BlackRock’s spot Bitcoin ETF pulled in billions this year. Wall Street finally embraced crypto. Institutions went long on Bitcoin.

Except none of that is actually true.

Arthur Hayes just dropped an uncomfortable truth. Most of those massive ETF inflows? They’re not bullish bets on Bitcoin. Instead, they’re something far more mundane: arbitrage trades that have nothing to do with long-term conviction.

So what’s really happening inside the world’s largest Bitcoin ETF? And why does it matter for the price action we’re seeing right now?

The Arbitrage Trade Wall Street Actually Runs

Hayes breaks down the strategy in simple terms. Hedge funds and bank trading desks aren’t buying IBIT because they believe in Bitcoin’s future.

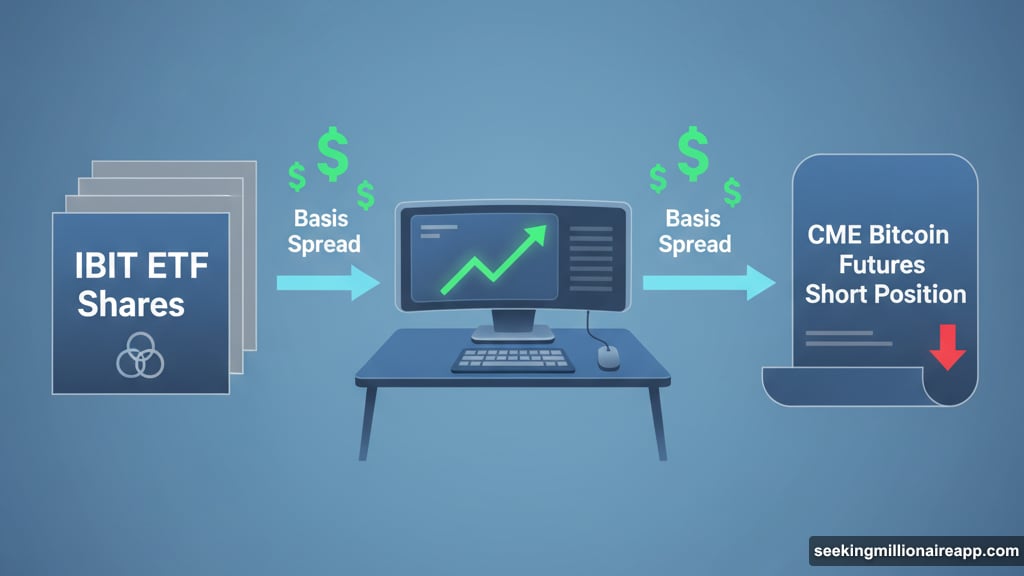

Here’s the actual playbook they’re running:

Buy shares of BlackRock’s IBIT ETF. Then immediately short CME Bitcoin futures. Capture the spread between the two (called the basis). Use the ETF shares as collateral for the futures position.

That’s it. No Bitcoin conviction required. Just pure yield farming.

Moreover, this trade became especially attractive in 2025. The Federal Reserve cut rates three times this year. Traditional yields dropped across the board. So arbitrage opportunities started looking more appealing to institutional players.

Hayes puts it bluntly: “They are not long Bitcoin. They only play in our sandbox for a few extra points over Fed Funds.”

Why ETF Flows Tell You Nothing About Sentiment

This creates a major problem for retail investors trying to read the market. When the basis widens, hedge funds pile into the trade. ETF inflows surge. Headlines scream about institutional adoption.

But when that basis compresses? Those same institutions unwind their positions. ETF shares get sold. Outflows spike. Yet nothing fundamentally changed about Bitcoin itself.

Plus, retail investors often misread these flows completely. They see big inflows and assume Wall Street is bullish. They see outflows and panic about institutional selling. Neither interpretation captures what’s actually happening.

The reality is simpler. ETF flows mostly track the profitability of a basis trade. Not institutional sentiment about Bitcoin’s long-term prospects.

What Changed This Fall

Earlier in 2025, Bitcoin rallied even as dollar liquidity tightened. The incoming Trump administration and increased Treasury issuance should have created headwinds. Instead, ETF inflows and buying from digital asset trusts propped up the price.

However, Hayes argues that dynamic has now reversed. Several digital asset trusts traded below net asset value this autumn. The ETF basis trade became less profitable as futures spreads narrowed. So hedge funds started reducing their positions.

With those artificial demand drivers fading, Bitcoin finally has to respond to underlying macro conditions again. And those conditions aren’t particularly bullish right now.

Hayes doesn’t mince words: “Bitcoin must fall to reflect the current short-term worry that dollar liquidity will contract or not grow as fast as the politicians promised.”

The Liquidity Problem Nobody Talks About

Here’s the core issue. ETF flows pushed Bitcoin higher when liquidity fundamentals didn’t justify it. Now those flows are reversing. But the liquidity situation hasn’t improved.

In fact, it may have gotten worse. Dollar liquidity remains constrained. Treasury issuance continues. The Federal Reserve hasn’t signaled any major pivot toward looser policy.

So Bitcoin faces a reckoning. The price got ahead of itself thanks to arbitrage-driven ETF flows. Now those flows are unwinding. And the underlying macro environment still looks challenging.

Hayes identifies three key takeaways for investors:

Most ETF inflows were arbitrage, not genuine long-term positioning. BlackRock’s biggest holders aren’t actually long Bitcoin. The unwind of basis trades is affecting Bitcoin’s price right now.

For retail investors, this means one thing. Don’t trust ETF flow data as a sentiment indicator. Those flows tell you more about the futures curve than institutional conviction.

What This Means for Bitcoin’s Price

Hayes is bearish on Bitcoin’s short-term prospects. Not because of any fundamental problem with the asset itself. But because the artificial support from ETF arbitrage trades is disappearing.

That doesn’t mean Bitcoin is heading to zero. But it does mean the price needs to adjust to reflect actual liquidity conditions. Not phantom demand from basis traders who never wanted Bitcoin exposure in the first place.

The trap for retail investors is clear. Wall Street created the illusion of institutional adoption through a simple arbitrage trade. Many bought that narrative without understanding what was really happening.

Now the trade is unwinding. And Bitcoin has to stand on its own fundamentals again. Whether those fundamentals can support current prices remains an open question.

One thing seems certain though. The next time you see headlines about massive ETF inflows, remember Arthur Hayes’s warning. Those flows might tell you nothing about what institutions actually think of Bitcoin.