Cardano jumped 7% this week. Then it stalled. Again.

This pattern keeps repeating. ADA rallies briefly, hits resistance near $0.37, and fades back down. Meanwhile, traders who bought the bounce watch their profits evaporate within days.

Three specific market signals explain why these rallies fail. Plus, they suggest the weakness might continue unless something fundamental changes.

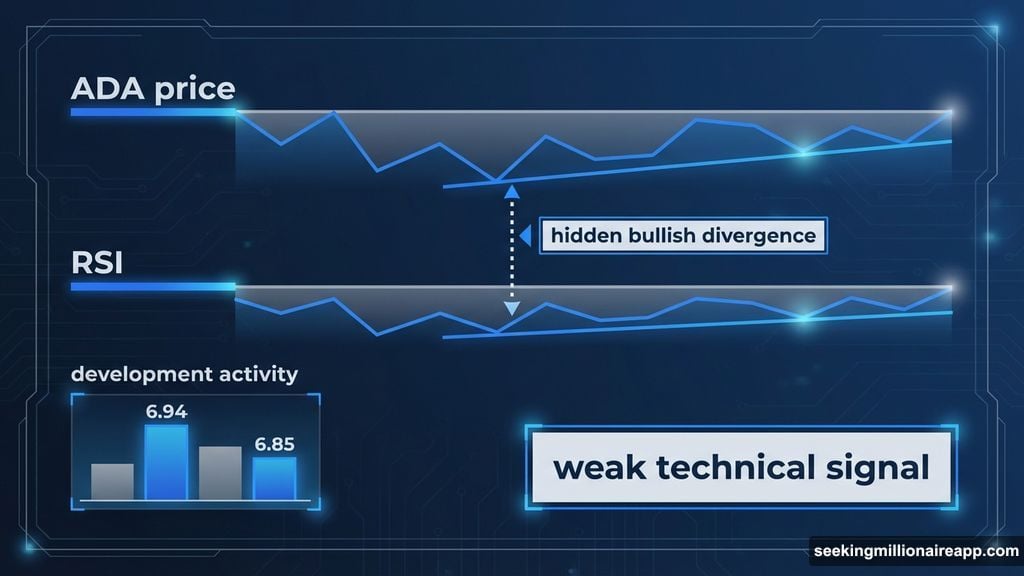

Weak Technical Signal Started the Latest Rally

A hidden bullish divergence appeared on Cardano’s 12-hour chart between late December and January 20. The price made a higher low while the RSI printed a shallow lower low.

That sounds bullish. But the shallow RSI reading matters more than most traders realize.

A shallow lower low on the RSI means selling pressure eased slightly. However, it doesn’t mean buyers took control. This type of divergence typically triggers short-lived bounces, not sustained rallies.

That’s exactly what happened. Cardano climbed about 7% to $0.37 on January 21. Then the move stalled immediately.

Development activity tells the rest of the story. On January 21, Cardano’s development activity score peaked near 6.94, its highest level in about a month. Development activity measures how much work happens on the blockchain and often supports price confidence.

But that support didn’t hold. Development activity slipped afterward, and the price followed it down. Now development activity sits around 6.85, still below the recent peak.

So the divergence stopped the immediate selloff. Yet it didn’t create enough demand to push higher because development momentum faded.

Profit-Taking Spikes Each Time ADA Moves Up

The real problem shows up after Cardano starts rising. Spent coins age band data tracks how many coins of all age groups are moving. Rising values usually signal selling and profit-taking.

Over the past month, each price bounce triggered a sharp rise in spent coins activity. In late December, Cardano’s price climbed roughly 12%. Meanwhile, spent coins activity jumped more than 80%, showing aggressive selling into strength.

In mid-January, ADA rose about 10%. Spent coins activity surged nearly 100%, confirming that holders used the rally to exit positions.

The same behavior is returning now. Since January 24, spent coins activity increased more than 11%, from 105 million to 117 million. Yet the ADA price hasn’t broken higher yet.

That detail matters. Sellers are positioning ahead of another bounce rather than waiting for confirmation. This explains why momentum keeps fading faster each time.

Each rally attempt gets met with quicker profit-taking than the last. So buyers can’t build sustainable momentum because sellers keep front-running any strength.

Whales Are Trimming Positions Instead of Buying

Normally, large holders absorb this selling pressure. Right now, they’re not.

Wallets holding between 10 million and 100 million ADA reduced their balance from roughly 13.64 billion ADA to about 13.62 billion ADA. That’s a drop of around 20 million ADA since January 21.

Starting January 22, wallets holding between 1 million and 10 million ADA slipped from about 5.61 billion ADA to roughly 5.60 billion ADA. They shed close to 10 million ADA.

These aren’t panic exits. But they’re clear net reductions. That lack of whale demand means profit-taking isn’t being absorbed, leaving the price more exposed to downside pressure.

Derivatives data reinforces this weakness. Over the next seven days, short liquidations stand near $107.6 million. Meanwhile, long liquidations sit closer to $70.1 million.

Shorts outweigh longs by more than 50%. That shows traders expect rallies to fail rather than extend. This imbalance suggests the market expects selling pressure to return quickly if Cardano attempts another bounce, especially near resistance.

Critical Price Levels for What Happens Next

The price structure now makes things clearer. On the upside, $0.37 remains the first critical level. A clean break and hold above it would trigger short liquidations and offer temporary relief.

However, $0.39 is far more important. A move above this zone would liquidate most remaining shorts and mark the first meaningful shift in momentum. Beyond that, $0.42 is the level where the broader structure could turn bullish again.

On the downside, $0.34 is the key support. A loss of this level would liquidate a large portion of remaining long positions. Moreover, it could accelerate downside pressure quickly as leverage unwinds.

What Needs to Change for Bulls to Win

For Cardano to escape this cycle, three things must align. Development activity needs to reclaim and hold above recent highs. Spent coins activity must slow instead of rising into bounces. And whales need to return as net buyers.

None of those conditions exist right now. Development activity remains below its recent peak. Profit-taking spikes on every bounce. Whales continue trimming positions rather than accumulating.

Until those three factors shift, Cardano’s price bounces remain vulnerable. Each rally attempt faces the same headwinds. Plus, traders who chase these bounces keep getting caught as momentum fades within days.

The charts don’t lie. This setup favors sellers until something fundamental changes. So bulls need to prove they can hold $0.37 and push through $0.39 with conviction. Otherwise, the pattern continues.