Three blockchain networks are pushing critical updates this week. Each upgrade promises to reshape how these platforms operate.

October’s final days bring significant technical improvements across the crypto ecosystem. These aren’t minor patches. They’re fundamental changes that could shift market dynamics for CRO, POL, and LDO tokens.

Let’s break down what’s actually happening and why it matters for your portfolio.

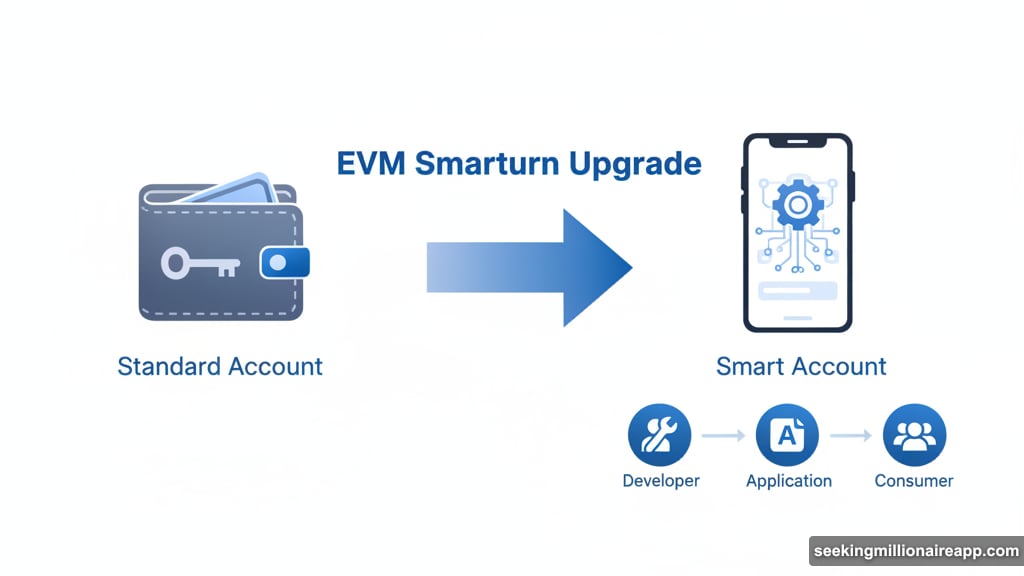

Cronos Brings Smart Accounts to EVM

Cronos rolls out its EVM Smarturn upgrade next week. The update delivers three core improvements: smarter account functionality, enhanced EVM compatibility, and stronger network performance.

The market already responded. CRO climbed 10% over the past seven days to $0.154. That’s not speculation. It’s traders positioning ahead of the technical changes.

Here’s what matters for price action. If $0.154 holds as support, CRO could push toward $0.160 and potentially $0.171. But that’s contingent on sustained buying pressure.

The flip side? Drop below $0.147 and momentum evaporates. Further losses could drag the token to $0.140. Technical support needs to hold firm or this rally fails.

Smart accounts represent a real upgrade. They enable more sophisticated on-chain interactions without requiring users to understand complex wallet management. For developers, that’s a big deal. It lowers the barrier for building consumer-friendly applications.

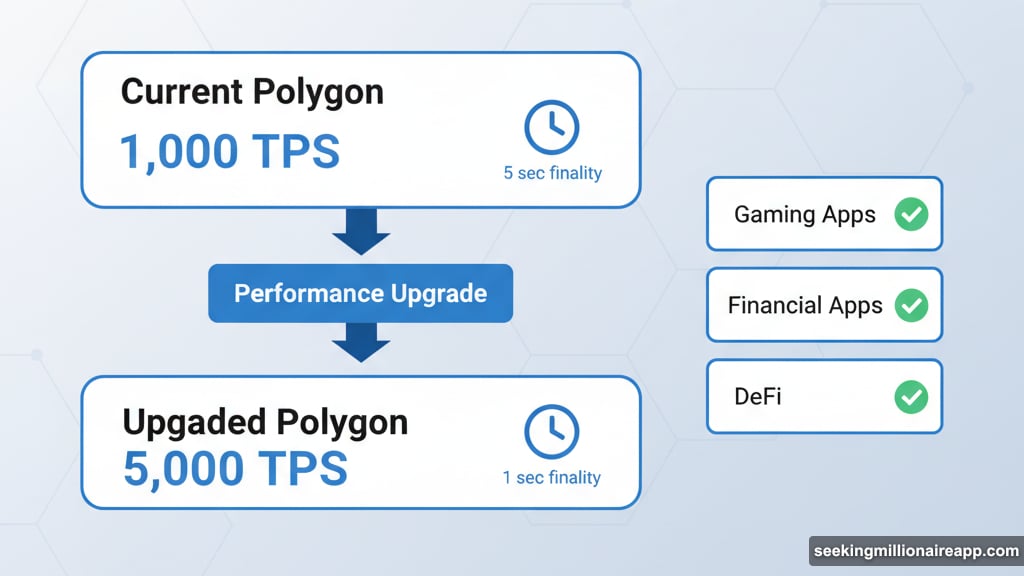

Polygon Targets 5X Performance Boost

Polygon’s preparing a performance upgrade that could change everything. The network plans to jump from 1,000 transactions per second to 5,000 TPS. Plus, finality drops from 5 seconds to just 1 second.

Those numbers matter. Current transaction speeds limit what developers can build on Polygon. Gaming applications struggle with 5-second finality. Financial apps need instant confirmation. This upgrade removes those bottlenecks.

POL sits at $0.203 right now. The token needs to defend that level aggressively. Break above it with volume, and $0.220 becomes the next target. Fail to hold, and $0.183 looms below.

However, there’s a warning sign. The RSI indicator remains stuck below 50, signaling weak momentum. Sellers still outnumber buyers in the short term. So despite the upgrade potential, technical indicators suggest caution.

The real question is whether this performance boost attracts new projects. Polygon’s been fighting for developer mindshare against Solana, Arbitrum, and Base. Five-second finality was a competitive disadvantage. One-second finality changes that conversation.

Lido V3 Transforms Staking Infrastructure

Lido’s evolution from simple liquid staking protocol to full infrastructure platform happens this month. V3 represents a fundamental architecture shift.

The upgrade makes Lido modular, transparent, and institution-grade. That’s not marketing speak. Institutional investors require specific security and compliance features. V3 delivers those while maintaining Lido’s core staking functionality.

LDO trades at $1.00 currently. Break above that psychological level and $1.07 comes into play. The Chaikin Money Flow indicator shows consistent capital inflows despite market skepticism. That’s a positive divergence worth watching.

But institutions move slowly. Even with V3 live, meaningful capital deployment takes months. So immediate price impact might disappoint. Long-term? This positions Lido for serious institutional adoption.

The downside risk sits at $0.923. Lose that support and $0.862 becomes the next stop. The bullish case relies entirely on defending current price levels while institutional interest builds.

What These Upgrades Actually Mean

Technical upgrades don’t guarantee price increases. They create potential. Execution matters more than announcements.

Cronos needs developers to actually build with smart accounts. Polygon must prove 5,000 TPS works in production. Lido has to convert institutional interest into real TVL growth.

Each project faces different challenges. Cronos competes in a crowded EVM space. Polygon fights perception that it’s slower than newer chains. Lido navigates complex staking regulations while maintaining decentralization.

Smart money watches how these upgrades perform post-launch. Initial bugs? Price drops. Smooth deployment? Confidence builds. Reality rarely matches the optimistic pre-launch narrative.

The crypto market loves narratives. Right now, these three tokens have compelling stories. But stories don’t determine long-term value. Actual usage does.

Watch on-chain metrics after these upgrades go live. Transaction counts, developer activity, and capital flows tell the real story. Price speculation is just noise until fundamentals confirm the thesis.