Quantum computing gets talked about as Bitcoin’s ultimate technical nemesis. But the CryptoQuant CEO just made a compelling case that the real danger isn’t a powerful enough computer. It’s a community that can’t agree on what to do when one arrives.

That distinction matters enormously. Because code can be updated. People are a lot harder to update.

Satoshi’s Bitcoin Sits at the Center of the Fight

Ki Young Ju, CEO of CryptoQuant, recently reignited one of crypto’s thorniest debates. A quantum-resistant Bitcoin upgrade would almost certainly require freezing dormant wallets, including the roughly 1 million BTC widely attributed to Satoshi Nakamoto.

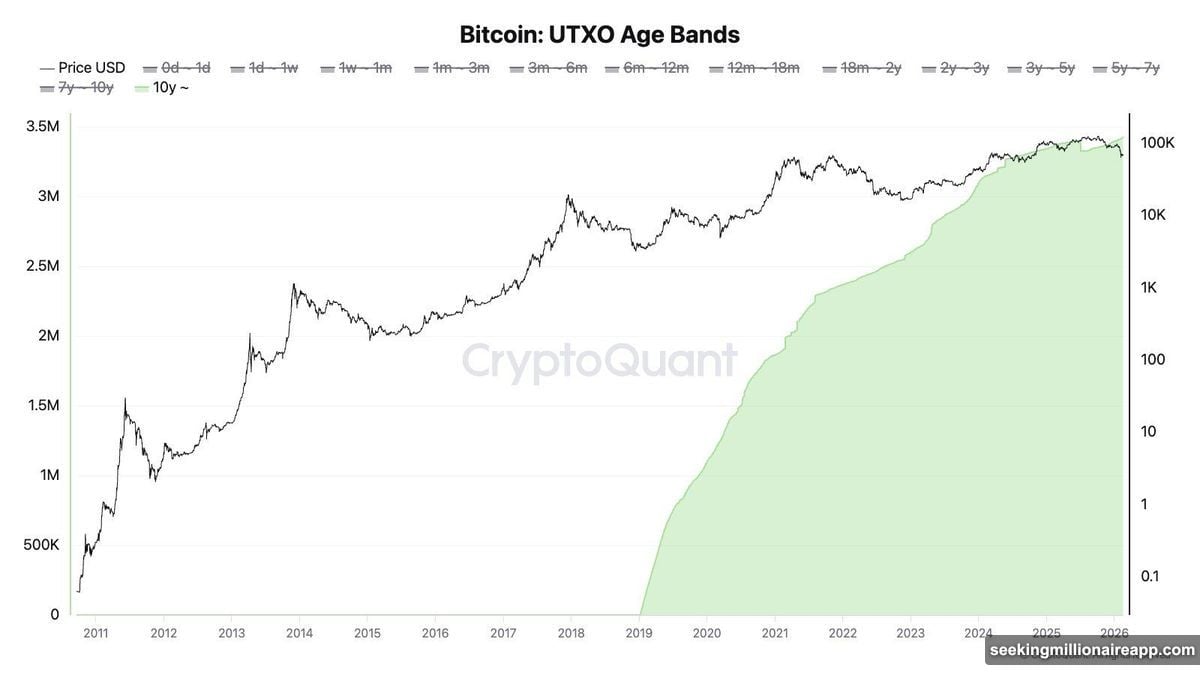

That’s not a small ask. At current prices, Satoshi’s stash alone represents hundreds of billions of dollars. And roughly 3.4 million BTC total haven’t moved in over a decade, all of them potentially vulnerable to a sufficiently powerful quantum machine.

Ju’s argument is straightforward. Bitcoin’s security model assumes that attacking the network stays economically irrational. But quantum computing could flip that assumption completely. Once breaking a private key becomes cheap and practical, every dormant old-format wallet becomes a target worth chasing.

So the question stops being purely technical. It becomes: who decides which coins get frozen, and on what authority?

Consensus Has Broken Bitcoin Before

Ju didn’t sugarcoat the community challenge. He pointed to Bitcoin’s own history as evidence of how badly these debates can go.

The block size war dragged on for over three years and eventually split the network into competing chains. SegWit2x, a widely discussed upgrade, collapsed under the weight of community disagreement before it ever launched. A proposal to freeze dormant coins, including wallets that could belong to Bitcoin’s anonymous creator, would face even fiercer resistance.

That resistance isn’t irrational, either. Bitcoin’s core appeal rests on immutability and neutrality. The idea that no authority can touch your coins is a feature, not a bug. Freezing wallets, even to protect the network, directly challenges that principle.

As Ju put it, developers aren’t the bottleneck here. Consensus is. The technical fix might take months. The social agreement could take decades, or might never come at all.

ECDSA Vulnerability and the Quantum Timeline Debate

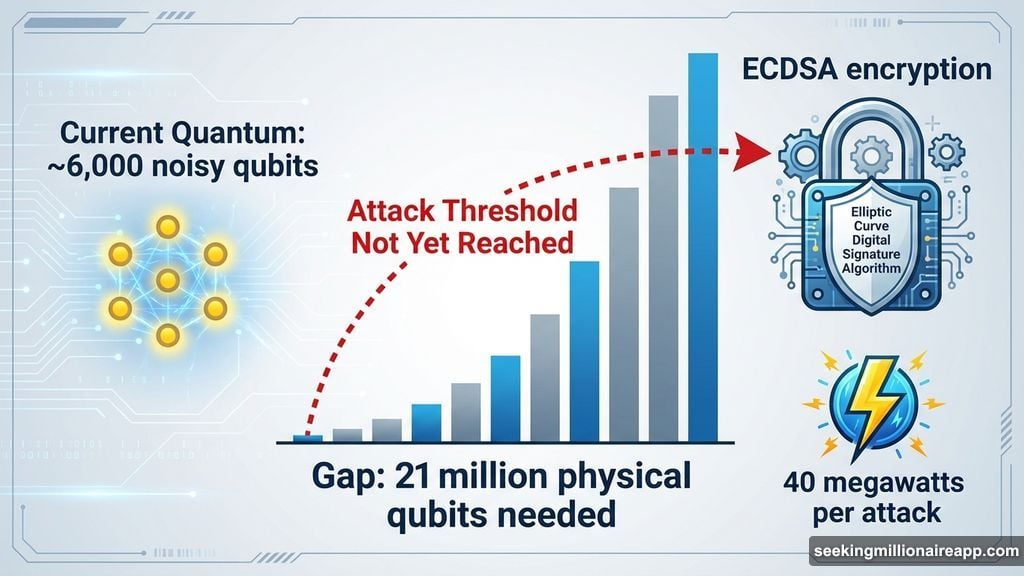

Not everyone agrees the clock is even ticking loudly yet. Bitcoin entrepreneur Ben Sigman laid out the math clearly. Cracking Bitcoin’s current ECDSA (Elliptic Curve Digital Signature Algorithm) encryption would require approximately 2,100 logical qubits, with each logical qubit potentially needing up to 10,000 physical qubits for error correction. That adds up to around 21 million physical qubits and up to 40 megawatts of power for a single attack.

Today’s most advanced quantum machines run about 6,000 noisy, non-fault-tolerant qubits. The gap between current capability and actual threat is enormous.

Sigman put the real risk at 30 to 50 years out. His point is that fear of quantum computing may cause more market disruption than quantum computing itself for a very long time.

Bitcoin Isn’t the Only Target

Several analysts pushed back on Bitcoin-specific doom narratives with a broader point. Quantum computing capable of breaking Bitcoin’s cryptography would simultaneously destroy global banking infrastructure, SWIFT transfer networks, stock exchanges, military communications, nuclear command systems, and every HTTPS-secured website on earth.

In other words, if quantum kills Bitcoin, your crypto portfolio is genuinely the least of your worries. That framing doesn’t eliminate the risk. But it does suggest that Bitcoin-focused panic may be somewhat misplaced relative to the scale of the actual problem.

Quantum-Resistant Signatures and the Lost Coin Problem

Analyst Willy Woo offered a more nuanced take. He expects Bitcoin will eventually adopt quantum-resistant signature schemes. That upgrade, however, wouldn’t solve the lost coin problem on its own.

If quantum computers eventually crack wallets currently assumed to be permanently inaccessible, that Bitcoin could re-enter circulation. Woo estimated a 75% probability that lost coins would not be frozen through a protocol-level hard fork. That means quantum-recovered BTC could flow back into active supply, effectively expanding the available pool and putting downward pressure on price.

Woo also noted that markets appear to be pricing this in already. The possibility of previously lost coins returning isn’t purely hypothetical anymore. It’s becoming a real factor in how investors model Bitcoin’s long-term supply dynamics.

The Community Response Is Already Split

André Dragosch, European Head of Research at Bitwise, came out firmly against protocol-level intervention. “I would say lose them, don’t enforce upgrades on anyone,” he said, reflecting a strong strain of Bitcoin thinking that values principle over pragmatism.

Others supported freezing the coins outright, arguing the network’s survival outweighs concerns about immutability doctrine.

That split, even at this early and mostly theoretical stage, is exactly what Ju warned about. If the community can’t agree when quantum computing is still decades away from posing a credible threat, reaching consensus under actual time pressure looks nearly impossible.

The Social Challenge Is the Real Test

What makes this situation genuinely fascinating is that Bitcoin has survived technical challenges before. What it hasn’t survived, cleanly, is fundamental disagreements about its own identity.

The quantum debate forces Bitcoin’s community to answer questions that have no comfortable answers. Does immutability matter more than security? Can coins be frozen to protect the network without destroying the principle that made the network worth protecting? Who speaks for Satoshi’s Bitcoin?

These aren’t engineering problems. They’re philosophical and political ones. And Bitcoin, by design, has no central authority to resolve them quickly.

Ju’s message is essentially a warning. The window to start this conversation is now, while quantum computing remains distant enough that panic doesn’t drive decisions. Waiting until Q-day is on the horizon means making one of the hardest calls in Bitcoin’s history under maximum pressure with minimum time.

Whether the community takes that seriously, or whether it fractures along familiar ideological lines, will say a great deal about whether Bitcoin is truly built to last.