Bitcoin traded sideways for weeks. Yet nobody’s panicking about the charts anymore.

Instead, top analysts are asking a bigger question. Does Bitcoin’s famous four-year cycle still work? The answer might reshape how we think about crypto markets entirely.

The Cycle That Always Worked Before

Bitcoin followed a predictable rhythm for over a decade. Price bottoms happened roughly 1,064 days before peaks. Then came 364-day corrections back down.

This pattern held through multiple cycles. Traders built entire strategies around it. Plus, the math was eerily consistent across different market conditions.

But 2025 broke the script. Q4 typically brings strong gains. Instead, Bitcoin stalled despite massive institutional buying. Something fundamental changed beneath the surface.

Institutions Buy While Old Whales Sell

Tom Lee from Fundstrat spotted the tension first. Record ETF inflows poured into Bitcoin. Corporate treasuries added billions to their holdings. Yet prices barely budged.

Why? Original Bitcoin holders are selling into that demand. Analyst Daan Crypto Trades calls it “big OG whales and 4-year cycle selling.” The new money gets absorbed before it can push prices higher.

This creates a strange standoff. Demand exists but can’t translate into upside momentum. Meanwhile, long-term holders cash out after years of waiting. The result? Price action that defies traditional cycle expectations.

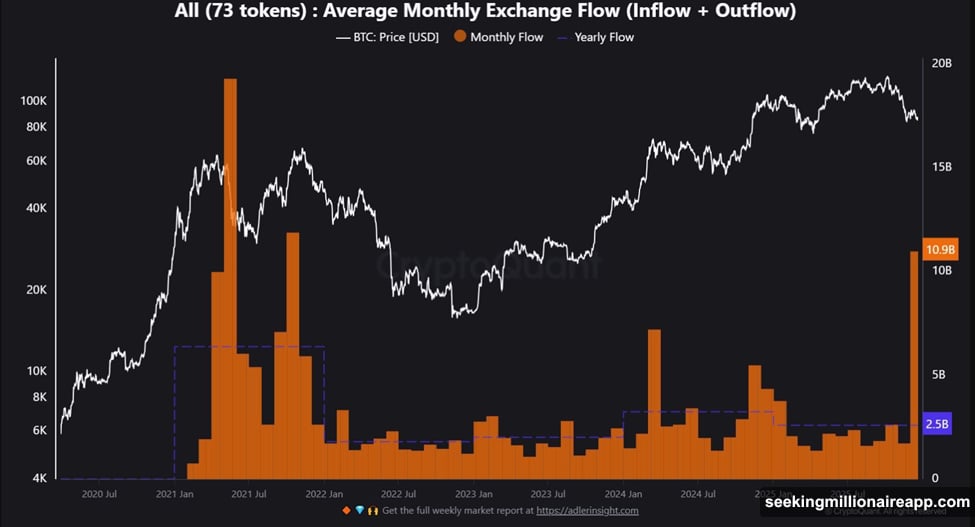

Exchange Data Reveals Hidden Pressure

Monthly Bitcoin flows to exchanges hit $10.9 billion in December. That’s the highest level since May 2021. Remember what happened after that? A brutal correction.

Jacob King warns these numbers signal “increased selling pressure” as investors move coins to exchanges for liquidation. Historically, spikes like this mark late-cycle behavior, not healthy accumulation phases.

Plus, the Coinbase premium stayed negative for seven straight days. Kyle Doops notes this means “U.S. spot demand is lagging the rest of the market.” American institutions aren’t aggressively buying anymore. They’re hesitant, waiting for clearer signals.

The Premium Vanished

Coinbase premium tracks the price difference between U.S. and global exchanges. When American buyers push hard, the premium goes positive. Now it’s stuck in negative territory.

This isn’t panic selling. But it’s definitely not the enthusiasm that drove previous bull runs. Capital sits on the sidelines instead of chasing Bitcoin higher. That reluctance matters more than any single price level.

Moreover, this shift contradicts the narrative of unstoppable institutional adoption. Companies still accumulate Bitcoin. Yet their buying barely registers in price action because distribution from other holders matches every purchase.

Two Camps Form Among Top Analysts

Tom Lee thinks Bitcoin will break free from its four-year cycle pattern. He argues the market structure changed too much for old timing models to apply. Institutional participation and corporate treasury adoption create different dynamics than retail-driven cycles.

Fidelity’s Jurrien Timmer takes the opposite view. According to his analysis, Bitcoin topped in October and now enters a traditional bear market. He expects support around $65,000-$75,000 with 2026 being “a down year.”

Meanwhile, Fundstrat’s Sean Farrell sits somewhere in the middle. He acknowledges “valuation no man’s land” with multiple pressures weighing on price. Still, he expects Bitcoin to challenge new highs before year-end, implying a “shorter, smaller bear market” than previous cycles.

The Timing Still Adds Up

Ali Charts examined Bitcoin’s historical patterns and found remarkable consistency. Previous cycles followed that 1,064-day rise to peak, then 364-day fall to bottom formula almost perfectly.

If the pattern holds this time, Bitcoin may be inside its corrective window right now. Historical retracements suggest further downside before any durable recovery begins. That puts the four-year cycle debate into sharp focus.

But here’s the complication. Traditional cycle math assumes similar market participants behaving in predictable ways. What happens when institutions replace retail traders? When corporate treasuries compete with speculative investors?

Q1 2026 Becomes the Test

Daan Crypto Trades identified Q1 2026 as the critical period. “Q1 is generally a good quarter for Bitcoin,” he notes. If Bitcoin performs well, maybe the cycle persists with modifications. If it disappoints, the four-year framework might be dead.

This matters beyond just Bitcoin. The entire crypto market uses Bitcoin’s cycle as a reference point. Altcoins time their rallies around Bitcoin peaks. Traders plan entries and exits based on cycle stages.

Break that cycle and you break the mental models that guided crypto investment for over a decade. That’s why analysts obsess over demand signals instead of daily price movements. The infrastructure beneath the market matters more than the ticker.

Nobody’s Really Panicking Yet

Despite negative exchange premiums and rising flows, major liquidations haven’t happened. Institutions aren’t dumping holdings. Retail isn’t capitulating in fear.

Instead, the market feels uncertain. Buyers lack conviction but aren’t fleeing. Sellers take profits methodically without flooding markets. This creates choppy, directionless price action that frustrates everyone.

Sean Farrell’s “valuation no man’s land” description captures it perfectly. Bitcoin isn’t obviously cheap or expensive. Traditional metrics send mixed signals. Historical patterns conflict with current structure.

So participants wait for clarity. That patience shows maturity compared to previous cycles dominated by emotional extremes. But it also means decisive moves in either direction could trigger outsized reactions.

The Framework Itself Is Under Question

Tom Lee’s suggestion that Bitcoin will break its four-year cycle challenges more than just timing predictions. It questions whether any historical model can predict Bitcoin’s future given how much the market changed.

In 2013, crypto was dominated by individual speculators. By 2017, early institutional interest emerged. The 2021 cycle brought real institutional participation. Now in 2025, corporate treasuries and spot ETFs represent major market forces.

Each transition brought structural changes. But the four-year cycle persisted through all of them, driven by Bitcoin’s halving schedule reducing new supply. Tom Lee argues that institutional demand now overshadows supply reduction as the dominant force.

If he’s right, Bitcoin enters uncharted territory. If Jurrien Timmer is right, nothing fundamental changed despite surface-level differences. Q1 2026 will reveal which perspective better explains current market dynamics.

What Actually Matters Now

Bitcoin’s price will fluctuate regardless of which framework proves accurate. But the debate over cycle validity matters for strategic positioning. Those betting on traditional patterns expect lower lows before the next major run. Those expecting cycle breaks might accumulate through current weakness.

Neither group panics over daily movements. Instead, they watch exchange flows, institutional accumulation rates, and long-term holder behavior. These demand signals reveal market structure better than price charts.

That shift from price obsession to structural analysis marks evolution in crypto market sophistication. But it also creates uncertainty when historical patterns conflict with current data. Nobody really knows if Bitcoin’s four-year cycle still works. We’ll only know for certain when enough time passes to judge in hindsight.

Meanwhile, the market waits for decisive signals. Either institutions accelerate buying and overpower selling pressure, or distribution continues until traditional cycle support levels get tested. Q1 2026 approaches with unusual attention from analysts who normally focus on price.

The real question isn’t where Bitcoin trades next week. It’s whether the framework that guided crypto investment for over a decade still applies to a market transformed by institutional adoption.