Bitcoin demand from US buyers just woke up after a month-long nap. The Coinbase Bitcoin Premium Index turned positive for the first time in weeks, meaning Americans are finally willing to pay a little extra for BTC compared to global prices.

Meanwhile, silver hit a record high above $55 per ounce. Two seemingly unrelated assets moving at once? Not quite. The timing tells us something important about where money is flowing right now.

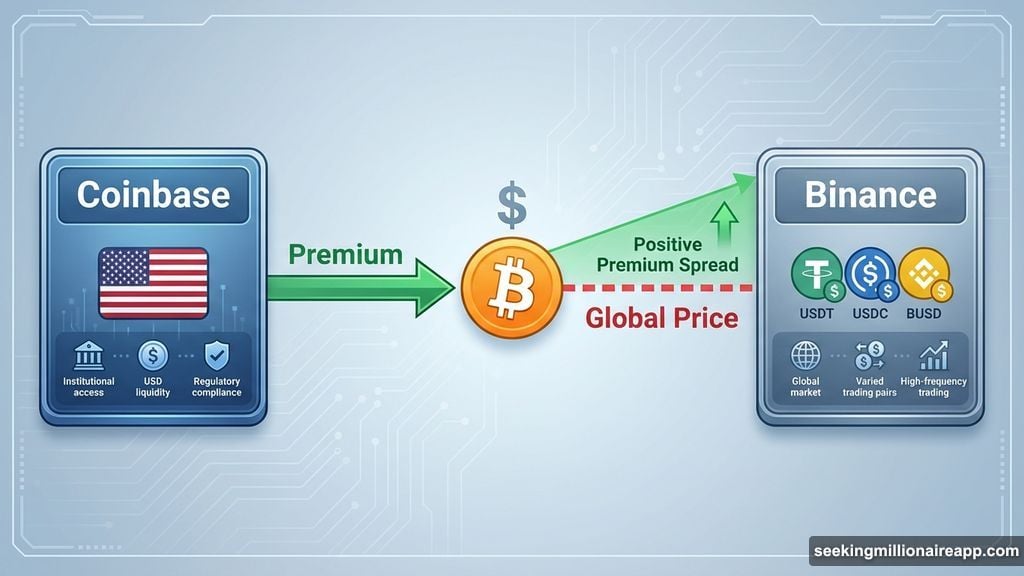

What the Coinbase Premium Actually Measures

The Coinbase Premium Index compares Bitcoin prices on Coinbase (where US traders buy in dollars) against major global exchanges like Binance (where traders use stablecoins). When the number goes positive, US buyers are paying more than the rest of the world. When it goes negative, they’re paying less or sitting on the sidelines.

November kept the premium stuck in negative territory almost the entire month. ETF outflows dominated. Liquidity dried up. US demand looked dead in the water.

Then today happened. The premium flipped green for the first time since early November. That means US spot buyers are back at the table, paying slightly above global prices to get exposure. It’s not a flood of demand yet, but it’s the first real pulse in weeks.

This matters because US buyers have historically led Bitcoin price turns. When Coinbase buyers start paying premiums again, major price shifts tend to follow within days or weeks.

Silver Hits All-Time High. What That Means for Bitcoin

Silver climbing above $55 per ounce set a new record. For context, silver’s previous high was around $50 back in 2011. So this isn’t just another routine rally. It’s a legitimate breakout.

Now, Bitcoin and silver don’t usually move together. Their correlation typically hovers between 0 and 0.3, meaning they’re mostly independent. They only sync up during major macro fear events, like liquidity crunches or currency crises. Right now, they’re clearly decoupled.

But here’s what matters. When silver rallies hard while Bitcoin stops falling, it often signals the end of fear-driven selling. Silver’s strength shows that hard-asset appetite is returning across markets. Gold, silver, real estate, Bitcoin—these assets benefit when investors lose faith in fiat currency stability or expect looser monetary policy.

So while BTC and silver aren’t correlated today, they’re both responding to the same macro shift. Dollar weakness, rate-cut expectations, and renewed appetite for alternative stores of value are boosting both assets. The Coinbase Premium turning green right as silver hits a record high? That’s not random timing.

Binance Whales and Coinbase Institutions Both Buying

On-chain data shows accumulation picking up on both major platforms. Binance whales—typically non-US traders—have been scooping up Bitcoin for days. Now Coinbase institutions are bidding too, based on the positive premium shift.

This two-sided demand is crucial. When only retail or only institutions buy, rallies tend to fizzle out. But when both groups accumulate at the same time, price moves tend to stick. We’re seeing the first signs of that dual-sided interest returning after weeks of one-way selling.

Plus, seller exhaustion is real. Bitcoin dropped from above $108,000 to around $92,000 in late November. That’s a brutal 15% decline in days. Most weak hands already sold. The remaining holders are less likely to panic at this point.

Fed Pivot Expectations Are Building

Markets are pricing in a higher chance of rate cuts in 2025. The Federal Reserve held rates steady recently, but forward guidance suggests cuts could start by mid-year if inflation continues cooling. Lower rates make yield-free assets like Bitcoin and gold more attractive compared to bonds or savings accounts.

This macro backdrop helps explain why hard assets are catching bids. Investors aren’t just chasing BTC or silver because of technical setups. They’re repositioning ahead of a potential liquidity shift. If the Fed does pivot, both assets could see sustained flows.

So the Coinbase Premium turning green today isn’t just noise. It’s part of a broader pattern where money is moving back into alternative assets after a month of extreme caution.

What Happens Next

December tends to be more active for Bitcoin. Historically, Q4 delivers stronger returns than Q1 or Q2. This year, December also brings year-end rebalancing, tax-loss harvesting, and potentially new institutional flows if sentiment improves.

The combination of seller exhaustion, improving US demand, and macro tailwinds sets up a more bullish environment than we’ve seen in weeks. That doesn’t guarantee a rally. Bitcoin could still chop sideways or dip again if broader markets stumble. But the pieces are aligning for upside into year-end.

Silver’s breakout adds conviction to that view. When hard assets across the board start catching bids, it usually means something bigger is shifting under the surface. The Coinbase Premium going green confirms that shift is real, not just hopeful speculation.

Keep an eye on whether the premium stays positive over the next few days. If it holds or expands, that’s a strong signal that US demand has genuinely returned. If it flips negative again, the rally thesis loses credibility fast.

For now, the first green print in weeks is a welcome sign. US buyers are back. Silver is ripping. And Bitcoin finally stopped bleeding. December could get interesting.