Institutional interest in Uniswap just got serious. Bitwise Investments filed an S-1 with the SEC for a spot Uniswap ETF, marking the first attempt to bring UNI to traditional investment portfolios.

Meanwhile, on-chain metrics hit record highs. Daily UNI token burns surged in February as trading fees spiked. Plus, whale wallets scooped up millions of dollars worth of tokens.

Yet UNI’s price dropped 15% in 24 hours. So what gives?

Bitwise Wants UNI in Every Portfolio

The asset manager registered the “Bitwise Uniswap ETF” in Delaware, following the same playbook used for previous crypto ETF filings. If approved, the fund would track UNI’s spot price minus expenses, with Coinbase Custody handling storage.

Here’s the catch. This ETF won’t include staking at launch. That means investors get pure price exposure without the yield component that makes UNI attractive to DeFi users.

Still, market observers called this a watershed moment. “With the regulatory clouds cleared and Bitwise leading the charge, UNI is about to become a staple in every institutional portfolio,” noted crypto analyst Whale Factor.

The timing matters. February saw record UNI burns coinciding with the filing, suggesting Bitwise recognized growing protocol strength before making their move.

Token Burns Hit Record Pace

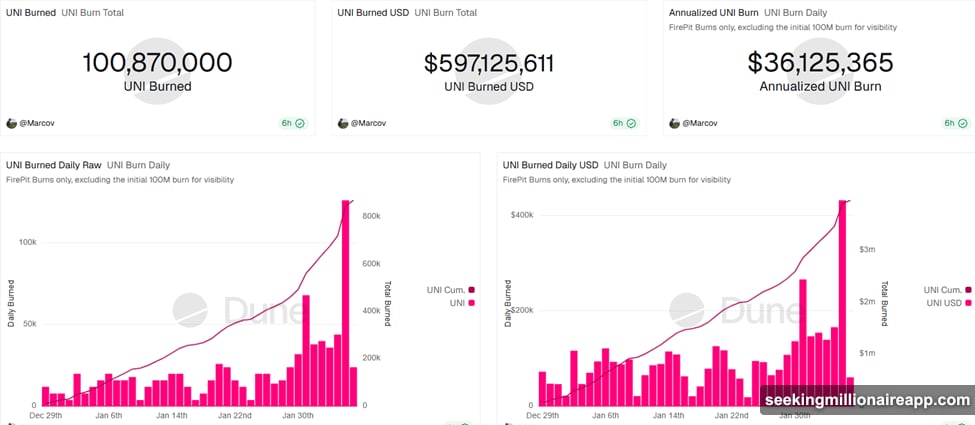

Daily UNI burns accelerated sharply in early February, according to Dune Analytics data. Over 100 million UNI tokens have been destroyed since the burn mechanism launched, valued at approximately $597 million.

The annualized burn rate now exceeds $36 million. That’s real supply reduction hitting the market regularly.

What’s driving these burns? Uniswap’s Fee Switch converts a portion of trading fees into burned UNI tokens. As trading volume surges, more fees flow to the protocol, which triggers more burns.

Daily fee generation confirms this pattern. Charts show Uniswap fees climbing throughout January and early February, directly correlating with increased burn rates.

So the protocol fundamentals look strong. Users are trading. Fees are flowing. Supply is shrinking. Yet the price dropped anyway.

Whales Bought While Retail Sold

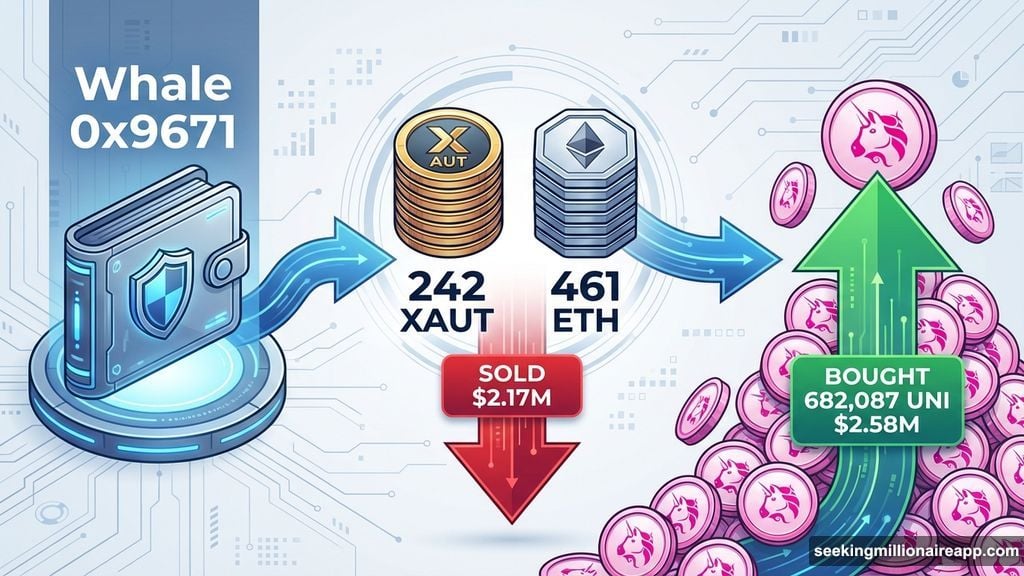

On-chain data reveals a split between large and small holders. Whale address 0x9671 sold 242 XAUT worth $1.19 million and 461 ETH worth $985,000, then used the proceeds to buy 682,087 UNI for $2.58 million.

That’s conviction. This whale dumped gold-backed tokens and Ethereum to load up on UNI during the price drop.

But exchange flows tell a different story. CryptoQuant data shows UNI reserves on exchanges climbed throughout this period. More tokens sitting on exchanges typically signals selling pressure from smaller holders.

Historical patterns confirm that higher exchange inflows often precede short-term volatility. Even when protocol metrics look bullish, concentrated selling can drag prices down temporarily.

As of this writing, UNI traded at $3.20, down 13.73% in 24 hours. The broader market selloff contributed, but UNI’s drop exceeded most major tokens.

Fee Switch Revenue Disappoints Some Analysts

Not everyone sees UNI’s fundamentals as bullish. The Fee Switch launched in December with high expectations, but early revenue data fell short for some governance participants.

BeInCrypto reported in December that initial revenue disappointed versus projections. Some analysts questioned whether the mechanism was properly calibrated or if expectations were simply unrealistic.

Uniswap founder Hayden Adams pushed back hard. “The analysis is just wrong, overeager and misleading,” he stated on social media. Adams argued that only a subset of fee sources had activated so far, with more parameters to tune in future proposals.

Plus, the treasury burned UNI roughly equal to what would have occurred if the Fee Switch ran the entire time. So the mechanism worked as designed, even if partial activation confused some observers.

Still, this controversy might explain why price action remained weak despite strong burn metrics. Markets don’t like uncertainty, and conflicting narratives about the Fee Switch’s success created doubt.

Institutional Interest Meets DeFi Volatility

The Bitwise ETF filing represents a bridge between traditional finance and decentralized protocols. If approved, mainstream investors could gain UNI exposure through standard brokerage accounts without touching MetaMask or Uniswap’s interface.

That’s huge for adoption. But it also introduces new dynamics.

ETF flows tend to be stickier than crypto-native trading. Traditional investors typically hold positions longer, creating price stability over time. However, the approval process takes months, and uncertainty about SEC decisions often weighs on tokens during review periods.

Meanwhile, UNI faces near-term headwinds from rising exchange reserves. As long as tokens keep flowing onto trading platforms, sellers can find liquidity easily. That caps price appreciation even when fundamentals improve.

The next few months will test whether institutional interest can overcome these technical pressures. Bitwise’s filing signals confidence in UNI’s long-term potential, but short-term volatility likely persists.

Whale accumulation suggests smart money expects higher prices eventually. But timing remains uncertain, especially with broader market conditions still fragile. Keep watching exchange flows and burn rates—they’ll signal when supply dynamics shift in UNI’s favor.