BitMine just doubled down on Ethereum during one of crypto’s worst drawdowns. The firm scooped up over 40,000 ETH in a single day while sitting on $7 billion in unrealized losses.

Most investors flee when prices crater 62% from recent highs. But BitMine’s Tom Lee sees something different. He’s betting on history repeating itself with a sharp V-shaped recovery.

Let’s examine why this move is either brilliant or reckless.

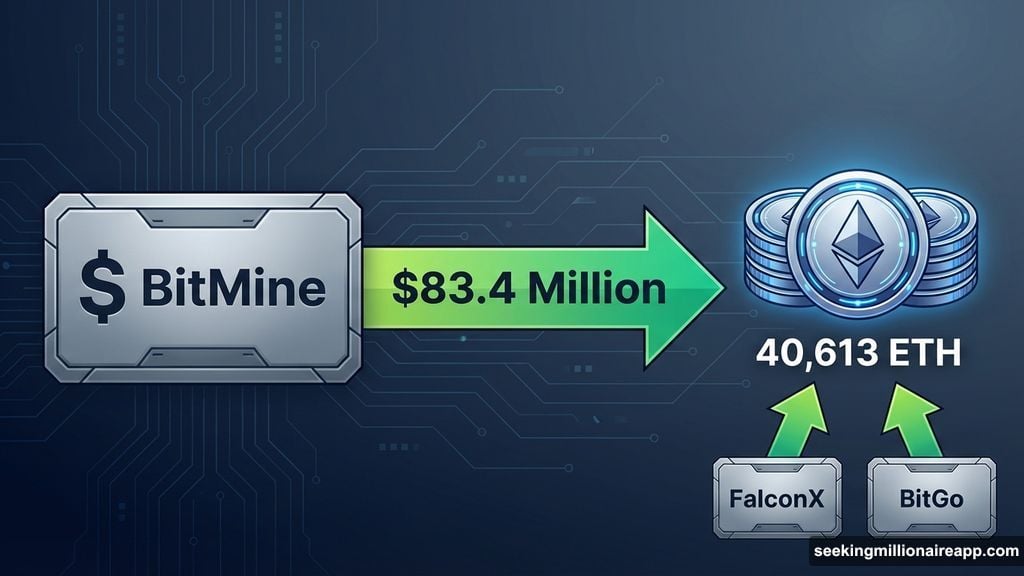

The Numbers Behind BitMine’s Massive Buy

BitMine disclosed acquiring 40,613 ETH last week. That brought total holdings to 4.325 million ETH as of February 8, 2026.

But they didn’t stop there. On-chain data from Lookonchain revealed additional purchases the same day. First, 20,000 ETH through FalconX. Then another 20,000 ETH via BitGo, worth roughly $42.3 million.

So in one trading session, BitMine deployed $83.4 million into Ethereum. That’s aggressive accumulation while most investors watch from the sidelines.

The market noticed. BitMine’s stock (BMNR) jumped 4.79% to close at $21.45 on February 9. Investors apparently liked the bold strategy despite the obvious risks.

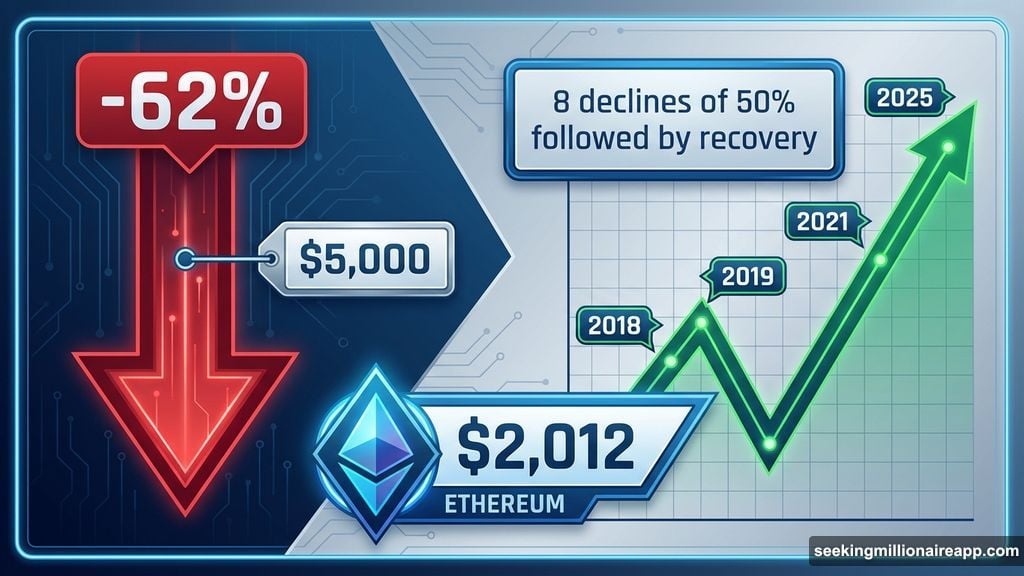

Ethereum Dropped 62% While BitMine Kept Buying

Here’s the context that makes this move interesting. ETH crashed 13.2% over the past week alone. At press time, it traded around $2,012, down 3.28% in 24 hours.

That’s a far cry from 2025 highs. In fact, Ethereum has fallen approximately 62% from peak prices. Most portfolios would panic at those losses.

Yet BitMine treats each dip as a buying opportunity. Tom Lee pointed to network fundamentals that suggest underlying strength despite price weakness.

Ethereum daily transactions hit 2.5 million in 2026. Active addresses reached 1 million. Those numbers indicate growing adoption regardless of market sentiment.

“In our view, the price of ETH is not reflective of the high utility of ETH and its role as the future of finance,” Lee stated in BitMine’s announcement.

That’s either visionary thinking or dangerous optimism. Time will reveal which.

The V-Shaped Recovery Theory

Lee’s confidence stems from historical patterns. Since 2018, Ethereum experienced 8 separate declines of 50% or more from recent highs. Each time, it recovered sharply.

The most recent example came in 2025. ETH plummeted 64% between January and March, bottoming around $1,600. Then it surged to nearly $5,000 later that year.

That’s the V-shaped recovery Lee expects again. He believes 2026 will follow the same playbook as previous cycles.

“The best investment opportunities in crypto have presented themselves after declines,” Lee explained. He referenced 2025 when tariff concerns triggered sharp selloffs that later reversed.

So BitMine’s strategy is simple. Buy aggressively during maximum pain. Wait for the inevitable bounce. Profit from the recovery.

But that assumes history repeats. Markets don’t always cooperate with historical patterns.

Why This Bet Could Work

Network activity supports Lee’s thesis. Ethereum isn’t dying. It’s processing millions of transactions daily with growing user adoption.

Plus, BitMine generates staking revenue from its massive ETH holdings. That provides ongoing cash flow even during price slumps. Unlike pure speculation, staking creates income that offsets some downside risk.

Moreover, institutional investors typically have longer time horizons than retail traders. BitMine can afford to wait years for a recovery. Most individual investors can’t stomach that volatility.

The firm also benefits from dollar-cost averaging. Buying during multiple dips lowers the average entry price. If ETH eventually rebounds to previous highs, those accumulated positions pay off handsomely.

Why This Bet Could Fail

Here’s the uncomfortable truth. Past performance doesn’t guarantee future results. Just because ETH recovered 8 times before doesn’t mean it will recover a ninth time.

BitMine already sits on $7 billion in unrealized losses. That’s real money that could evaporate completely if Ethereum continues falling or stagnates for years.

Also, the crypto landscape changed significantly since previous cycles. Regulatory pressure increased. Competition from other Layer 1 blockchains intensified. Market dynamics evolved.

What worked in 2018, 2020, and 2025 might not work in 2026. The V-shaped recovery pattern could break this time.

Finally, BitMine’s strategy creates concentration risk. They’re massively overweight in a single asset. If Ethereum fails to recover, the entire thesis collapses.

The Real Question Nobody’s Asking

Is $2,000 actually cheap for Ethereum? Or is it still overvalued relative to actual network utility?

Lee argues that ETH trades below its intrinsic value based on transaction volume and active users. But measuring crypto’s “true value” remains more art than science.

Traditional valuation metrics don’t cleanly apply to cryptocurrencies. There’s no cash flow to discount. No earnings multiple to calculate. Just network activity and speculative demand.

So BitMine’s bet ultimately rests on belief. Belief that Ethereum will power the future of finance. Belief that current prices represent a temporary discount. Belief that history will repeat.

Whether that belief proves correct determines if this $83 million gamble looks genius or foolish in hindsight. Right now, it’s simply bold.