September 2025 delivered a reality check to the blockchain industry. Revenue dropped 16% across major networks. Ethereum slowed. Solana cooled. Bitcoin’s volatility fell by 26%.

But here’s the surprising part. This downturn might actually signal maturity rather than decline.

VanEck’s latest report reveals something fascinating happening beneath the surface. While speculation fades, utility grows. The blockchain sector isn’t dying. It’s just growing up.

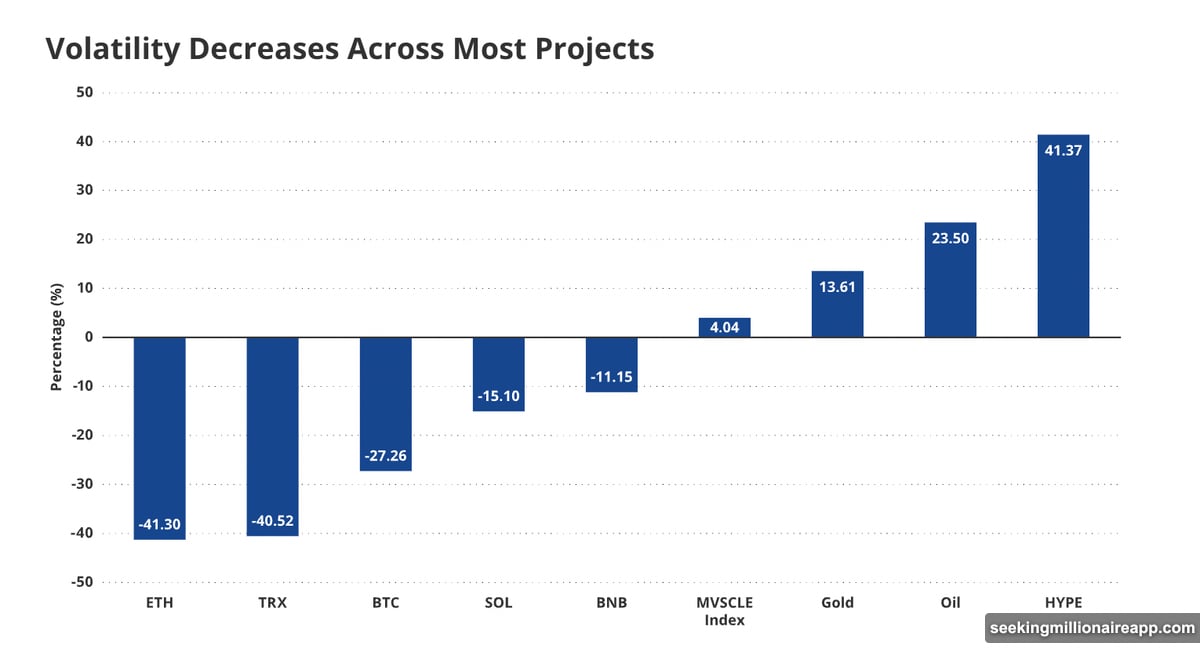

The Volatility Collapse That Broke Revenue Models

Lower token volatility killed the golden goose for blockchain networks. When crypto prices swing wildly, traders pay massive fees to chase arbitrage opportunities. September’s calm market eliminated those opportunities.

Ethereum’s volatility dropped 40%. Bitcoin fell 26%. Fewer price swings meant traders had no reason to pay premium transaction fees.

VanEck explained it clearly. Without volatility, arbitrage opportunities vanish. So traders stop paying high priority fees to jump ahead in transaction queues.

That’s the direct link between market excitement and blockchain revenue. More price action equals more fees. Less drama equals thinner margins.

Yet this shift reveals something important. Blockchains built solely on speculation face trouble when markets stabilize. Meanwhile, networks providing real utility can weather these storms.

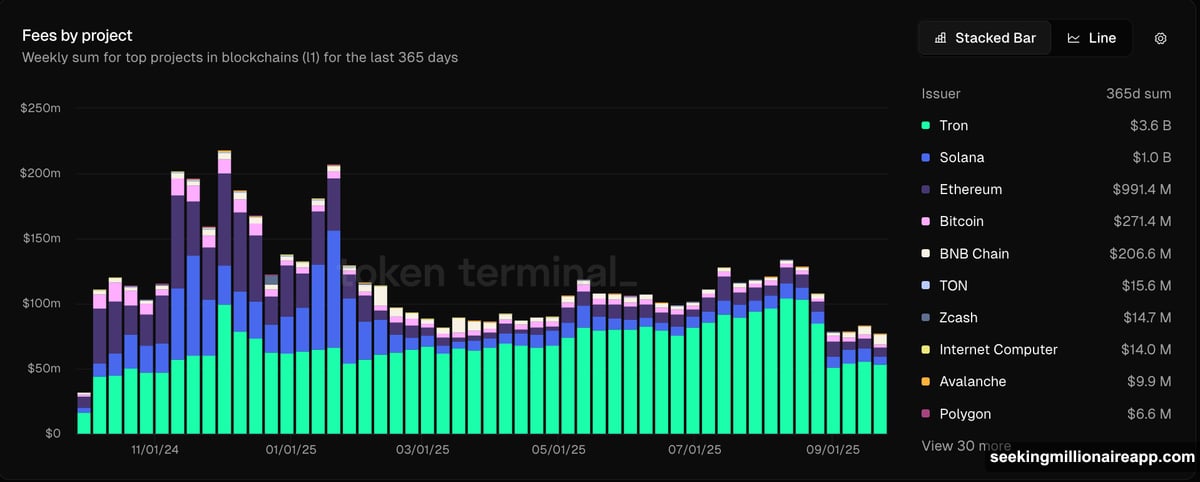

Tron Quietly Won While Everyone Watched Ethereum

Here’s a stat that should shock you. Tron generated $3.6 billion in revenue over the past year. Ethereum managed only $1 billion. And Tron’s market cap is 16 times smaller.

How did this happen? Stablecoins.

Tron hosts 51% of all circulating USDT. That means more than half the world’s most popular stablecoin lives on Tron’s network. People use it for fast, cheap payments without traditional banks.

Yes, Tron’s revenue dropped 37% in September after governance reduced fees. But that annual figure tells the real story. While other blockchains chase hype, Tron built infrastructure for actual economic activity.

Stablecoins now exceed $292 billion in total market cap. They’re not just speculation tools anymore. They power cross-border payments, informal finance, and everyday transactions in regions with limited banking access.

Tron positioned itself at the center of this transformation. So when volatility disappeared, Tron’s utility-based revenue model proved more resilient than speculation-driven competitors.

Ethereum and Solana Race to Stay Relevant

Both networks see the writing on the wall. So they’re adapting fast.

Ethereum is preparing “Fusaka,” an upgrade focused on Layer 2 scalability. The goal? Make it easier for Layer 2 networks to validate transactions quickly and cheaply. That should reduce costs and attract more activity back to the Ethereum ecosystem.

Meanwhile, Solana deployed Alpenglow. This upgrade slashed finality time by 80 times, dropping from 12 seconds to just 150 milliseconds. Plus, Solana introduced P-tokens, a new format that cuts computational load by 95%.

These aren’t minor tweaks. They’re fundamental redesigns aimed at competing with newer, faster blockchains. Both networks realize speed and cost matter more than ever.

Furthermore, enterprises are returning to blockchain. But not like before. After failed experiments from 2018-2020, companies like J.P. Morgan and Société Générale are building private blockchains that connect to public networks. They want the benefits of decentralization without fully exposing themselves to public networks.

This hybrid approach could bring massive institutional adoption. However, it also raises questions about true decentralization versus corporate control.

The ASTER Token Nobody Saw Coming

Amid all this transformation, one token exploded. ASTER jumped 1667% since launching in September. The reason? Yield farming opportunities on Binance Chain attracted speculators chasing returns.

This shows speculation isn’t dead. It just migrated to new opportunities. While major blockchains face revenue pressure, individual tokens can still generate massive hype and price action.

Similarly, Coinbase stock rose 10.8% in September according to VanEck. That suggests investors still see long-term value in crypto infrastructure, even during revenue downturns.

These bright spots matter. They remind us that crypto markets move in cycles. Temporary lulls don’t mean permanent decline.

What September’s Numbers Actually Tell Us

The 16% revenue drop isn’t a disaster. It’s a transition.

Blockchains built on speculation are struggling. Those providing utility are surviving. Networks that adapt to user needs will thrive. Those clinging to old models will fade.

Stablecoins now drive more real economic activity than most cryptocurrencies. That’s not a failure of blockchain technology. It’s proof the technology works when applied to genuine problems.

Plus, the infrastructure improvements from Ethereum and Solana show major networks aren’t giving up. They’re investing in speed, scalability, and cost reduction to win back users and developers.

Enterprises are also returning, though cautiously. Private blockchains connected to public networks could bring the next wave of adoption. But only if they balance decentralization with regulatory compliance.

September’s cooldown feels uncomfortable after years of explosive growth. Yet maturity requires consolidation. The blockchain industry is learning which use cases matter and which were just hype.

That’s healthy. Painful, but healthy.

The real test comes next. Can utility-focused blockchains maintain revenue when speculation returns? Can Ethereum and Solana successfully upgrade their networks? Will enterprises actually follow through on their blockchain projects this time?

Those answers will determine whether September 2025 marked a temporary slump or the beginning of blockchain’s utility era. Based on current trends, the utility era looks more likely.