Crypto bear markets hit different from traditional downturns. We’re not talking about a modest 20% dip. We’re talking 70% to 90% price collapses from peak values. That’s the kind of drawdown that wipes out years of gains in a matter of months.

And yet, some traders actually profit during these periods. How? Arkham Intelligence recently outlined six concrete strategies that experienced market participants use to navigate — and even benefit from — sustained crypto downturns. Let’s walk through each one.

What a Crypto Bear Market Actually Looks Like

First, a quick reality check on what we’re dealing with here.

A bear market officially begins when prices fall 20% or more from recent highs and keep trending down. In traditional stock markets, that’s painful but survivable. In crypto, the pain runs much deeper.

Arkham notes that lower highs and lower lows dominate price action across most timeframes during these cycles. Trading volumes drop as participants exit positions or sit on the sidelines. That reduced liquidity makes already volatile price swings even more extreme.

So the environment is genuinely tough. But disciplined traders can still find meaningful opportunities — if they know where to look.

Short Selling Crypto Assets During a Downtrend

Short selling is the most direct way to profit from falling prices. The basic mechanic works like this: you borrow a digital asset, sell it at the current price, then buy it back later at a lower price and return it to the lender. The difference is your profit.

Sounds simple enough. But Arkham is clear about the risks here.

Because prices can theoretically rise without limit, your losses as a short seller are theoretically unlimited too. That asymmetry makes position sizing critical. Arkham recommends using stop-loss orders to cap potential losses before entering any short position.

So this strategy rewards disciplined traders. It punishes those who size too aggressively or skip risk controls.

Put Options and Inverse Products: Capped Downside Risk

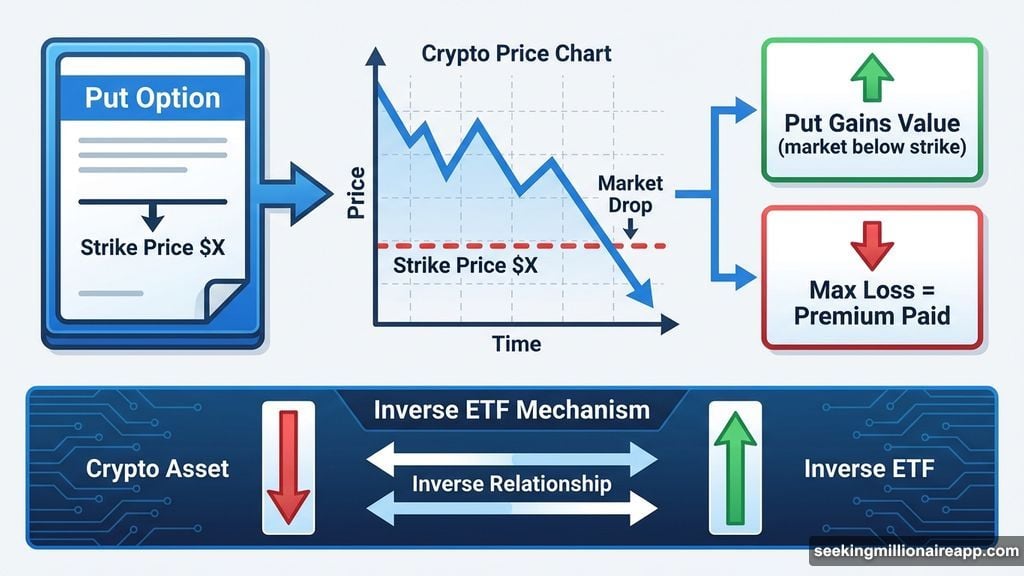

For traders who want bearish exposure without the unlimited loss potential of short selling, put options and inverse products offer a more controlled alternative.

A put option gives you the right — but not the obligation — to sell an asset at a fixed price before the contract expires. If the market drops below that strike price, your put gains value. And here’s the key advantage: your maximum loss is capped at whatever premium you paid for the contract upfront.

Inverse products work differently but achieve a similar goal. These instruments move opposite to the underlying asset. When the asset falls, the inverse product rises. Inverse ETFs in crypto markets track the daily inverse return, letting you gain downside exposure without opening a traditional short position.

Both tools increase in value as prices decline. Both limit your maximum loss to your initial investment. That makes them useful tools for managing downside exposure with more predictable risk parameters.

Range Trading in Sideways Crypto Markets

Not every phase of a bear market involves aggressive, relentless selling. Sometimes prices consolidate and move sideways within defined boundaries. That’s where range trading comes in.

The strategy is straightforward. You identify clear support levels at the bottom of the range and resistance levels at the top. Then you buy near support and sell near resistance, capturing the movement between those two zones repeatedly.

Arkham points out an important limitation here, though. Range trading works best in relatively stable, sideways conditions. During violent sell-offs, technical support levels break down fast. So applying range trading during a panic-driven cascade can lead to significant losses.

Timing and market context matter enormously with this one.

Selective Accumulation for the Next Bull Cycle

Not every bear market strategy is about trading actively. Sometimes the smartest move is simply buying quality assets at heavily discounted prices and waiting.

Arkham calls this disciplined accumulation. The goal isn’t to catch the bottom perfectly or generate immediate profits. Instead, you’re positioning for the eventual recovery. Historically, patient investors who accumulated quality assets during bear markets have seen substantial returns when the next bull cycle arrived.

The critical word there is quality. Accumulation only works if you’re buying assets with genuine fundamentals, real utility, or strong network effects. Loading up on speculative tokens at a 70% discount is still a bad bet if those tokens never recover.

So the strategy rewards research and patience in equal measure.

Stablecoin Yield Strategies for Capital Preservation

Some participants simply don’t want active exposure during a bear market. For them, stablecoin yield strategies offer a defensive alternative.

The core idea is to convert holdings into stablecoins and deploy them in yield-generating protocols while waiting for better market conditions. Yes, stablecoin yields typically decline during bear markets alongside broader risk appetite. But you’re still earning something while protecting your principal from further price declines.

Arkham frames this as a gradual capital-building approach. You preserve your buying power, earn modest returns, and slowly accumulate dry powder for when opportunities improve. It’s not exciting. But it’s effective for participants who prioritize capital preservation over short-term gains.

Scalping and Day Trading Volatile Price Swings

Bear markets are volatile. And volatility, while painful for long-term holders, creates frequent short-term trading opportunities for skilled operators.

Scalpers target tiny price inefficiencies over minutes. Day traders aim for broader intraday momentum shifts. Both approaches thrive on the rapid swings, liquidity gaps, and panic-driven sell-offs that characterize bear market conditions.

Arkham notes that bear markets often feature predictable intraday patterns during specific trading sessions. Experienced short-term traders learn to recognize these patterns and capture small profits repeatedly throughout the day.

That said, this approach demands significant skill, fast execution, and iron emotional control. One bad trade driven by panic or greed can erase hours of small gains instantly.

The Psychological Trap That Catches Everyone

Arkham saved an important warning for the end of their report. And it’s worth sitting with.

Even the best strategies break down under emotional pressure. Reduced liquidity in bear markets creates wider bid-ask spreads and slippage, eating into profits. Mounting losses create psychological stress. And that stress leads traders to abandon their plans at exactly the wrong moment.

Every strategy on this list requires the same underlying foundation: disciplined risk management and emotional control. Without those, even technically sound approaches fall apart in real market conditions.

Bear markets expose weaknesses in both portfolios and psychology. The traders who survive and profit are usually the ones who prepared a plan before the downturn hit, then stuck to it when things got scary.

If you’re navigating the current environment, that discipline might matter more than which specific strategy you choose.