Bitcoin just completed another year of massive gains. But Fidelity’s latest analysis suggests this rally might be running out of steam.

Jurrien Timmer, Director of Global Macro at Fidelity, released fresh data showing Bitcoin’s current growth wave appears nearly complete. However, his projections hint at another surge on the horizon. The timing? That’s where things get interesting.

Wave 5 Nears Its Peak

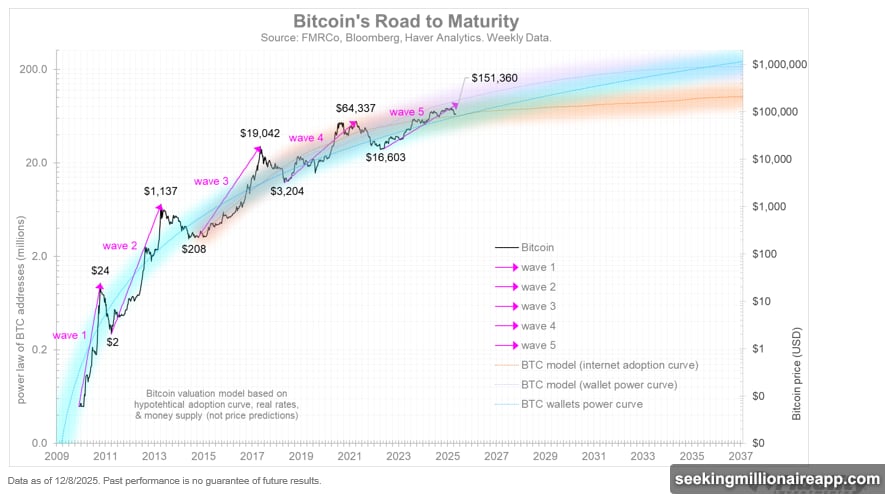

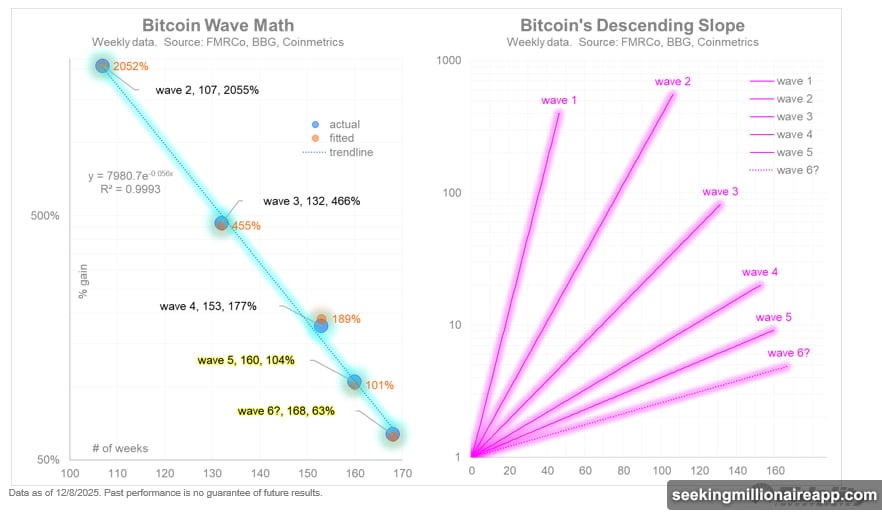

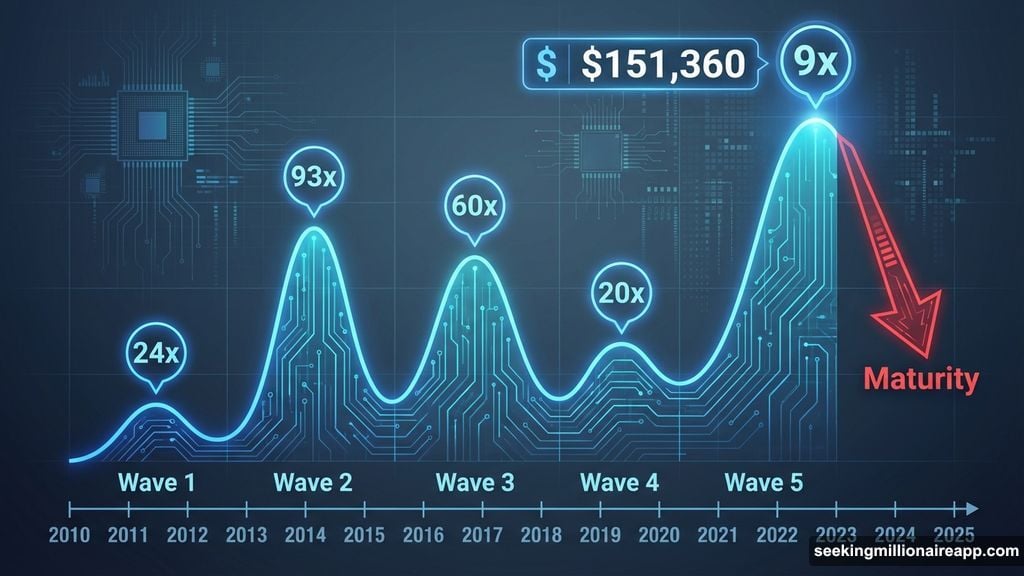

Fidelity tracks Bitcoin’s development through a wave model spanning back to 2010. Each cycle follows a predictable pattern. Growth magnitude shrinks with each wave. Duration extends longer.

Right now, Bitcoin sits deep into its fifth wave. The cycle started from the 2022 bottom at $16,603. Timmer’s model projects a potential peak around $151,360.

“It’s hard to tell in real time whether a new winter is upon us,” Timmer noted in his report. “But the evolving wave structure shows that the most recent bull market looks pretty mature.”

So far, Wave 5 delivered approximately 9x returns over 160 weeks. That’s solid. But it pales compared to Wave 4’s 20x growth over 153 weeks. The pattern holds. Each cycle produces smaller multiples but lasts longer.

Short-Term Optimism Meets Long-Term Questions

Timmer remains bullish through year-end. Federal Reserve monetary easing improved investor sentiment. Plus, late-year rallies have become a Bitcoin tradition.

Beyond that? Wave 6 could deliver another 5x growth over 168 weeks, according to Fidelity’s linear projections. That would push Bitcoin significantly higher from wherever the next bottom forms.

Here’s the catch. Nobody knows exactly where that bottom will land. Timmer suggested a potential support level around $80,554. But that’s an educated guess, not a guarantee.

Jimmy Xue, COO and Co-founder of Axis, shared cautious optimism with BeInCrypto. He expects stabilization before any sharp rebound.

“The market needs time to absorb the recent volatility,” Xue explained. “However, the medium-term setup remains bullish for Q1 2026 as the rate cuts eventually cycle into global liquidity.”

Translation? Don’t expect a V-shaped recovery immediately. But Q1 2026 could bring renewed strength as rate cuts filter through the system.

The Midterm Election Problem

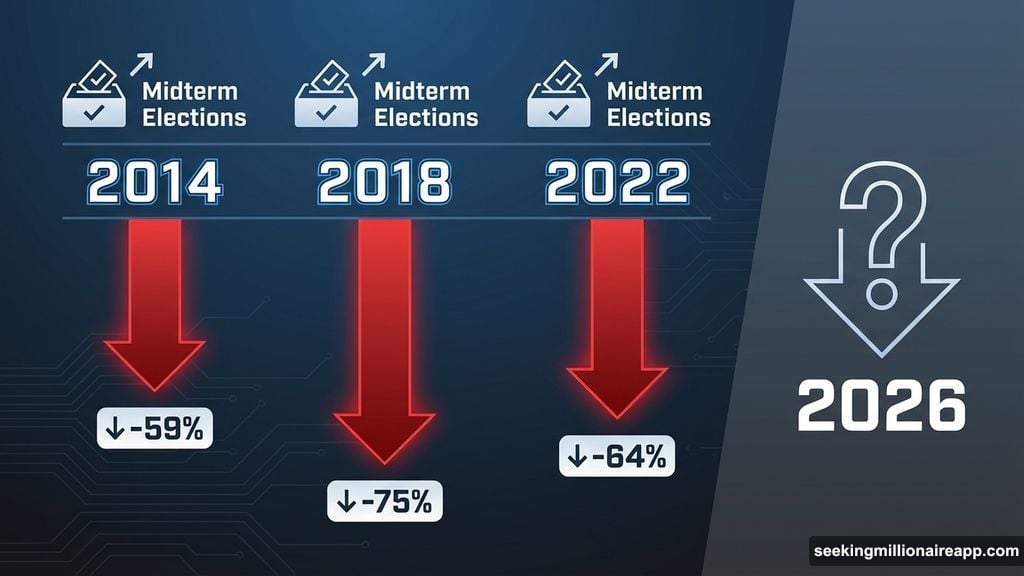

Not everyone shares that enthusiasm. Historical data reveals a troubling pattern for 2026.

Midterm election years typically hammer Bitcoin. The drawdowns tell the story:

- 2014: Down 59%

- 2018: Down 75%

- 2022: Down 64%

Those numbers should concern anyone holding BTC through 2026. Three consecutive midterm years produced brutal corrections. The pattern isn’t coincidental.

Political uncertainty, policy shifts, and reduced risk appetite often dominate midterm years. Bitcoin historically suffers under those conditions.

So we face competing forces. Fidelity’s wave model suggests continued growth potential. But midterm election history screams caution.

Institutional Money Keeps Flowing

Despite conflicting signals, institutions haven’t stopped accumulating. Bitcoin ETF approvals in recent years opened floodgates for professional investors.

Corporate treasuries, pension funds, and hedge funds continue building positions. That steady demand provides support even during volatile periods.

Miners also keep stacking. While corporate Bitcoin buying slowed recently, mining operations still accumulate rather than sell. That behavior typically signals confidence in higher future prices.

The question becomes whether institutional demand can override historical midterm weakness. It’s never happened before. But Bitcoin’s institutional adoption reached new heights over the past two years.

Wave 6 Timeline Remains Fuzzy

Assuming Wave 5 completes soon, when does Wave 6 actually begin? Fidelity’s model doesn’t answer that question precisely.

Historical waves lasted between 150-170 weeks from bottom to top. If Wave 5 peaked around $151,360, the subsequent correction could take months to find a bottom.

Then Wave 6 would need 168 weeks (roughly 3.2 years) to complete its projected 5x climb. That timeline pushes the next peak somewhere into late 2028 or early 2029.

Of course, models break. Bitcoin doesn’t follow rules. External factors like regulation, macroeconomic conditions, or technological developments could accelerate or derail these projections entirely.

Timmer’s analysis provides a framework, not a prophecy. The wave model worked historically. But past performance guarantees nothing about future results.

What This Means for 2026

So what should investors expect next year? Probably chop and consolidation rather than explosive gains.

If Fidelity’s analysis holds, Wave 5 maturity suggests limited upside from current levels. The midterm election pattern adds another layer of concern. Together, they paint a picture of potential weakness.

However, institutional accumulation and Fed rate cuts provide counterbalancing support. Bitcoin rarely moves in straight lines. Volatility will continue regardless of direction.

Smart investors might wait for clearer signals before making major moves. Buying support levels makes more sense than chasing peaks when a wave appears mature.

The real opportunity likely emerges when Wave 6 begins. Finding that bottom requires patience and discipline. It also requires surviving whatever correction comes between Wave 5’s peak and Wave 6’s start.

For now, Bitcoin sits in an interesting spot. Short-term momentum looks decent. Medium-term projections split between optimism and caution. Long-term models suggest another major wave ahead, but timing remains uncertain.

That’s crypto. Contradictory signals, competing narratives, and constant uncertainty. Navigate carefully.