One crypto investment firm just became impossible to ignore.

Bitmine accumulated over 4 million ETH in just six months. That’s 3.37% of Ethereum’s entire supply now locked in one treasury. Plus, they’re not done yet. The company publicly aims for 5% ownership, a target that could reshape ETH’s supply dynamics entirely.

Meanwhile, Ethereum trades just below $3,000 after multiple failed breakout attempts. The question isn’t whether Bitmine’s accumulation matters. It’s whether this concentrated buying pressure can finally push ETH past resistance levels that have held for weeks.

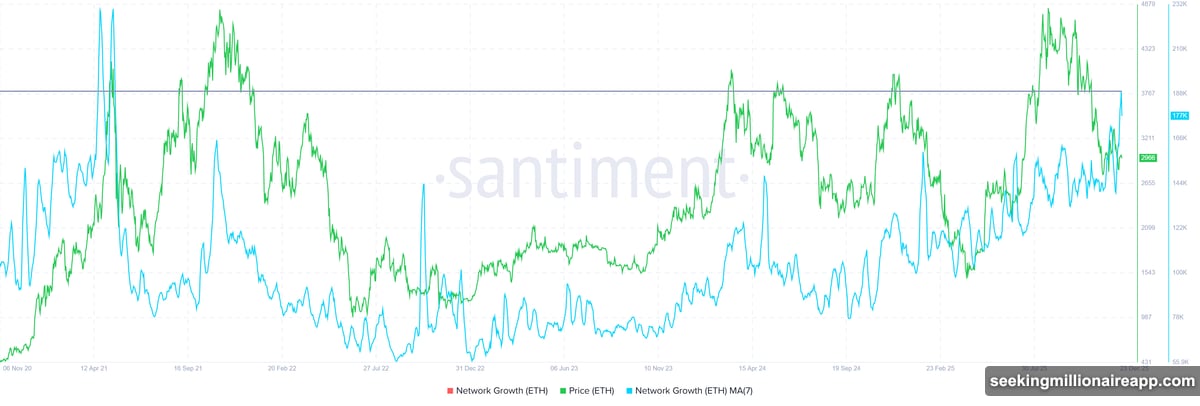

New Addresses Flood The Network

Ethereum’s network growth just hit a four-year and seven-month high. This metric tracks how fast new addresses join the blockchain. The surge suggests fresh capital is entering despite ETH’s price struggles.

New participants expand liquidity pools. They also strengthen demand foundations beyond short-term speculation. For Ethereum, this matters because sustained recovery depends on real inflows, not just traders flipping positions.

Strong address growth typically signals long-term confidence. Current price levels appear attractive enough to bring in participants willing to hold through volatility. That’s a positive sign even as momentum remains fragile.

Bitmine’s Treasury Play Changes The Math

Bitmine’s Ethereum holdings reached approximately 4.066 million ETH. The firm achieved this position within six months through aggressive accumulation. Their stated goal? Control 5% of all Ethereum in existence.

This strategy directly reduces circulating supply. When large entities remove tokens from active trading, it creates scarcity. Scarcity supports price appreciation if demand holds steady or increases. Bitmine’s public commitment to more buying suggests this supply squeeze will intensify.

The company’s approach mirrors corporate treasury strategies in other markets. By accumulating during periods of uncertainty, they position themselves to benefit when sentiment shifts. Their continued buying could provide a price floor that wasn’t present during previous correction attempts.

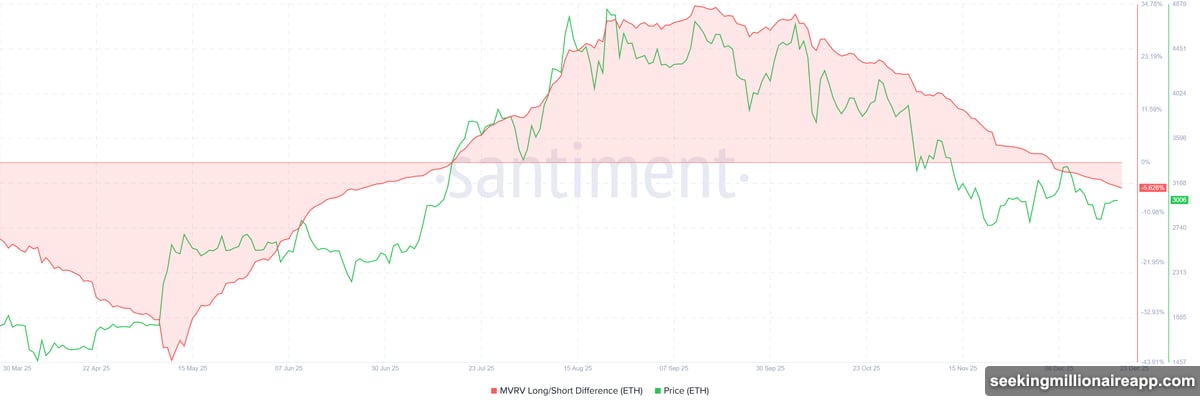

Profitability Levels Tell A Different Story

The MVRV Long/Short Difference currently sits at low negative levels. This indicator measures profitability for both long-term holders and short-term traders. Right now, neither group shows meaningful gains.

Lack of profitability typically slows transaction activity. Market participants hesitate to move assets when they’re underwater. This creates a stalemate. However, it also reduces selling pressure significantly.

Low profit conditions prevent aggressive distribution. Long-term holders rarely sell at losses. Short-term traders wait for better exit opportunities. This environment can actually stabilize prices during volatile periods. When external catalysts appear, these same holders absorb supply instead of adding to it.

Ethereum’s current setup reflects this balance. Weak profitability limits enthusiasm. Yet it prevents panic selling. A positive shift in macro conditions could change sentiment quickly, allowing stronger hands to push ETH higher without facing heavy resistance from profit-takers.

ETH Faces Its Make-Or-Break Level

Ethereum trades near $2,968 at press time. The $3,000 psychological level remains just overhead. This price point has capped rallies repeatedly in recent weeks. Continued failure to reclaim it keeps ETH vulnerable to renewed downside pressure.

To revisit December’s high of $3,447, Ethereum needs a 16% recovery. The first obstacle stands at $3,131, a key resistance zone. Sustained network growth and Bitmine’s ongoing accumulation could provide the buying pressure needed to clear this hurdle.

Downside risks haven’t disappeared. If Ethereum fails to secure $3,000 as support, the next test arrives at $2,798. Given ETH’s tendency for sharp moves in this range, a breakdown could accelerate losses before buyers step in again.

Supply Concentration Could Force Price Action

Bitmine’s accumulation represents more than just bullish positioning. When a single entity controls over 3% of a major cryptocurrency’s supply, it changes market dynamics fundamentally.

Supply concentration reduces the tokens available for trading. This makes price movements more sensitive to changes in demand. Even modest buying pressure can push prices higher when circulating supply is constrained. Conversely, it makes the market more dependent on that entity’s future actions.

Bitmine’s public commitment to reaching 5% ownership adds credibility to this supply squeeze. They’re not accumulating quietly. Their transparent strategy signals long-term conviction, which can influence other institutional investors’ decisions.

The crypto market has seen similar scenarios before. Large holders who publicly commit to long-term positions often create self-fulfilling prophecies. Their presence alone attracts additional buyers who want to benefit from the same supply dynamics.

What Happens Next Depends On Momentum

Ethereum’s setup presents conflicting signals. Network growth and concentrated accumulation suggest strong underlying demand. Yet price action remains choppy, unable to break cleanly above resistance.

The catalyst for a sustained move higher could come from multiple sources. Improved macro conditions might boost risk appetite broadly. Successful network upgrades could renew attention on Ethereum’s technology. Or simply, Bitmine’s continued buying could eventually overwhelm available supply at current prices.

Conversely, failure to reclaim $3,000 would damage technical positioning. It could trigger stop-loss orders and discourage new buyers who view that level as a crucial indicator. The difference between these outcomes may come down to timing and broader market sentiment shifts.

For now, Ethereum sits at an inflection point. Bitmine’s accumulation and network growth provide fundamental support. But technical resistance and lackluster profitability create headwinds. Which force wins will determine whether ETH finally breaks higher or tests lower support levels first.