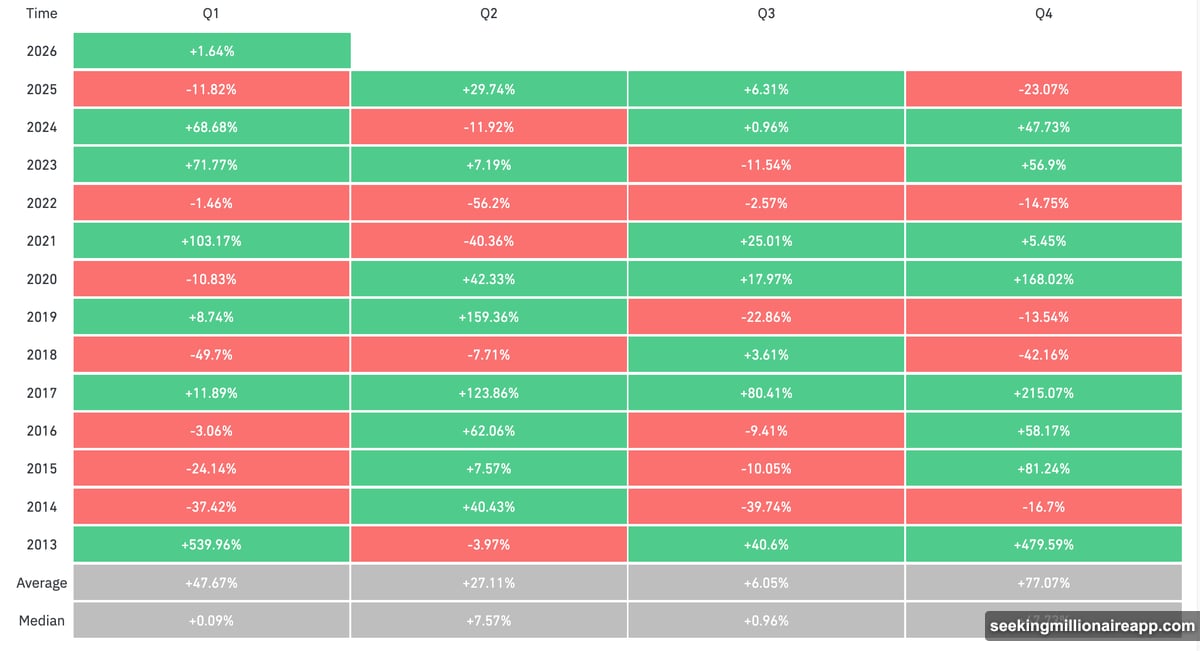

Bitcoin crashed 5.7% in 2025. The fourth quarter alone? Down 23.7%. That’s the worst Q4 performance since 2018.

So naturally, everyone’s asking the same question. Will 2026 bring an extreme crypto bear market?

Turns out, the answer isn’t simple anymore. The old playbook stopped working. Plus, the factors that once predicted market cycles no longer apply the way they used to.

The Four-Year Cycle Just Died

Bitcoin always followed a pattern. Four years, like clockwork. Halving triggers bull run. Peak arrives. Bear market follows. Rinse and repeat.

Except that model broke in 2025. Despite a pro-crypto US president, Fed rate cuts, and massive liquidity injections, the market tanked anyway.

Nic Puckrin, co-founder of Coin Bureau, told me why this happened. ETF approval and institutional capital fundamentally changed everything.

“Bitcoin is increasingly dancing to the same tune as other financial assets now, not just the rhythm of its halvings,” Puckrin explained.

Jamie Elkaleh from Bitget Wallet agreed. He pointed to a bigger shift happening underneath the surface.

“Bitcoin’s sensitivity to global liquidity, M2 expansion, and Fed policy increasingly outweighs the mechanical impact of halvings. We are effectively seeing a ‘de-halving’ of crypto,” Elkaleh stated.

Translation? Traditional macro cycles now drive Bitcoin more than internal crypto events. The halving still matters. But it doesn’t explain price movements anymore.

Traditional Forecasting Models Can’t Keep Up

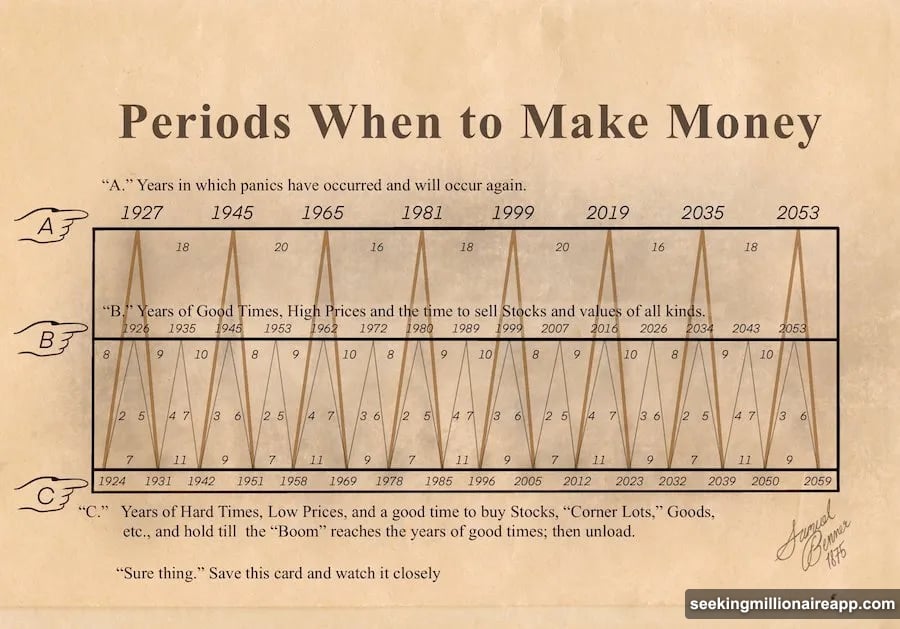

Some analysts turned to longer-term frameworks like the Benner Cycle. Under that model, 2026 represents “Years of Good Times, High Prices.”

Sounds bullish, right? Not so fast.

Andrei Grachev from DWF Labs warned against oversimplifying the outlook. Markets don’t follow century-old patterns automatically.

“I don’t think that 2026 will fit cleanly into a classic bull or bear narrative. Instead, we might start to see divergence. Bitcoin will still drive the markets, but I’m not convinced that other crypto assets will follow as closely,” Grachev noted.

Moreover, Elkaleh described 2026 as a “period of structural consolidation” rather than a clear bull or bear phase. Excess leverage got flushed out in 2025. But the underlying infrastructure remains solid.

ETFs, corporate treasuries, and clearer policy frameworks like the GENIUS Act suggest any downturn will establish a higher floor than previous cycles. That changes the risk profile completely.

What Could Trigger a Real Bear Market in 2026

Obviously, bad outcomes are still possible. So what specific events could actually crash the market?

Puckrin outlined the most realistic scenario. An extreme bear market needs multiple shocks hitting simultaneously.

“Tightening global liquidity, a prolonged risk-off environment, and a structural shock. For Bitcoin, such a shock could emerge if digital asset treasuries collectively begin selling into an already fragile market,” Puckrin forecasted.

He also mentioned the AI bubble as a potential catalyst. If AI stocks collapse, crypto would likely follow.

Elkaleh focused on external risks instead. He sees three main threats:

First, an AI bubble bursting triggers sharp US equity sell-offs. Second, renewed Fed tightening if inflation stays sticky. Third, a systemic trust event like a major exchange failure or overleveraged corporate treasury collapse.

“In a scenario where institutional inflows stall amid geopolitical instability, the lack of new buyers could accelerate capital flight and push prices toward realized levels around the $55,000–$60,000 range,” Elkaleh detailed.

Meanwhile, Maksym Sakharov from WeFi warned about hidden leverage risks. Some new “safe yield” product works perfectly until it doesn’t.

“The trigger is always leverage, hiding somewhere it shouldn’t be,” Sakharov revealed.

Stablecoin Supply Reveals Market Health Better Than Price

Before price action confirms a bear market, on-chain signals flash warnings first. Elkaleh highlighted several key indicators to watch.

A sustained decline in wallets holding 100 to 1,000 BTC shows sophisticated investors reducing exposure. Weak on-chain buying demand while prices stay stable suggests leverage props up the market artificially.

But Sakharov focuses on something different. He tracks stablecoin market cap religiously.

“If the stablecoin market cap shrinks, it’s a solid sign that capital is abandoning the ecosystem entirely. That’s different from a crash where money just rotates or sits on the sidelines waiting,” Sakharov explained.

He also monitors real usage on stablecoin rails. If infrastructure stays busy during downturns, the selloff is just noise. Capital remains committed to the space.

Grachev watches derivatives and liquidity conditions instead. Persistent negative funding rates, declining open interest, and thinning order books signal defensive positioning.

“When it becomes harder to move size without affecting the market, it signals that liquidity is pulling back and risk tolerance is tightening,” Grachev conveyed.

Why Institutional Money Changes Everything

The bear case weakens significantly if institutions start deploying capital again. Grachev noted two critical factors working in crypto’s favor right now.

First, healthier leverage profiles compared to previous cycles. Less excess risk leads to more disciplined market behavior. Second, capital with longer investment horizons entering the space.

“If institutions start deploying capital again after year-end (which they commonly do) and if regulatory clarity continues to improve, the crypto market will have more supportive conditions,” Grachev reiterated.

Elkaleh sees even bigger catalysts ahead. Sovereign adoption or large-scale tokenization of financial assets could invalidate the bear case entirely.

If a G20 nation adds Bitcoin to strategic reserves, or if US regulators enable broader capital-market tokenization, Bitcoin’s scarcity narrative shifts from speculative to essential.

“Combined with a potential liquidity supercycle — driven by fiscal stimulus or a weaker US dollar — these factors could overwhelm cyclical pressures and support a renewed bull phase, with upside toward the $150,000+ range,” Elkaleh affirmed.

Key Price Levels That Actually Matter

Puckrin focuses less on short-term moves and more on market structure. He watches two critical thresholds closely.

First, $82,000 represents the true market mean. That’s the average cost basis of active investors. Second, $74,400 marks Strategy’s cost basis.

“A breakdown below these levels wouldn’t automatically indicate an extreme bear market is here, but it would warrant caution,” Puckrin disclosed.

He also monitors the 50-week and 100-week moving averages. Persistent breakdowns below those levels, combined with repeated failures at key resistance, signal major trouble.

Yet none of this guarantees outcomes. Markets surprise even experts regularly.

Mark Zalan from GoMining emphasized that real resilience comes when structural demand outgrows cyclical sentiment. He pointed to three main drivers: macro and policy catalysts, sustained institutional inflows, and real-world usage growth.

The Old Rules Don’t Apply Anymore

2026 won’t follow historical patterns neatly. Traditional four-year cycles lost their predictive power. Macro conditions now drive Bitcoin more than internal crypto events.

Still, several factors could prevent an extreme bear market. Healthier leverage profiles reduce systemic risk. Institutional capital brings longer investment horizons. Regulatory clarity lowers barriers to entry.

Plus, sovereign adoption and tokenization of financial assets could anchor demand in real utility instead of pure speculation.

So will 2026 bring an extreme crypto bear market? Probably not. But it won’t deliver a simple bull run either.

Instead, expect consolidation, divergence, and increased sensitivity to external macro factors. The market is maturing. That means less predictability but potentially higher floors during downturns.

Watch liquidity flows, stablecoin supply, and institutional positioning. Those signals matter more than price action alone. The market just got harder to read, but the fundamentals are stronger than they were three years ago.