Crypto markets are bouncing back after Friday’s chaos. What looked like a complete meltdown 48 hours ago now feels like an overreaction.

Bitcoin dropped nearly 13% when Trump announced 100% tariffs on Chinese imports. The crash triggered the biggest liquidation event in crypto history. Over $19 billion in positions got wiped out in hours.

But now? Markets are climbing again. ADA and DOGE are leading the charge with double-digit gains. Bitcoin recovered to around $114,665. Traders who panicked Friday are wondering if they sold too early.

The Numbers Tell the Recovery Story

Let’s talk specifics. Cardano jumped 10.8% in 24 hours. Dogecoin matched that with a 10.7% surge. Both coins attracted bargain hunters who saw discounted prices as opportunity.

Bitcoin climbed 2.7% to $114,665. Not spectacular, but steady. Ethereum performed better with an 8.3% gain to $4,135. BNB exploded 13.9% higher as money flowed back into ecosystem tokens.

XRP added 7.4%. Solana gained 7.2%. The pattern is clear. Traders are buying the dip aggressively across major cryptocurrencies.

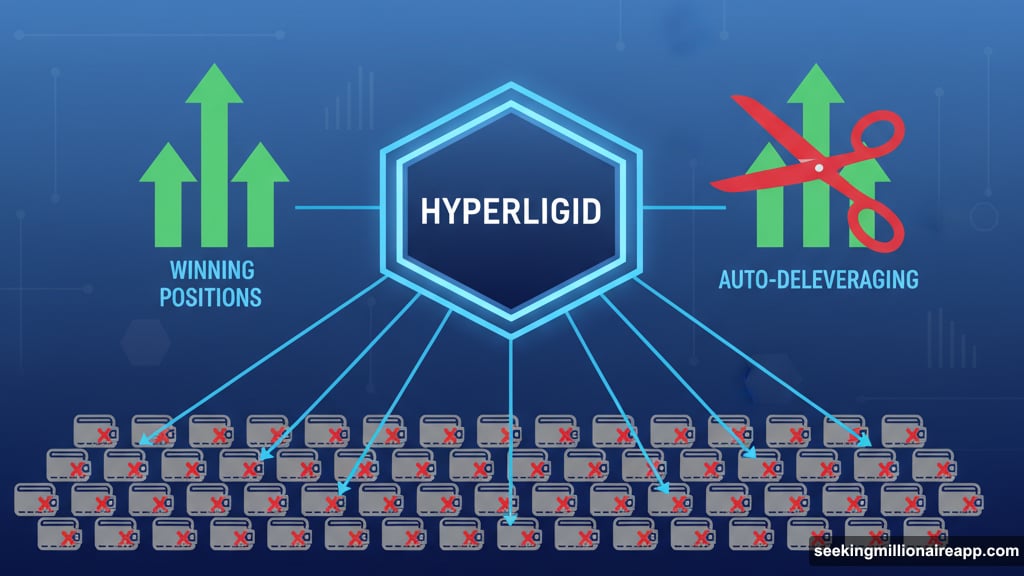

Meanwhile, the liquidation carnage was brutal. Over 6,300 wallets got liquidated on Hyperliquid alone. Some traders lost millions when the exchange triggered Auto-Deleveraging. That’s a circuit breaker that closes winning positions to prevent total system collapse.

What Actually Changed Since Friday

The crash stemmed from Trump’s tariff announcement. Markets freaked out about escalating trade war between the U.S. and China. Fear selling accelerated into panic.

Then over the weekend, things cooled down. China’s Ministry of Commerce clarified their rare-earth export controls wouldn’t be a blanket ban. Trump himself posted on social media that “the U.S.A wants to help China, not hurt it.”

That shifted sentiment immediately. Risk assets bounced. Crypto followed the broader market recovery.

“What we just saw was a massive emotional reset,” said Justin d’Anethan from Arctic Digital. He argues the longer-term bullish structure remains intact despite the volatility.

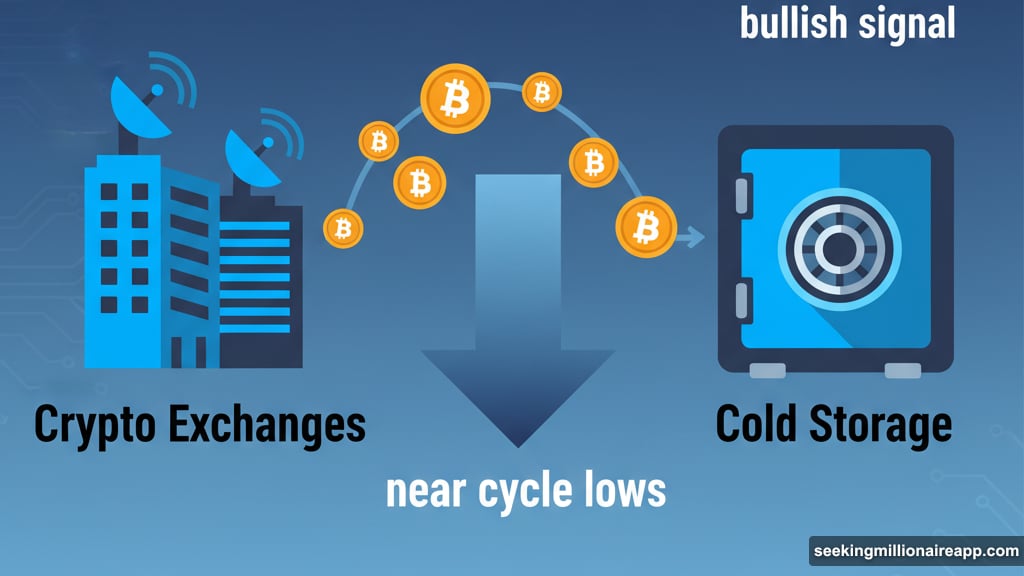

Moreover, fundamentals didn’t actually change. ETF inflows stayed strong through the chaos. Exchange balances hit near cycle lows. That means bitcoin is moving off exchanges into cold storage. Typically a bullish signal.

Why This Wasn’t a Normal Crash

Friday’s event exposed serious infrastructure issues. Hyperliquid’s Auto-Deleveraging system protected the platform from bad debt. But it magnified the crash by forcibly closing winning positions.

Traders who were profitable got their positions closed without warning. That created additional selling pressure on top of the panic. The correction became a structural event instead of just a price dip.

This matters because it shows crypto markets still have systemic risks. High leverage combined with algorithmic liquidations creates cascading failures. When everyone tries to exit at once, the infrastructure breaks down.

Yet traders seem undeterred. The rapid recovery suggests most market participants view this as a temporary shock rather than trend reversal.

“If the U.S.-China spat doesn’t escalate into a full-on trade war, the market is likely to recover and push back toward all-time highs,” noted Jeff Mei from BTSE.

What Traders Are Watching Now

The path forward depends on macro factors. Trade tensions between the U.S. and China remain the biggest variable. Any escalation could trigger another selloff.

Interest rates matter too. If central banks continue easing, traders expect ETH and yield-generating tokens to outperform. That’s because lower rates make staking rewards more attractive compared to traditional bonds.

Funding rates on derivatives exchanges will show where smart money moves next. Options skew reveals whether traders are positioning for continued volatility or expecting stability.

Whale wallet flows provide another signal. Large holders accumulating during dips typically indicates confidence. Mass selling by whales would suggest the opposite.

For now, the market structure looks intact. Bitcoin held above key support levels despite the crash. That’s technically bullish. But the inability to reclaim previous highs quickly shows some damage was done.

CoinDesk data shows combined spot and derivatives trading hit $9.72 trillion in August. That’s the highest monthly volume of 2025. High trading volume during recovery phases often signals renewed interest rather than just shorts covering.

The Bigger Picture Behind the Panic

This crash reset sentiment more than fundamentals. Leveraged traders got wiped out. But institutions kept buying.

Marathon Digital bought 400 BTC during the crash according to on-chain data. That’s $45.9 million worth. Mining companies don’t usually buy during crashes unless they’re confident about recovery.

Exchange balances dropping to cycle lows tells a similar story. Long-term holders are accumulating, not selling. The panic was mostly leveraged speculators getting liquidated.

That distinction matters. Speculators provide short-term volatility. Long-term holders provide stability. When leveraged positions get flushed out, it removes selling pressure from the system.

The emotional reset d’Anethan mentioned might actually strengthen the market. Weak hands sold. Strong hands bought. That’s typically how major rallies begin.

Still, nobody should pretend this was normal. $19 billion in liquidations is massive. Thousands of traders lost money. The psychological impact will linger even as prices recover.

Markets that can inflict this much pain in hours will continue attracting speculation. But they’ll also continue punishing overconfidence. Volatility cuts both ways, as Friday’s crash and Sunday’s recovery both prove.

The broader narrative around crypto remains intact. ETF adoption continues. Institutional interest grows. Regulatory clarity improves slowly. These trends don’t reverse because of a weekend crash.

But the infrastructure needs improvement. Liquidation mechanisms that amplify crashes instead of dampening them create systemic risk. Better circuit breakers and risk management could prevent future cascades.

For now, traders seem willing to look past Friday’s chaos. The bounce in ADA and DOGE shows speculation hasn’t died. Bitcoin’s steady climb suggests confidence returning. Whether that confidence is justified depends on what happens next with U.S.-China trade talks.

Markets recovered this time. But they’ll face similar tests again. How traders respond to the next shock will show if any real lessons were learned from this one.