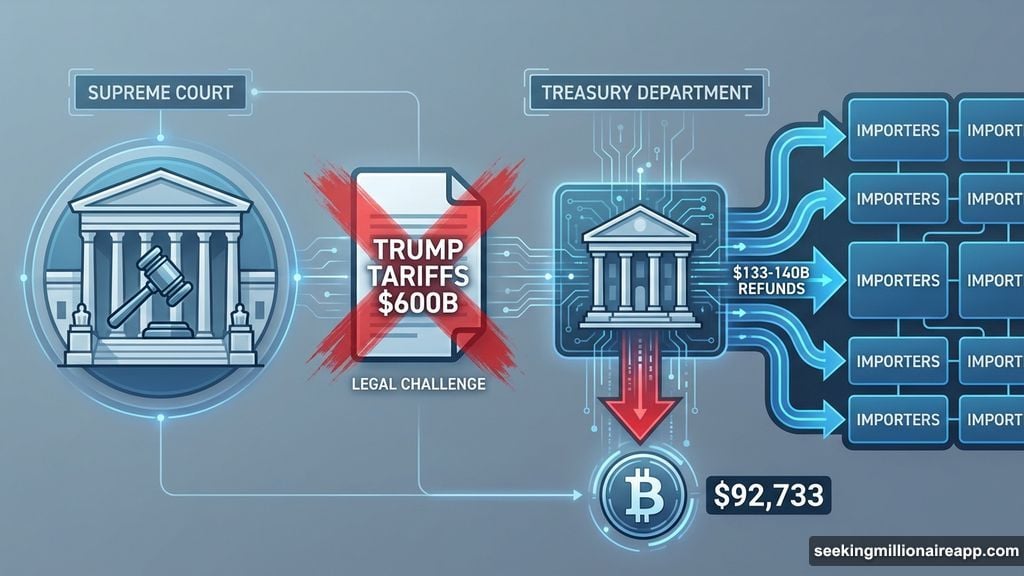

Bitcoin hovers near $92,733. But a Supreme Court ruling this Friday could shatter that stability overnight.

The case centers on Trump’s global tariffs. If the justices strike them down, the Treasury faces refunding $133-$140 billion to importers. Plus, that money has to move fast. Markets hate uncertainty. They hate forced liquidations even more.

Here’s why January 9 might become crypto’s worst day of 2026.

Trump’s Tariff Empire Faces Legal Reckoning

President Trump imposed tariffs that allegedly generated $600 billion in revenue. The Supreme Court now decides whether he exceeded his authority. Justices return from a four-week break to release their opinion at 10:00 AM ET Friday.

A negative ruling creates immediate fiscal chaos. The government would owe importers massive refunds. That drains liquidity from markets already stretched thin by high valuations and concentrated risk.

Moreover, the ruling affects more than just trade policy. It touches inflation expectations, corporate margins, and cross-border capital flows. Bitcoin, which thrives on policy clarity and despises sudden macro shocks, sits directly in the blast radius.

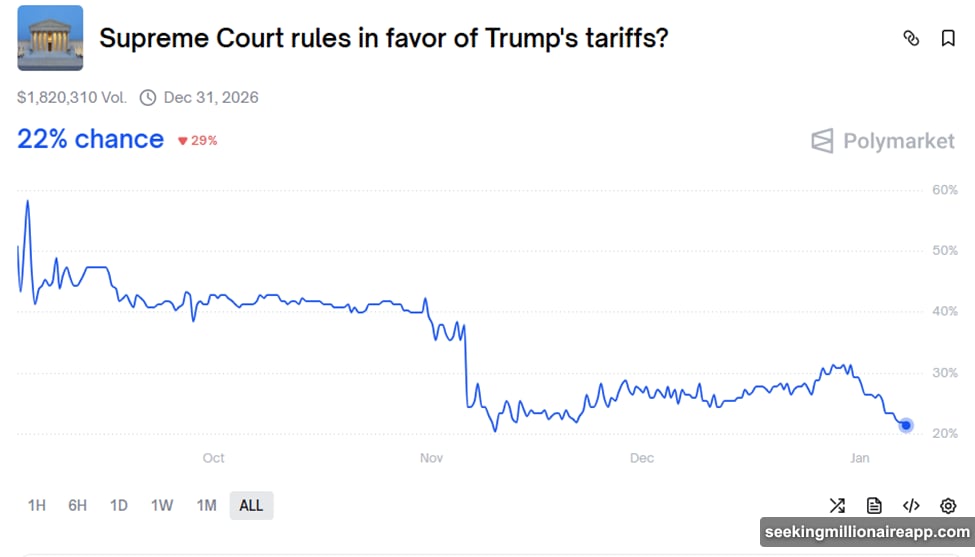

Prediction Markets Show 78% Chance of Tariff Collapse

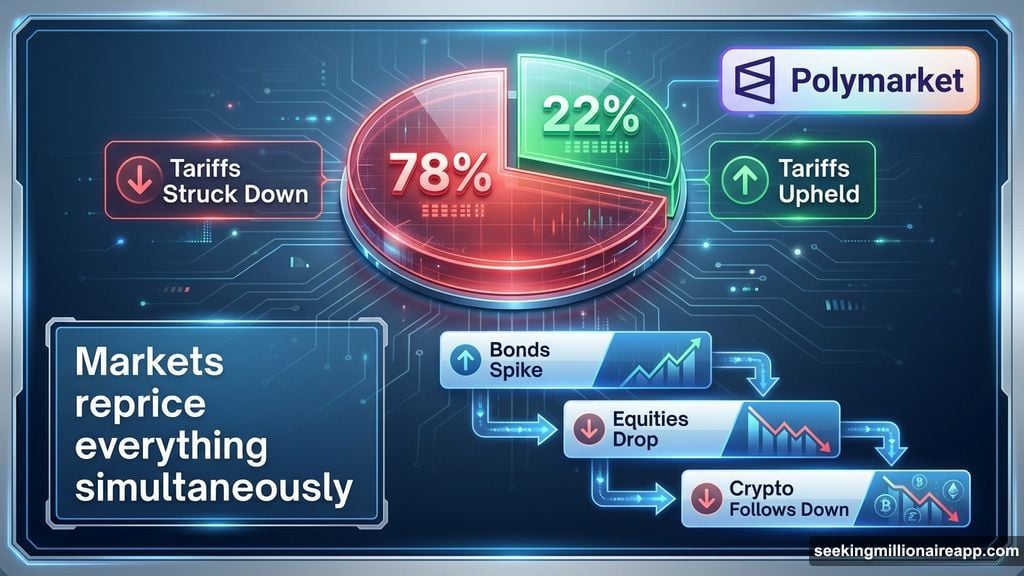

Polymarket data reveals stark odds. Only 22% probability the Court upholds Trump’s tariffs. That leaves a 78% chance they get struck down.

Trader Wimar.X captured the market’s anxiety perfectly: “This Friday will be the worst day of 2026. Trump claims tariffs generated around $600 billion. So if the court nukes the tariffs, the market instantly starts asking one thing. How much gets refunded, and how fast? That’s not clarity. That’s chaos.”

Indeed, markets reprice everything simultaneously when major policy foundations crumble. Bonds spike. Equities drop. And crypto follows traditional markets down.

The refund question matters enormously. $133-140 billion doesn’t just disappear from Treasury accounts. It flows back to importers who may need to liquidate other assets to manage sudden cash positions. That forced rebalancing hits every asset class at once.

Macro Conditions Amplify Downside Risk

Current market structure makes this worse. Equity valuations are stretched beyond historical norms. Corporate spending remains elevated despite economic uncertainty. Plus, passive investment flows have concentrated massive risk in major indices.

Bitcoin’s recent recovery rally pushed it above $90,000 for the first time in weeks. But that technical strength means nothing if a macro shock forces institutional selling. Retail investors follow suit. Leverage unwinds. Volatility explodes.

Another analyst noted that Trump losing the tariff case represents “one of the largest underpriced risks in markets today.” Few participants have positioned for this outcome. So when it happens, the repricing gets violent.

Bond rates could spike as Treasury funding needs shift. The dollar might strengthen or weaken depending on safe-haven flows. And crypto markets, which depend heavily on dollar liquidity, could face sudden withdrawal of capital.

DeFi and Tokenized Assets Face Collateral Damage

Beyond Bitcoin’s price, the ruling threatens broader crypto infrastructure. Decentralized finance platforms rely on international capital flows. Trade disruptions affect those flows directly.

Tokenized assets representing real-world goods face immediate repricing. If tariffs disappear, import costs change. Corporate margins shift. And any crypto assets tied to those underlying economics need new valuations.

Cross-border payments using crypto could see increased volume as companies rush to rebalance international positions. But that increased activity comes with increased volatility. Not exactly ideal for mainstream adoption narratives.

The uncertainty also delays institutional crypto adoption. Large financial players prefer stable policy environments. A Supreme Court ruling that overturns major trade policy doesn’t exactly scream “stable environment.”

Three Scenarios for Bitcoin Post-Ruling

Best case: The Court upholds Trump’s tariffs. Markets breathe a sigh of relief. Bitcoin continues its recovery rally toward $100,000. Policy uncertainty decreases. Institutional money flows back into risk assets.

Base case: The Court strikes down tariffs but Treasury announces a manageable refund schedule. Bitcoin drops 10-15% on the news. Then stabilizes as clarity emerges about fiscal impact. Recovery takes weeks instead of days.

Worst case: Tariffs get nuked with no clear refund plan. Treasury faces immediate $140 billion hole. Bond markets panic. Equities crash. Bitcoin plunges below $80,000 as forced liquidations cascade through crypto markets. Volatility stays elevated for months.

Current market positioning suggests most traders expect the base or worst case. That 22% probability on Polymarket tells you everything. People aren’t betting on good news.

Friday Marks a Turning Point

This ruling matters more than most crypto news. It’s not about adoption metrics or technical upgrades. It’s about fundamental market structure and fiscal policy.

Bitcoin survived plenty of regulatory challenges. But macro shocks test even the strongest assets. And this particular shock arrives when markets are already fragile.

Watch bond yields Friday morning. If they spike before the crypto markets fully react, that’s your signal to reduce leverage. If equities gap down at open, Bitcoin will follow within minutes.

The Supreme Court doesn’t care about your portfolio. But their ruling will shape it regardless.