Bitcoin just crushed Q4 historically, averaging 79% gains since 2013. But this time feels different.

Three major forces converged simultaneously. The Fed slashed rates to a three-year low. Institutions dumped $18 billion into crypto ETFs last quarter. Plus, altcoins are finally waking up after years of underperformance.

So the setup looks stronger than usual seasonal trends. Let’s break down why this quarter might actually deliver on those historical promises.

Interest Rates Hit the Sweet Spot

The Federal Reserve’s latest rate cut changed the game overnight. Rates dropped to their lowest level in nearly three years.

Why does this matter for crypto? Lower rates make risk assets more attractive. Traditional savings accounts and bonds suddenly look less appealing. So investors start hunting for higher returns elsewhere.

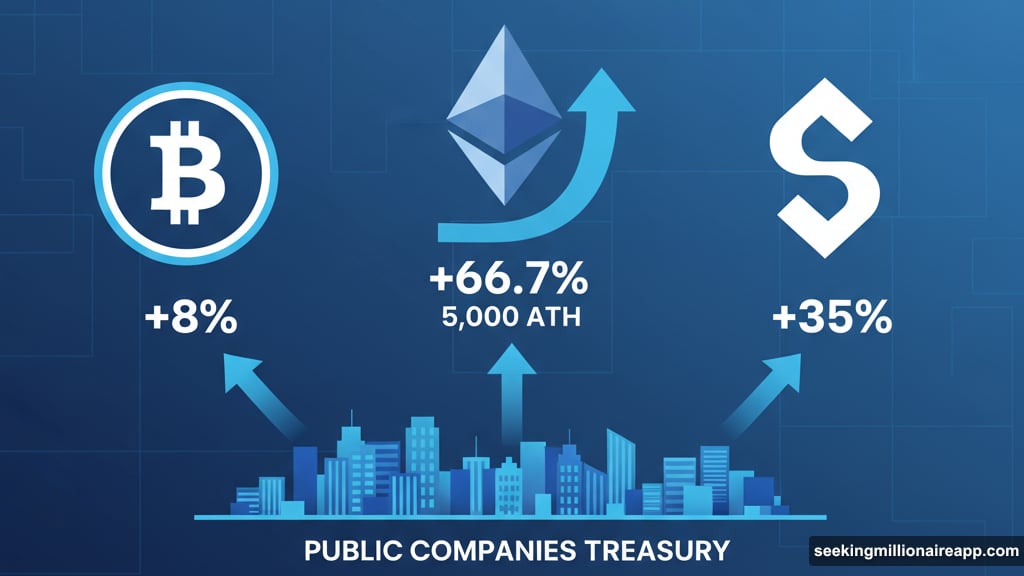

Bitcoin responded exactly as expected. It closed Q3 at $114,000, up 8% for the quarter. However, that gain doesn’t tell the full story.

Institutional adoption accelerated dramatically. Public companies now hold over 5% of bitcoin’s total supply. That’s a massive shift from even six months ago. Plus, more than 50 publicly listed firms now hold altcoins on their balance sheets. Forty of those joined just last quarter.

The Fed hinted at additional cuts ahead. So this supportive environment could extend through year-end and beyond.

ETF Money Keeps Flowing

U.S. spot bitcoin and ether ETFs pulled in over $18 billion during Q3 alone. That’s real institutional capital entering crypto markets.

Traditional investors can now buy bitcoin through familiar channels. They don’t need to deal with wallets, private keys, or exchanges. Just call their broker and add BTC exposure to their portfolio.

The numbers prove institutions took that path aggressively. ETF inflows continued week after week throughout the quarter. Moreover, the momentum hasn’t stopped as Q4 begins.

What makes this different from previous rallies? Sustained institutional demand creates a more stable foundation. Retail FOMO cycles crash hard. But pension funds and treasury departments tend to hold long-term positions.

Furthermore, generic listing standards for crypto ETFs just received approval. That opens the door for more product launches. Multi-asset and staking-based ETPs are already in development.

So the ETF story is just getting started.

Altcoins Finally Caught Fire

Bitcoin shared the spotlight this quarter. Ethereum surged 66.7%, hitting a new all-time high near $5,000. That’s the kind of move that changes narratives.

Several factors drove ETH’s breakout. Treasury accumulation by public companies accelerated. ETF flows reached record levels. Plus, November’s Fusaka upgrade promises major scalability improvements.

Solana delivered a 35% quarterly gain backed by large corporate purchases. Record ecosystem revenue proved the network is actually being used for real applications. New exchange-traded products launched. And the Alpenglow upgrade aims to boost performance even further.

XRP gained nearly 37% year-to-date after finally getting legal clarity. The SEC and Ripple withdrew their appeals, ending years of uncertainty. Meanwhile, Ripple’s RLUSD stablecoin is expanding globally. That growth could bring more DeFi protocols to the XRP Ledger.

Cardano rose 41.1% in Q3, outperforming several larger competitors. Activity remains modest compared to Ethereum or Solana. But consistent growth in stablecoin usage and DEX activity created a stable base for expansion. Plus, a pending decision on a spot ADA ETF could mark a turning point.

The CoinDesk 20 Index, tracking the 20 most liquid digital assets, gained over 30% in Q3. That outpaced bitcoin’s 8% return. So diversified crypto exposure beat pure BTC holdings last quarter.

The Macro Setup Keeps Improving

Three favorable conditions aligned simultaneously. Lower interest rates reduce the cost of taking risks. Institutional adoption provides steady demand. And regulatory clarity removes major sources of uncertainty.

Bitcoin’s historical Q4 performance averages 79% gains since 2013. Obviously past performance doesn’t guarantee future returns. But the current setup matches or exceeds previous favorable quarters.

Compare this environment to earlier bull markets. In 2013 and 2017, retail speculation drove most gains. Those rallies crashed hard once sentiment shifted. But today’s rally includes pension funds, public company treasuries, and sovereign wealth funds.

That institutional foundation should dampen volatility. It won’t eliminate crashes. Nothing prevents temporary selloffs. But the bid support from long-term holders creates a different market structure.

Moreover, bitcoin is increasingly viewed as a hedge against currency debasement. Central banks continue expanding money supplies. Government debt keeps rising. So the case for hard-capped digital assets gets stronger.

Ethereum’s November Upgrade Could Shift Momentum

Ethereum’s Fusaka upgrade launches in November. This upgrade focuses on scalability and network efficiency improvements.

If successful, it could reinforce Ethereum’s role as the foundation for on-chain finance. Most DeFi protocols run on Ethereum. Better performance means lower fees and faster transactions. That makes DeFi more accessible to mainstream users.

The upgrade also benefits “low-risk” DeFi applications. Think regulated stablecoins and tokenized securities. These applications need reliable infrastructure. Plus, they can’t tolerate network congestion or unpredictable fees.

Institutional interest in Ethereum grew significantly last quarter. Treasury accumulation rivaled bitcoin in some weeks. ETF inflows reached record levels. And the all-time high near $5,000 grabbed attention from traditional finance.

However, success isn’t guaranteed. Network upgrades sometimes encounter technical issues. Delays happen. Bugs emerge. So the November timeline represents a risk factor.

Still, Ethereum’s developer community has delivered on previous upgrades. The transition to proof-of-stake succeeded despite complexity. So confidence remains high for Fusaka.

Solana Targets High-Performance Applications

Solana positioned itself as the high-performance layer for decentralized applications. Throughput and cost efficiency matter for certain use cases.

Large-scale corporate purchases drove Solana’s 35% Q3 gain. Companies are betting real money that Solana’s architecture will support mainstream applications. Record ecosystem revenue validates that bet.

New exchange-traded products are launching specifically for SOL. That brings traditional investors into the Solana ecosystem. Plus, the pending Alpenglow upgrade promises further performance improvements.

What makes Solana attractive for institutions? Speed matters for trading platforms and payment applications. Ethereum can handle many use cases. But Solana’s architecture enables sub-second finality and thousands of transactions per second.

Cost efficiency also drives adoption. Network fees on Solana remain fractions of a cent. That makes micropayments practical. So applications like decentralized social media or gaming can actually work economically.

The big question remains long-term reliability. Solana experienced multiple network outages in previous years. Those issues damaged its reputation. But recent improvements suggest the network is stabilizing.

XRP’s Legal Clarity Changes Everything

XRP gained 37% year-to-date after the SEC and Ripple finally ended their legal battle. Years of uncertainty are over.

That clarity matters enormously. Exchanges can list XRP without regulatory fear. Investors can buy without worrying about sudden enforcement actions. And Ripple can focus on growing adoption instead of fighting lawsuits.

Ripple’s RLUSD stablecoin is expanding rapidly. Global adoption is accelerating. More importantly, DeFi protocols are considering integration with the XRP Ledger. That could significantly increase XRP’s utility beyond cross-border payments.

However, competition in the stablecoin space is fierce. USDT and USDC dominate. New entrants like PayPal’s PYUSD are growing. So RLUSD faces an uphill battle for market share.

Still, regulatory clarity gives XRP advantages competitors lack. The legal precedent from the Ripple case provides a roadmap for other projects. That clarity attracts institutional capital.

The Q4 Outlook Stays Positive

Bitcoin entered Q4 with historical tailwinds and improved fundamentals. Lower interest rates support risk assets. Institutional adoption provides steady demand. And altcoins are finally participating in the rally.

The CoinDesk 100 Index, capturing mid and small-cap assets, posted strong returns last quarter. That breadth of performance suggests healthy market conditions. When only bitcoin rallies, it signals weak overall demand. But broad participation indicates genuine interest across the crypto ecosystem.

Generic listing standards for crypto ETFs could accelerate inflows further. Multi-asset products allow investors to gain diversified exposure through a single ticker. Staking-based ETPs provide yield while maintaining exposure. These products could attract entirely new investor segments.

Monetary policy remains supportive. The Fed signaled additional rate cuts ahead. Lower rates make yield-bearing assets like bonds less attractive. So capital should continue flowing toward higher-return alternatives like crypto.

Regulatory momentum is building in the U.S. The XRP case resolution set important precedents. Generic listing standards cleared a major hurdle for new products. And political support for crypto regulation is growing across both parties.

However, risks remain. Macroeconomic conditions could deteriorate. Geopolitical tensions might spike. Technical issues could derail network upgrades. And regulatory actions in other jurisdictions might create uncertainty.

Still, the setup for Q4 looks stronger than most recent quarters. Historical patterns suggest volatility will remain high. But the combination of lower rates, institutional adoption, and altcoin momentum creates favorable conditions for continued gains.