BlackRock’s Larry Fink just dropped a hint that sent ripples through the crypto world. The asset management titan is eyeing a bigger role in tokenization and expects explosive growth ahead.

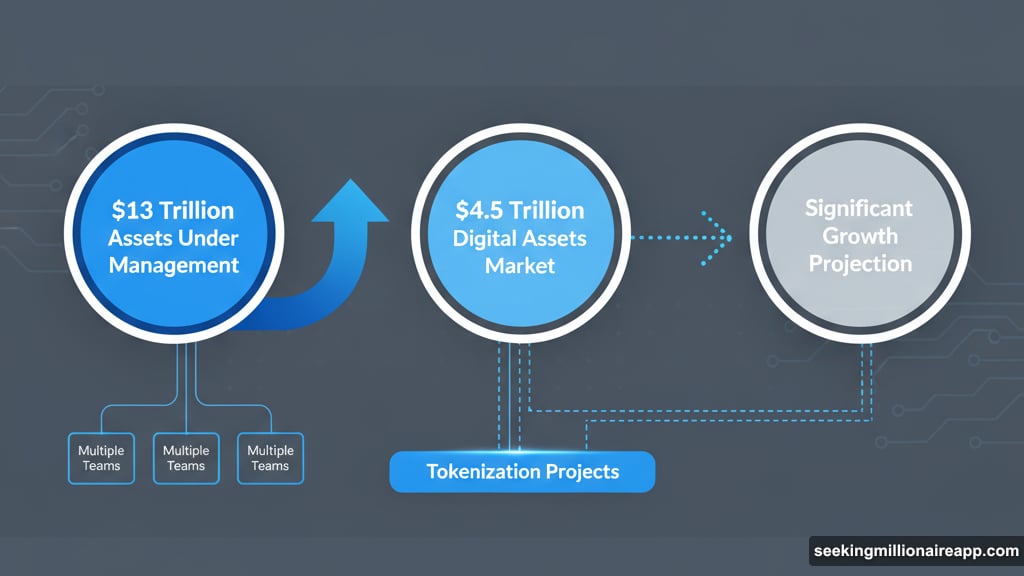

During Tuesday’s earnings call, Fink laid out an ambitious vision. His firm manages over $13 trillion in assets. Now they want to bring traditional finance onchain in a major way.

The numbers tell the story. Digital assets already hit $4.5 trillion in market value. But Fink sees that growing “significantly” over the next few years. Plus, BlackRock isn’t sitting on the sidelines waiting for that growth to happen.

BlackRock Already Dominates Crypto ETFs

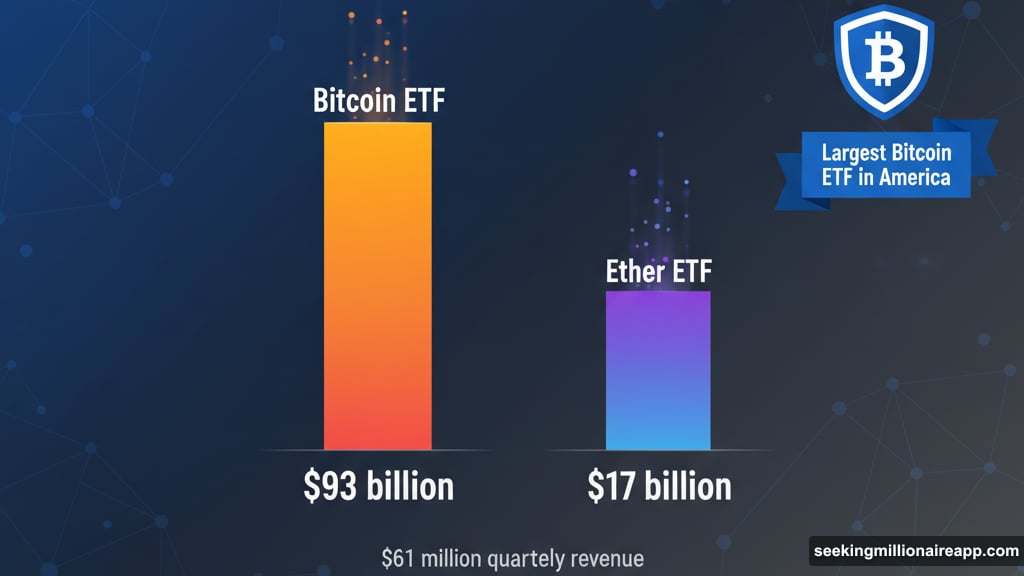

The firm moved fast when the U.S. approved spot bitcoin ETFs. Their bitcoin fund now holds $93 billion in assets. That makes it the largest bitcoin ETF in America by a wide margin.

Their ether ETF pulled in another $17 billion. Combined, these products generated $61 million in revenue last quarter. That’s tiny compared to BlackRock’s total $6.5 billion quarterly revenue. But it’s growing rapidly.

More importantly, these products proved traditional investors want exposure to digital assets. So BlackRock sees the opening to push deeper into tokenization.

Tokenized Money Market Fund Leads the Pack

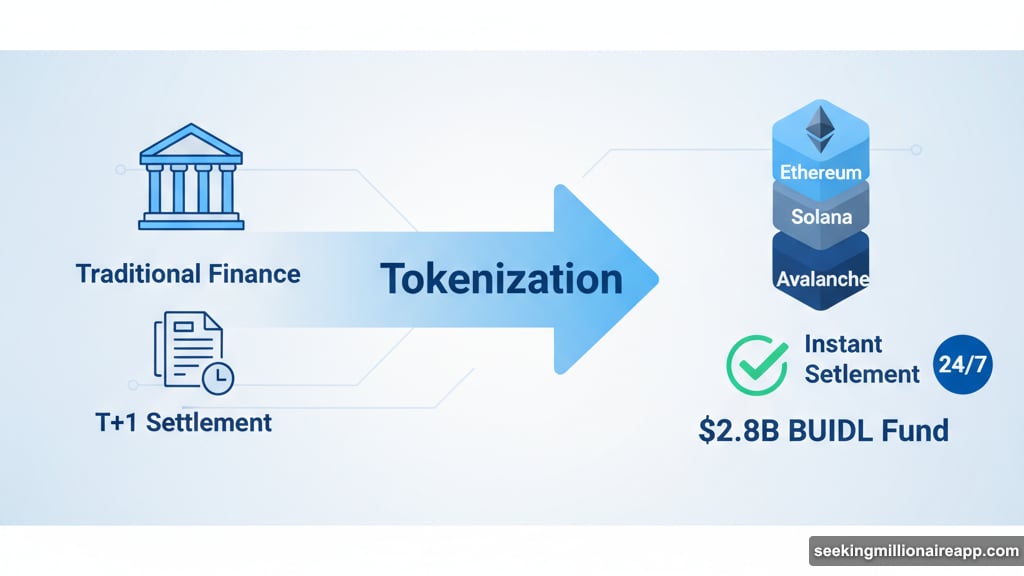

BlackRock launched BUIDL last year with tokenization specialist Securitize. The tokenized money market fund now manages $2.8 billion. That makes it the largest tokenized fund on the market.

BUIDL runs across multiple blockchains. You’ll find it on Ethereum, Solana, and Avalanche. This multi-chain approach lets investors access the fund wherever they prefer to operate.

The product delivers something traditional finance struggles to provide: instant settlement and 24/7 availability. Money market funds typically require T+1 settlement. BUIDL settles instantly through blockchain rails.

Traditional Finance Moves Onchain

Fink’s comments signal a broader shift. Traditional financial giants are realizing tokenization isn’t just hype. It actually solves real problems around market access and efficiency.

For decades, financial markets operated with layers of intermediaries. Each layer adds cost and delays. Tokenization removes many of these friction points.

Take a simple money market fund. Traditional versions require custodians, transfer agents, and multiple settlement systems. Each step introduces fees and delays. Meanwhile, tokenized versions settle instantly with programmable compliance baked in.

That efficiency matters at BlackRock’s scale. Every basis point saved across trillions of dollars adds up fast. So the economic incentive to embrace tokenization is massive.

Teams Across BlackRock Explore Tokenization

Fink revealed that multiple teams inside BlackRock are working on tokenization projects. This isn’t just one experimental initiative. It’s a firm-wide strategic push.

However, he stayed vague about specifics. “I do believe we have some exciting announcements in the coming years on how we could play a larger role on this whole idea of the tokenization and digitization of our assets,” Fink said.

That careful wording suggests big moves are brewing. But they’re not ready to announce details yet. Given BlackRock’s track record of moving fast once they commit, expect announcements to come sooner rather than later.

Securitize Partnership Proves the Strategy

BlackRock led Securitize’s $47 million funding round last year. That investment telegraphed where the firm’s thinking headed. They weren’t just testing tokenization. They were backing the infrastructure to make it mainstream.

Securitize provides the technical rails for BUIDL and other tokenized products. The partnership lets BlackRock focus on asset management while Securitize handles blockchain complexities.

This division of labor makes sense. BlackRock knows traditional finance inside and out. Securitize knows blockchain infrastructure. Together, they bridge the gap between TradiFi and DeFi.

The model could extend to other asset classes. Real estate, private equity, and bonds all face similar inefficiencies that tokenization could solve. BlackRock’s size gives them leverage to tokenize virtually any asset class they choose.

Stablecoins Get Mainstream Validation

The same earnings call featured another crypto milestone. Citigroup CEO Jane Fraser backed tokenized deposits over stablecoins. She argued too much focus goes to stablecoins when tokenized bank deposits offer similar benefits with less regulatory uncertainty.

This debate highlights a crucial tension. Stablecoins operate independently of traditional banking. Tokenized deposits keep banks in the loop. Both approaches have merit, but traditional finance clearly prefers tokenized deposits.

BlackRock will likely explore both paths. Their BUIDL fund essentially functions as an institutional stablecoin. But they could also partner with banks on tokenized deposit products.

Market Volatility Doesn’t Shake Long-Term Vision

Tuesday’s crypto markets showed typical volatility. Bitcoin slipped under $112,000. Ethereum and other major tokens dropped 5-6% as China retaliated against U.S. tariffs.

Yet BlackRock’s message ignored short-term price swings. Fink focused on multi-year growth trends. That perspective makes sense given BlackRock’s time horizon. They’re building infrastructure for decades, not trading volatility.

BlackRock shares rose 1.5% on Tuesday despite crypto market weakness. Investors apparently see tokenization as a growth opportunity, not a speculative gamble. The firm’s total assets under management grew from $11.4 trillion to $13.4 trillion year-over-year.

What This Means for Crypto Markets

When the world’s largest asset manager doubles down on tokenization, it validates the entire sector. Skeptics have questioned whether tokenization would ever escape niche crypto circles. BlackRock’s commitment answers that question.

Other asset managers will watch closely. If BlackRock succeeds in bringing more assets onchain, competitors will rush to follow. Nobody wants to cede market share to more efficient blockchain-based offerings.

This competition could accelerate tokenization adoption across traditional finance. What seemed like a distant future possibility suddenly looks inevitable. The question shifts from “if” to “when” and “how fast.”

For crypto builders, this creates opportunities. BlackRock will need more blockchain infrastructure, compliance tools, and integration services. Startups that solve these problems could see massive demand from traditional finance firms following BlackRock’s lead.

The digital asset market’s path from $4.5 trillion to Fink’s vision of “significant” growth will require more than just price appreciation. It needs real adoption of tokenized products by institutions and individuals. BlackRock’s commitment suggests that adoption is coming faster than many expected.