Cardano just had one of its worst months on record. While Bitcoin and Ethereum recovered 6-8%, ADA crashed over 31% in November alone.

But here’s the scary part. Two critical indicators suggest this isn’t over yet. Big money is pulling out, and supply pressure is building fast. Unless ADA reclaims key levels soon, another leg down looks inevitable.

Big Money Is Leaving the Building

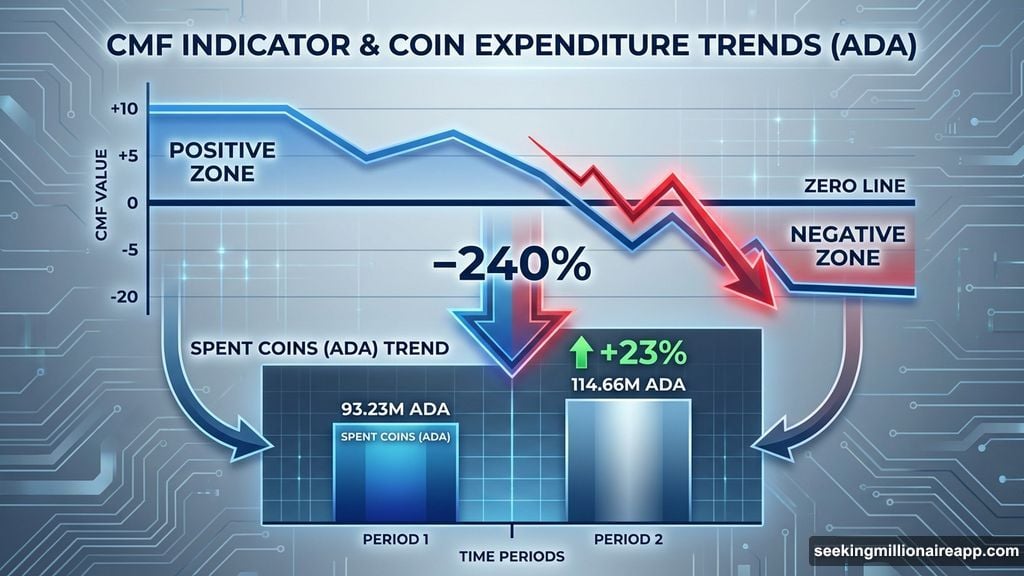

The Chaikin Money Flow (CMF) indicator tells a brutal story. It tracks whether large capital is flowing into or out of an asset.

Between November 24 and 28, ADA’s price formed a higher high. But CMF made a lower high and then broke below its descending trendline. That trendline had held since October 11.

This isn’t the first warning. The same pattern appeared on November 2. ADA then dropped over 20% in the following weeks.

CMF now sits below zero. That means big wallets are stepping back rather than buying the dip. Historically, when CMF falls sharply, Cardano follows fast.

Here’s the damage. Between November 10 and 17, money flow collapsed by more than 240%. ADA corrected 36% during that exact window. The correlation is undeniable.

Now CMF just broke down again. Plus, it’s under zero this time. So the setup looks even weaker than before.

Supply Pressure Just Spiked Hard

The second red flag comes from spent-coin activity. This metric tracks how many ADA coins across all holding groups move on any given day.

On November 29, spent coins hit a monthly low of 93.23 million ADA. That looked stable. But by the end of the month, the number jumped to 114.66 million. That’s a 23% increase in just days.

More importantly, it’s now at the highest weekly level. More ADA is moving around, which usually means more selling pressure.

When spent-coin activity rises while money flow weakens, prices struggle. That’s exactly what’s happening now. Big wallets are pulling back, and regular holders are moving coins at the same time.

This creates a double-whammy effect. Less demand plus more supply equals downside risk.

What the Charts Say About Next Moves

ADA has been in a clear downtrend since November 11. The structure hasn’t reversed yet, and key support levels are breaking down.

Right now, Cardano trades near $0.419. If that fails, the next support sits at $0.386. Below that, expect $0.354 and then $0.302.

Those aren’t random numbers. They’re natural continuation zones based on trend-based extensions. Given current conditions, ADA could easily test those levels if pressure persists.

So what would signal a reversal? ADA needs to close above $0.438 with a full candle. That would open the door to $0.607.

But that requires two things to flip. First, CMF must return above zero, showing big money is coming back. Second, spent-coin activity needs to cool off again.

Historically, whenever spent coins spike, ADA struggles to sustain any recovery. The current rise reinforces that risk.

Why This Time Feels Different

Cardano’s November collapse stands out for one reason. The broader market recovered, but ADA didn’t follow.

Bitcoin gained 6%. Ethereum climbed 8%. Meanwhile, ADA dropped 31%. That kind of underperformance usually signals deeper structural issues.

The weekly gain of only 1.9% confirms weak momentum. Even short-term bounces are getting sold immediately. There’s no follow-through.

Plus, the correlation with money flow is crystal clear. When big wallets step back, retail traders can’t carry the weight. So prices slide faster.

The Road Ahead Looks Rough

Right now, two scenarios exist. Either ADA stabilizes here and reclaims $0.438, or it continues lower toward $0.302.

Given current indicators, the second scenario looks more likely. CMF remains under zero, and spent-coin activity just spiked. Both signals point down.

That doesn’t mean Cardano is dead. But it does mean the correction probably isn’t finished yet. The 31% monthly drop might be the beginning, not the end.

For now, watch CMF closely. If it crosses back above zero, that’s the first sign of recovery. Until then, expect more pressure.

Also, monitor spent-coin readings. If they stay elevated, supply will keep overwhelming demand. That makes any bounce fragile and short-lived.

The bottom line? Cardano faces serious technical headwinds. Without improvements in money flow and supply dynamics, lower prices remain the path of least resistance.