BitMine just learned an expensive lesson about putting all your eggs in one crypto basket. The company now sits on over $4 billion in unrealized losses from its massive Ethereum holdings.

That’s not a typo. Four billion dollars underwater. And they’re still buying more ETH even as their stock crumbles and shareholders watch their investments evaporate. Let’s dig into why this corporate treasury strategy is starting to look like a trap instead of a triumph.

The Numbers Paint a Brutal Picture

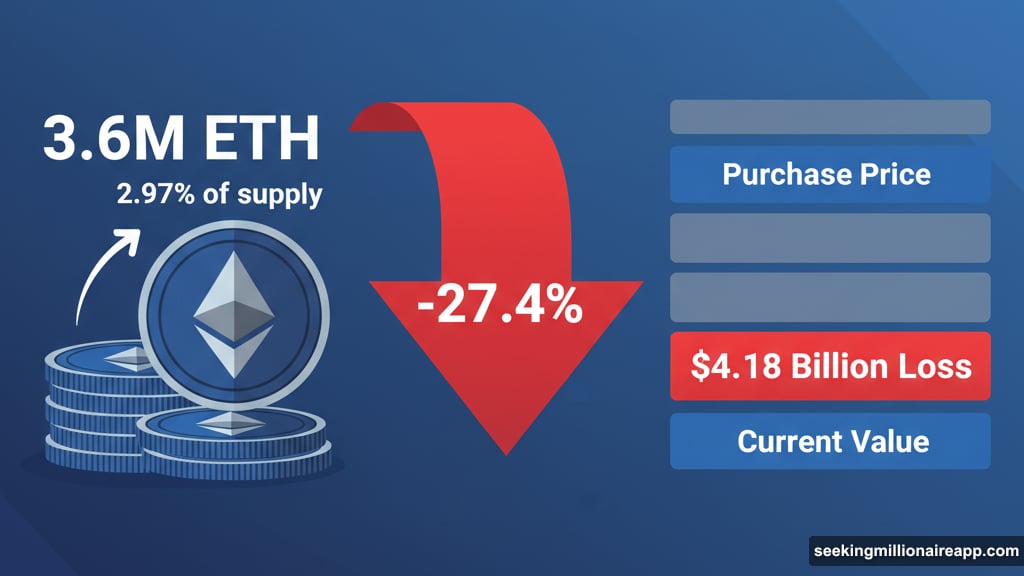

BitMine owns nearly 3.6 million ETH right now. That represents roughly 2.97% of Ethereum’s entire supply. Impressive scale. Terrible timing.

When Ethereum dropped 27.4% over the past month, BitMine’s treasury took the full hit. Their ETH stack is worth just under $10 billion today. But they paid significantly more to acquire it. That $4.18 billion gap between purchase price and current value tells the real story.

Meanwhile, BitMine’s stock (BMNR) crashed 49.8% in the same period. That’s nearly double Ethereum’s decline. Shareholders got hammered twice as hard as the underlying asset. So owning the company became even worse than just holding ETH directly.

This creates what researchers are calling a “Hotel California” scenario. You can check in anytime you like, but you can never leave. At least not without massive losses.

NAV Compression Traps Investors

The market-to-net-asset-value ratio reveals the core problem. BitMine’s basic mNAV sits at 0.73, with diluted mNAV at 0.88. Both numbers scream “distressed.”

What does that mean practically? The stock trades at a discount to the actual value of assets the company holds. Investors pay less per share than the ETH backing it is worth. That sounds like a bargain until you realize why the discount exists.

Nobody wants in because everyone already holding shares is bleeding money. New investors see billions in unrealized losses and run the other way. Who wants to buy into a sinking ship?

Research firm 10x Research nailed the problem in a recent analysis. When NAV rises, long-term holders win big. But when it falls, those same shareholders can’t escape without taking brutal losses. The structure magnifies downside risk instead of providing protection.

Plus, selling shares at these depressed prices means realizing losses that dwarf the ETH decline itself. Shareholders face a terrible choice: hold and hope for recovery, or sell and lock in catastrophic losses.

They’re Still Buying Despite the Pain

Here’s the twist that makes this story even more bizarre. BitMine keeps accumulating ETH even as their existing holdings bleed value.

The company bought 110,288 ETH earlier this month. Then they grabbed another 17,242 ETH worth $49.07 million from FalconX and BitGo. That’s over $130 million in fresh ETH purchases while sitting on $4 billion in unrealized losses.

Their stated goal is owning 5% of all Ethereum. They’re at 2.97% now, so they’re not backing down despite market conditions. This strategy works brilliantly in bull markets. Companies like MicroStrategy proved that with Bitcoin.

But in bear markets or corrections, it creates a devastating feedback loop. The company buys more ETH, which increases exposure to an asset that’s declining. Share prices fall faster than ETH because investors discount the company’s ability to create value beyond just holding crypto.

That discount grows as losses mount. Which makes raising capital harder. Which limits the company’s strategic options. The treasury model that looked genius at ETH’s peak now feels like handcuffs.

Other DAT Companies Face Similar Struggles

BitMine isn’t alone in this mess. The entire digital asset treasury model is getting stress-tested right now.

Sharplink Gaming, the second-largest corporate ETH holder, owns 859,853 tokens worth $2.4 billion. Their unrealized losses exceed half a billion dollars. Their stock (SBET) dropped 35.15% this month.

Bitcoin-focused treasury companies show the same pattern. Many report declines that exceed Bitcoin’s own price drop. The corporate wrapper that was supposed to add value instead multiplies losses during downturns.

This raises fundamental questions about the DAT model’s sustainability. Is it viable long-term? Or does it only work during crypto bull runs when rising prices hide structural weaknesses?

The Treasury Model’s Achilles Heel

Traditional treasuries hold diverse assets. Cash, bonds, maybe some equities. The goal is stability and liquidity to support operations.

Crypto treasuries do the opposite. They concentrate risk in volatile digital assets. BitMine’s 3.6 million ETH represents nearly their entire treasury. No diversification. No hedge against crypto downturns.

That strategy amplifies gains during bull markets. But it creates existential risk during corrections. If ETH drops 50%, BitMine’s treasury gets cut in half. Their stock might fall 75% or more due to NAV compression.

Furthermore, these companies face pressure to keep buying. Their investment thesis is that crypto will eventually go much higher. Stopping purchases signals doubt in that thesis. But continuing purchases while underwater puts more shareholder capital at risk.

The model assumes crypto prices trend upward long-term. That’s probably true for Bitcoin and Ethereum. But “long-term” might mean years of pain before recovery. Shareholders and boards might not have that patience.

What This Means for Crypto Corporate Adoption

BitMine’s struggles send a warning signal to other companies considering similar strategies. The DAT model carries serious risks that aren’t obvious during bull markets.

Companies attracted to crypto treasuries should ask hard questions. Can we survive a 50% drawdown? Will shareholders tolerate billions in unrealized losses? Do we have a viable exit strategy if crypto markets stay depressed?

For BitMine specifically, they’re committed now. Selling 3.6 million ETH would crash Ethereum’s price and guarantee massive realized losses. They’re locked into holding and hoping for recovery.

That might work out eventually. Ethereum could rally back to previous highs. But the timeline is uncertain. And in the meantime, shareholders are stuck watching their investments decay faster than the underlying asset.

The “Hotel California” metaphor fits perfectly. BitMine and its shareholders checked into the ETH treasury model during good times. Now they can’t leave without severe damage. The exit door is blocked by billions in unrealized losses and NAV compression that penalizes selling.

The crypto treasury model isn’t dead. But BitMine’s $4 billion lesson proves it’s far riskier than proponents suggested. Companies rushing to copy MicroStrategy’s Bitcoin playbook should study BitMine’s Ethereum pain first.

Sometimes the best investment strategy is the one you can actually exit when needed. BitMine’s shareholders are learning that lesson the expensive way.