Bybit just scored something most exchanges still can’t touch. Full regulatory approval from the UAE’s Securities and Commodities Authority.

This isn’t another “provisional license” or “in-principle approval.” It’s the real thing. Plus, Bybit claims they’re the first major exchange to snag this particular permit from the SCA. That matters more than you might think.

Why This License Beats the Usual Dubai Approvals

Most crypto companies operating in Dubai work under VARA’s framework. That’s fine for businesses inside Dubai’s jurisdiction. But it’s geographically limited.

The SCA license changes the game. It covers the entire UAE mainland, not just Dubai’s special zones. So Bybit can now legally serve customers across Abu Dhabi, Sharjah, and every other emirate under one unified framework.

Think of it like having a federal license versus a city permit. The scope expands dramatically. Plus, institutional clients care deeply about regulatory jurisdiction. Operating under SCA oversight signals serious compliance infrastructure.

What Bybit Can Actually Do Now

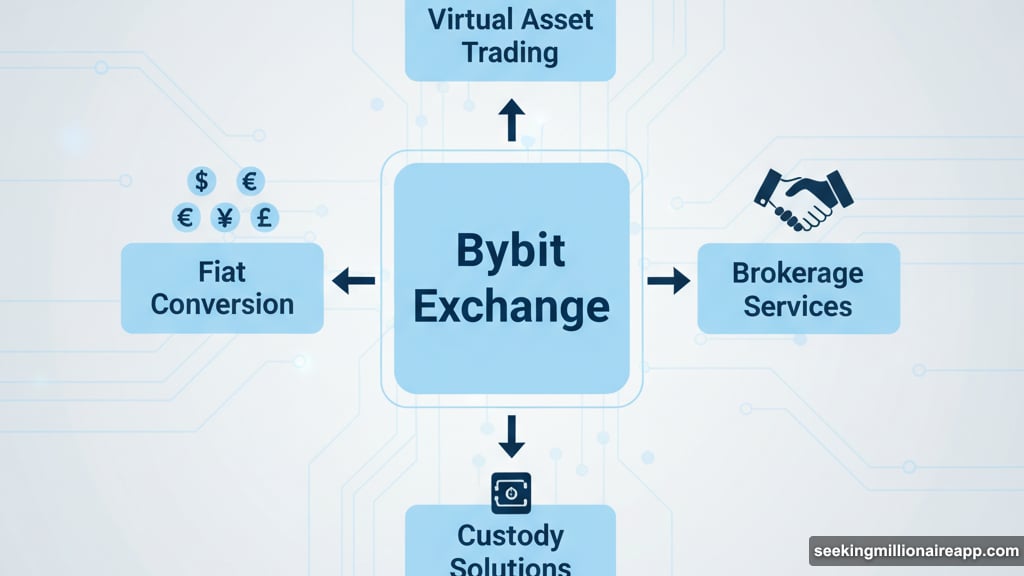

The license covers four critical activities. First, virtual asset trading for both retail and institutional clients. Second, brokerage services that connect buyers and sellers. Third, custody solutions for storing digital assets securely. Fourth, fiat conversion services that let users move between traditional money and crypto.

That’s basically everything a full-service exchange needs. No carve-outs or restrictions on specific features. Bybit can operate as a complete financial platform under UAE law.

They’re not wasting time either. The company plans to open a major operations center in Abu Dhabi. Over 500 employees will work across Abu Dhabi and Dubai handling compliance, operations, and customer service.

The Compliance Journey Nobody Talks About

Getting this license took serious work. Bybit received their initial In-Principle Approval from the SCA back in February 2025. That started months of regulatory scrutiny, documentation, and compliance reviews.

The Blockchain Centre in Abu Dhabi helped navigate SCA’s framework. These processes aren’t simple checkbox exercises. Regulators examine everything from anti-money laundering procedures to customer protection policies to technical infrastructure security.

So the time between IPA and full license represents intensive preparation. Companies that skip these steps or rush the process usually face rejection. Bybit clearly invested the resources needed to meet SCA standards.

Part of a Bigger Strategy

This license fits into Bybit’s global compliance push. Earlier this year, they secured a MiCA license in Europe. That’s the new regulatory framework covering crypto businesses across EU member states.

They also resumed full trading operations in India last September. Meanwhile, Bybit maintains provisional approval under Dubai’s VARA framework as well. Notice the pattern? The exchange is systematically collecting regulatory permissions in major markets.

Why bother with all this bureaucracy? Two reasons. First, institutional investors demand it. Banks, hedge funds, and corporate treasuries won’t touch exchanges lacking proper regulatory oversight. Second, clear rules reduce business risk. Operating in regulatory gray zones leaves companies vulnerable to sudden enforcement actions.

“Receiving the full Virtual Asset Platform Operator License from the SCA is a testament to Bybit’s unwavering commitment to building trust through compliance and transparency,” said CEO Ben Zhou. That’s corporate speak. But the underlying point holds. Compliance opens doors that staying unregulated keeps shut.

What This Means for UAE’s Crypto Ambitions

The UAE clearly wants to become a global crypto hub. Dubai and Abu Dhabi compete with Singapore, Hong Kong, and Switzerland for market leadership. Attracting the world’s second-largest exchange by trading volume reinforces that position.

Bybit’s 500-employee operation center represents substantial local investment. Those jobs require skilled workers. The company also plans education programs and Web3 innovation initiatives with local partners. That builds ecosystem infrastructure beyond just one exchange.

Moreover, having a fully licensed major exchange raises the bar for competitors. Other platforms will need similar approvals to compete effectively. So regulatory standards get stronger, which ultimately protects users better than anything-goes environments.

The Challenges Nobody Mentions

Don’t assume this solves everything. Operating under SCA oversight means ongoing compliance obligations. Bybit must file regular reports, maintain capital requirements, and submit to audits. Regulators can modify rules or impose additional restrictions.

Plus, global crypto regulation remains fragmented. A UAE license doesn’t help in the U.S., where regulatory uncertainty persists. Bybit still can’t serve American retail customers under current frameworks. So they’re building a patchwork of regional licenses rather than one global permission.

Customer onboarding gets more complex too. Know-your-customer checks, transaction monitoring, and reporting requirements all add friction. That’s necessary for legitimate financial services. But it makes crypto exchanges feel more like traditional banks, which some users specifically wanted to avoid.

Still, mainstream adoption requires regulatory clarity. Bybit chose compliance over regulatory arbitrage. That trade-off increasingly looks like the winning strategy as governments worldwide tighten crypto rules.

The UAE just validated that approach by granting their most comprehensive exchange license yet. Other platforms will need to follow suit or risk losing market access.