Chainlink just got its second ETF. Whale wallets piled in over $7 million this week. Yet the token’s still sliding.

That disconnect reveals something important about crypto markets right now. Institutional products and big-money accumulation don’t guarantee short-term price action. Let’s unpack what’s actually happening with LINK.

Bitwise ETF Starts Small

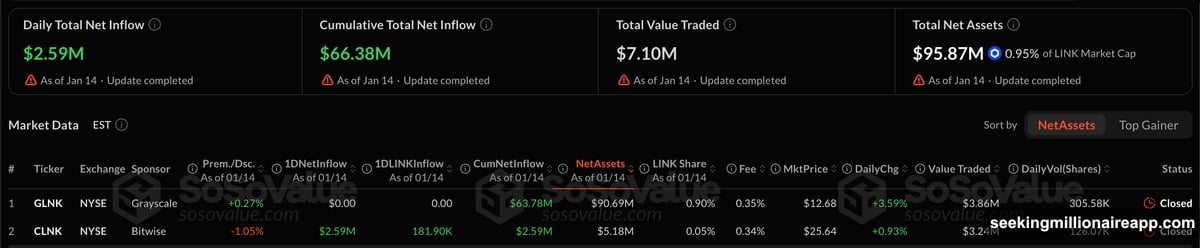

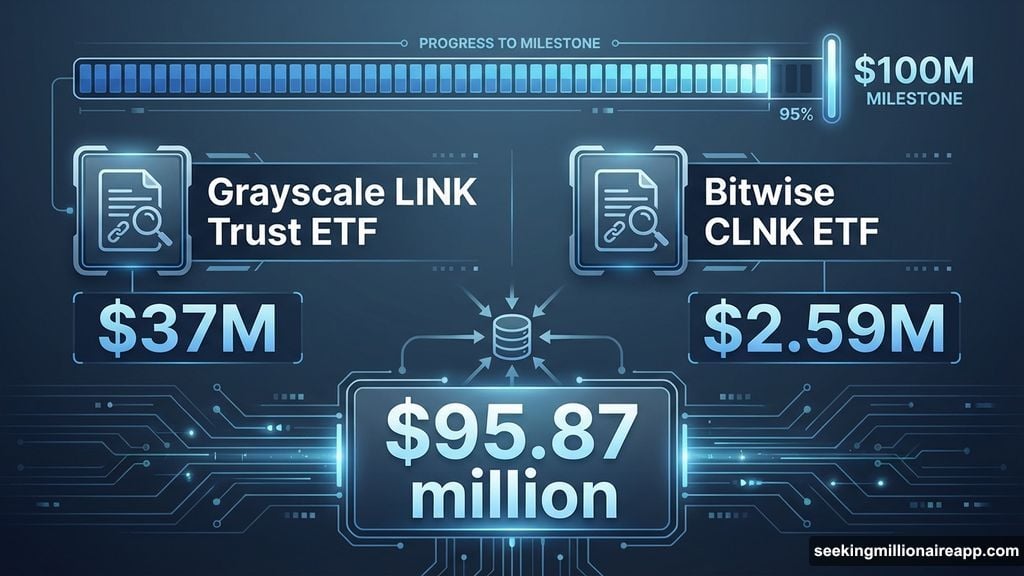

Bitwise launched its Chainlink ETF (CLNK) on January 14. The fund pulled in $2.59 million on day one.

That sounds underwhelming. Grayscale’s Chainlink Trust ETF debuted back in December with $37 million in first-day inflows. So Bitwise’s launch looks modest by comparison.

But here’s the thing. Bitwise waived management fees for three months on up to $500 million in assets. The 0.34% fee structure kicks in later. So the product’s designed for slower, steadier growth rather than a massive opening splash.

Total LINK ETF assets now sit at $95.87 million across both funds. That’s approaching the $100 million milestone. Not bad for a token that most retail investors still consider “altcoin territory.”

Whales Aren’t Waiting Around

On-chain data tells a different story than the price chart. Multiple whale wallets moved significant LINK off exchanges this week.

One wallet (0x10D9) withdrew nearly 140,000 LINK from Binance. That’s roughly $1.96 million worth. The same wallet had already grabbed another 202,607 tokens days earlier. Total haul? About $4.81 million in LINK accumulated over 48 hours.

Another wallet (0xb59) pulled 207,328 LINK off exchanges on January 12. That’s $2.78 million in a single transaction.

Plus, Nansen data shows whale balances increased 1.37% over the past week. Meanwhile, exchange-held LINK dropped 1% during the same period. That divergence matters. When large holders move tokens into self-custody, they’re usually betting long-term rather than trading short-term price swings.

Price Action Tells Different Story

Despite institutional products and whale accumulation, LINK dropped 1.2% over the past day. At the time of writing, the token traded at $13.80.

What gives? Broader crypto market weakness is dragging everything down right now. Bitcoin and Ethereum both faced selling pressure this week. Altcoins typically amplify those moves in both directions.

So even with solid fundamentals and institutional backing, LINK can’t escape macro headwinds. The token’s following the market, not fighting it.

That’s actually normal. Institutional interest builds slowly. ETF launches create access, not immediate demand. Whales accumulate over weeks and months, not days. Short-term price action doesn’t necessarily reflect long-term positioning.

Oracle Infrastructure Gets Attention

Matt Hougan, Bitwise’s Chief Investment Officer, framed the ETF launch around Chainlink’s role in blockchain infrastructure. His statement emphasized how LINK powers risk management and financial decision-making across DeFi.

That positioning matters. Chainlink isn’t trying to be the next Bitcoin or Ethereum. Instead, it’s building the connective tissue that makes smart contracts useful. Oracles bridge on-chain code with real-world data. Without that bridge, DeFi applications can’t access price feeds, weather data, or any external information.

So the ETF pitch isn’t about LINK mooning tomorrow. It’s about exposure to infrastructure that blockchain applications need to function. That’s a different value proposition than speculative tokens pumping on hype cycles.

For investors thinking long-term, that infrastructure angle is compelling. For traders watching daily charts, it’s less exciting.

Two Markets Operating Separately

Here’s what’s happening. Institutional investors and whales are accumulating LINK through ETFs and direct purchases. They’re betting on Chainlink’s fundamental role in blockchain infrastructure.

Retail traders are watching price action and following Bitcoin’s lead. When BTC drops, altcoins drop harder. LINK included.

These two dynamics can coexist without contradicting each other. Institutional accumulation happens regardless of short-term volatility. In fact, big players often prefer buying during weakness rather than chasing pumps.

So the “contradiction” between whale buying and price decline isn’t really a contradiction. It’s just different market participants operating on different timeframes.

What This Means Going Forward

Chainlink now has two ETF products in the US market. Whale wallets are moving tokens off exchanges at a steady pace. Those are positive long-term signals.

But none of that protects LINK from broader market selloffs. If Bitcoin continues declining, altcoins will follow. Institutional interest doesn’t create price floors in the short term.

However, the accumulation pattern suggests big players are positioning for eventual upside. They’re not buying LINK to flip it next week. They’re building positions they expect to appreciate over months or years.

For retail investors, that creates a decision point. Chase short-term momentum or accumulate alongside the whales? The ETF launches and whale activity suggest the smart money is doing the latter.