Tom Lee’s BitMine keeps piling chips on Ethereum. The firm just locked up another $260 million worth of ETH in staking contracts, bringing its total staked position to a staggering $1.6 billion in just one week.

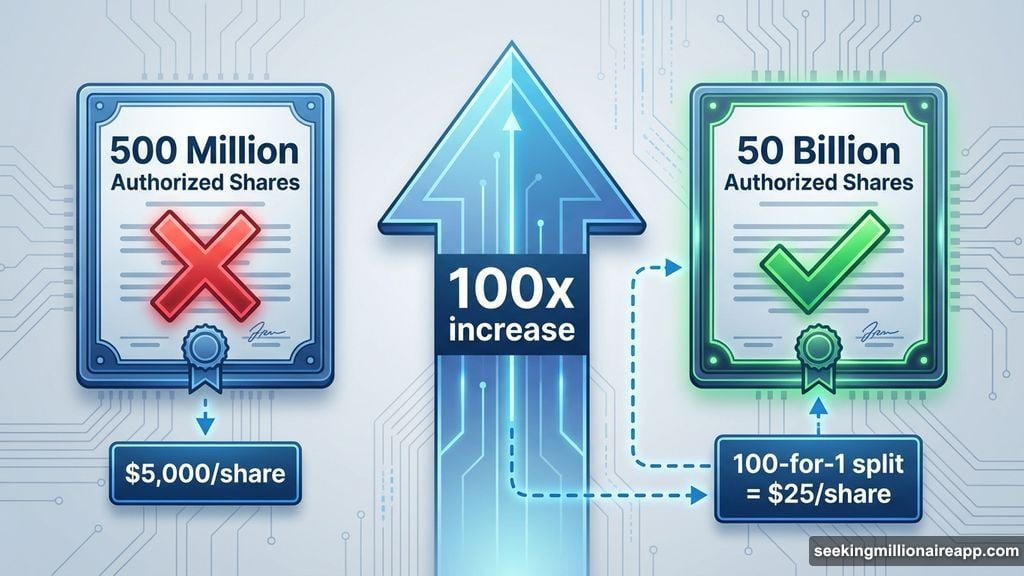

But here’s where it gets interesting. At the same time, BitMine is asking shareholders to approve something wild: increasing authorized shares from 500 million to 50 billion. That’s a hundredfold jump.

Lee calls it preparation for an Ethereum “supercycle.” Others might see warning signs. Let’s break down what’s actually happening.

The Numbers Behind BitMine’s Staking Spree

On January 2, BitMine deposited 82,560 ETH into staking protocols. That’s roughly $259 million at current prices.

This wasn’t a one-time move. Over the past week, the company staked a total of 544,064 ETH, worth approximately $1.62 billion. That represents about 13% of BitMine’s massive 4.07 million ETH treasury.

For context, BitMine is the largest public holder of Ethereum. So when they make moves this big, the market notices. Plus, staking these assets generates yield. Instead of holding dormant ETH, BitMine now earns rewards by validating network transactions.

However, staking also locks up capital. You can’t quickly sell staked ETH if market conditions change. That’s a meaningful trade-off when you’re managing nearly $10 billion in crypto assets.

Why BitMine Wants 50 Billion Authorized Shares

Here’s where things get complicated. BitMine currently has authorization for 500 million shares. Lee wants to increase that limit to 50 billion shares.

The official explanation? Future stock splits. Lee argues that if Ethereum hits his price targets, BitMine’s share price could reach $5,000. At that level, retail investors get priced out. So the company would need to split shares, potentially 100-for-1, to keep prices around $25.

But critics point to another possibility. With 50 billion authorized shares, BitMine gains enormous capacity to issue new stock through At-The-Market (ATM) offerings. This means selling shares whenever they want to raise cash for buying more Ethereum.

Lee frames this as taking advantage of the NAV premium. That’s the gap between BitMine’s share price and the actual value of its ETH holdings. When the stock trades above net asset value, issuing new shares becomes attractive.

Yet issuing new shares also dilutes existing shareholders. More shares outstanding means each share represents a smaller slice of the company. That’s a tough pill for current investors.

Tom Lee’s Ethereum Supercycle Vision

Lee isn’t shy about his bullish thesis. He projects Ethereum could reach $250,000 per token, driven by Wall Street’s adoption of tokenization.

His reasoning centers on institutional finance moving on-chain. BlackRock CEO Larry Fink called tokenization “the next evolution of global markets.” Since most tokenization happens on Ethereum, Lee believes ETH will capture massive value.

Moreover, Lee sees Wall Street re-engineering traditional finance using blockchain technology. Securities, bonds, real estate—everything could eventually tokenize. And if Ethereum becomes the infrastructure for that transformation, its value proposition multiplies.

However, these projections require perfect execution across multiple fronts. Ethereum must maintain technical dominance. Regulatory environments must support tokenization. Traditional finance must actually migrate substantial assets on-chain.

That’s a lot of “ifs” for a $250,000 price target. In fact, even Ethereum bulls question such aggressive numbers.

The Risk Nobody’s Discussing

BitMine’s strategy essentially bets the company on one asset. Diversification? Non-existent.

Most corporate treasuries spread risk across multiple assets. BitMine does the opposite. They concentrate everything in Ethereum. So if ETH performs well, shareholders win big. But if Ethereum faces headwinds, there’s no safety net.

Plus, the 50 billion share authorization creates potential for massive dilution. Even if used for “strategic purposes,” issuing billions of new shares fundamentally changes the investment equation for current holders.

Lee argues the NAV premium protects against this. If shares trade above asset value, selling new shares at premium prices theoretically benefits everyone. But markets don’t always cooperate. What happens if sentiment shifts and shares trade at a discount?

Staking Risks Add Another Layer

Staking generates yield. That’s the upside. But staked ETH faces withdrawal delays and smart contract risks.

When you stake Ethereum, you can’t instantly access those funds. Unstaking takes time. In volatile markets, that delay could prove costly. BitMine essentially accepts illiquidity in exchange for staking rewards.

Additionally, staking involves smart contracts. While Ethereum’s staking contracts are battle-tested, smart contract risk never fully disappears. A critical vulnerability could theoretically impact staked assets.

For retail investors, these risks might seem acceptable. For a publicly traded company managing billions, the risk calculation changes. Yet BitMine embraces these trade-offs aggressively.

What This Means for Ethereum Markets

BitMine’s actions have tangible market effects. By staking 544,064 ETH, they remove that supply from circulation. Less available supply can support higher prices, all else equal.

Moreover, BitMine’s public commitment to Ethereum sends a signal. When a major corporate holder doubles down, other institutions take notice. That could attract additional capital to ETH.

However, the flip side matters too. If BitMine eventually needs to sell, those assets could flood the market. Large holders create both support and potential overhang.

The shareholder vote on January 14 will reveal whether investors back Lee’s vision. Approval opens the door to aggressive expansion. Rejection forces BitMine to pursue more conservative growth.

The Bigger Picture

Lee’s betting that Ethereum becomes the backbone of future finance. If he’s right, BitMine shareholders could see extraordinary returns. His $250,000 price target implies roughly 80x gains from current levels.

But that scenario requires everything to break right. Technology must scale. Regulators must cooperate. Competition from other blockchains must fail. Traditional finance must embrace public blockchains over private alternatives.

That’s a big ask. Yet stranger things have happened in crypto. Five years ago, institutional Bitcoin adoption seemed impossible. Today, BlackRock manages a Bitcoin ETF.

Still, concentration risk remains real. BitMine isn’t diversified. It’s all-in on one asset. For investors who share Lee’s conviction, that focus appeals. For those seeking balance, it raises concerns.

Choose your exposure carefully. BitMine represents a pure play on Ethereum’s success. If you believe in Lee’s supercycle, the strategy makes sense. If you prefer broader crypto exposure, plenty of alternatives exist. Either way, watching how this plays out will be fascinating. BitMine just made the biggest institutional bet on Ethereum staking. Now we see if it pays off.