The biggest US crypto exchange isn’t asking nicely anymore. Coinbase just told the Federal Reserve that American payment infrastructure is falling behind countries like Brazil and India.

That’s embarrassing. And it’s costing businesses money every single day.

Here’s what’s happening. The Fed proposed letting non-bank firms access special payment accounts. Sounds technical. But this change could reshape how money moves through the American economy.

Why Crypto Firms Need Direct Fed Access

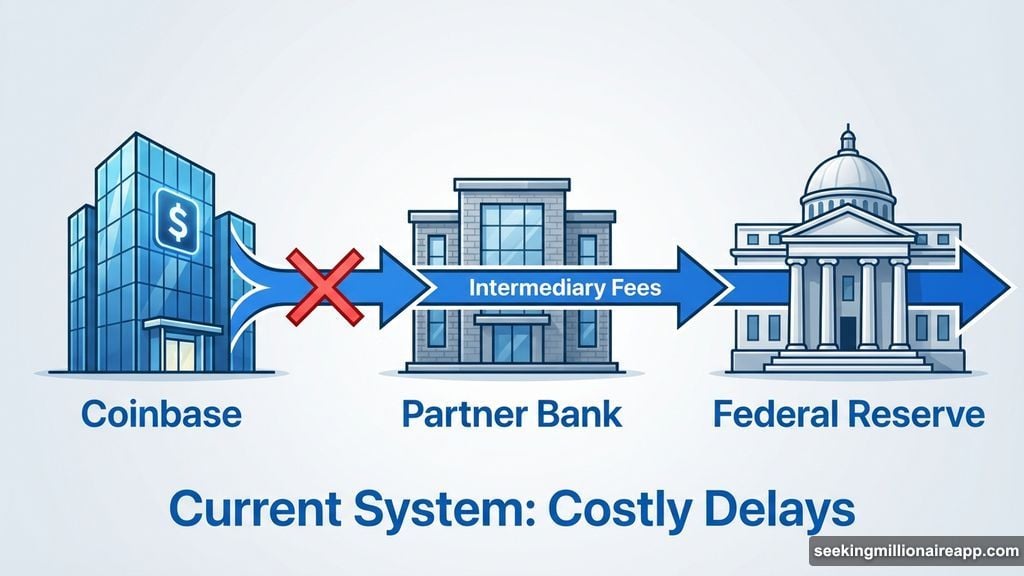

Right now, crypto companies can’t touch the Fed’s payment rails directly. They need traditional banks to act as middlemen for every dollar transaction.

This creates three major problems. First, it adds unnecessary costs. Banks charge fees for acting as intermediaries. Second, it introduces delays. Transactions bounce between multiple institutions before settling. Third, it creates counterparty risk. If your partner bank fails, your payment operations freeze.

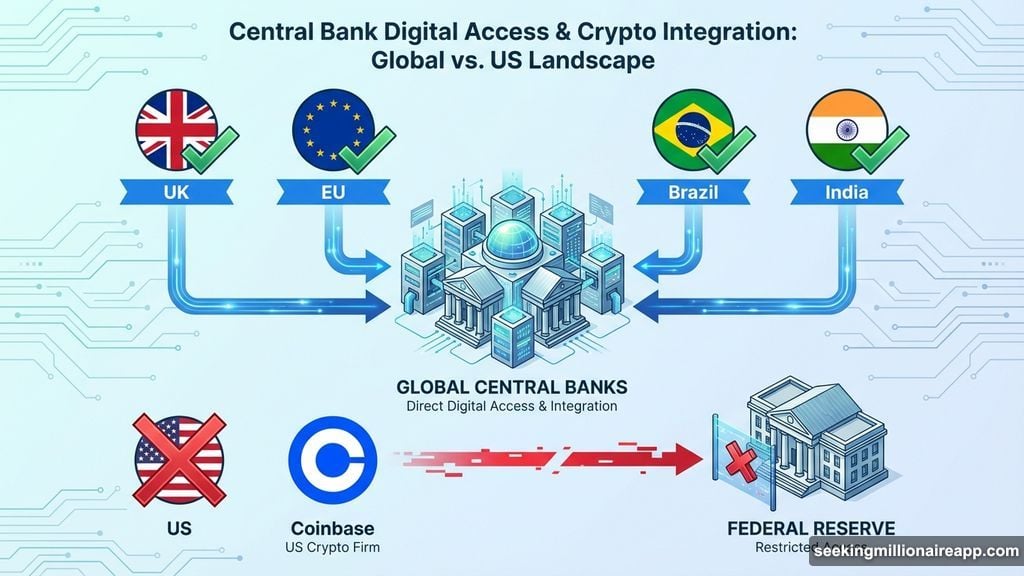

Coinbase argues this outdated system holds back American innovation. Meanwhile, competitors in the UK, EU, Brazil, and India already offer direct central bank access to fintech firms.

“By reducing reliance upon FDIC-insured partner banks as intermediaries for core payment functions, the Payment Account would allow account-holding institutions to offer safe and efficient services to U.S. consumers and businesses,” the exchange stated in its letter to the Fed.

Faryar Shirzad, Coinbase’s chief policy officer, pointed out that other countries moved faster. Their financial sectors became more competitive as a result. The US risks falling further behind.

The Fed’s Proposal Might Be Dead on Arrival

Coinbase supports the Fed’s direction. But the company warns that current restrictions could kill the whole idea.

The problem? Balance limits that are far too low for real-world operations. Plus, the Fed won’t pay interest on end-of-day balances. That makes these accounts commercially unviable for any large-scale operation.

Think about it this way. You’re offering a payment service to millions of customers. But the Fed caps how much money you can hold overnight at levels designed for small credit unions. Your business can’t function under those constraints.

“Combining all of the proposed restrictions risks unnecessarily constraining the account in a way that could limit its adoption by eligible institutions for the use intended,” Coinbase wrote.

The exchange specifically challenged the Fed’s logic on balance-sheet limits. Payment processing creates operational risks, not credit risks. So why tie account limits to balance sheet size? It doesn’t match how these businesses actually work.

Coinbase Wants Pooled Customer Funds

Here’s where things get interesting. Coinbase is pushing for “omnibus” account structures.

What does that mean? Instead of individual accounts for each customer, firms could pool user funds together. This enables much more efficient settlement at scale.

Traditional finance uses this approach constantly. Your brokerage doesn’t hold separate Fed accounts for each client. They aggregate customer funds for operational efficiency.

But regulators remain cautious about letting crypto firms do the same thing. They worry about consumer protection if funds get commingled. Fair concern. But Coinbase argues the restrictions go too far in the other direction.

The exchange is essentially saying: treat us like the systemic financial players we’ve become. We’re not some startup operating out of a garage anymore. We handle billions in daily transaction volume.

Europe Already Figured This Out

The most damning part of Coinbase’s argument? Other major economies solved this years ago.

The European Central Bank lets payment firms access TARGET2, its real-time settlement system. The Bank of England opened up RTGS access to non-banks in 2017. Brazil’s Pix system revolutionized payments by letting any licensed institution connect directly.

These changes didn’t cause financial instability. Instead, they sparked competition that lowered costs and improved services for consumers.

Meanwhile, the US payment system still operates like it’s 1985. ACH transfers take days. Wire fees remain absurdly high. And innovative companies need permission from legacy banks to access basic infrastructure.

That puts American fintech and crypto firms at a disadvantage. They can’t offer the same speed and pricing as competitors in other markets. So talent and investment flow elsewhere.

Why This Actually Matters

You might think this is just industry politics. But payment infrastructure affects everyone.

Slow settlement systems mean businesses wait longer for revenue. High intermediary fees get passed to consumers. Outdated technology makes it harder to build new financial services.

Plus, the current system concentrates enormous power in a few large banks. If those banks decide they don’t like crypto, fintech, or any other sector, they can effectively shut companies out of dollar payments.

Direct Fed access would change that dynamic. It would let innovative firms compete on merit rather than banking relationships.

However, the Fed moves slowly for good reason. Opening core infrastructure to new participants creates systemic risks if not done carefully. Regulators need to balance innovation against stability.

The Real Fight Is Just Beginning

Coinbase is positioning itself as a mainstream financial institution that deserves the same infrastructure access as traditional banks. But the Fed isn’t going to hand over the keys easily.

Expect months of debate over the details. How much capital should firms hold? What operational standards apply? How do you prevent bad actors from abusing direct Fed access?

Those questions matter more than the headline proposal. The devil lives in implementation details that determine whether these accounts actually work in practice.

My take? The Fed will eventually cave on some restrictions. The pressure from global competition is too strong. American policymakers won’t let payment infrastructure lag behind Brazil forever.

But it’ll take longer than anyone wants. And the first version of these accounts will probably be too limited for serious commercial use. Then we’ll spend another five years arguing about loosening the restrictions.

Meanwhile, European and Asian fintech companies will keep building better, faster payment systems. American consumers will keep paying more for slower service. And we’ll wonder why the US fell behind in yet another technology sector.

The Fed has a chance to fix this now. Let’s see if they take it.