The crypto world just lived through its worst day in years. Over $19.5 billion in leveraged positions vanished within hours on October 10-11, 2025. Bitcoin dropped 8.4%. Traders across the globe watched their portfolios evaporate in real-time.

Most people blamed panic selling after Trump announced 100% tariffs on Chinese goods. But now analysts are asking uncomfortable questions. Were we witnessing natural market forces? Or something far more calculated?

The evidence points toward market manipulation on a scale the crypto industry has never seen before.

The Numbers Tell a Disturbing Story

$19.5 billion in liquidations doesn’t just happen by accident. Yet that’s exactly what occurred during Crypto Black Friday.

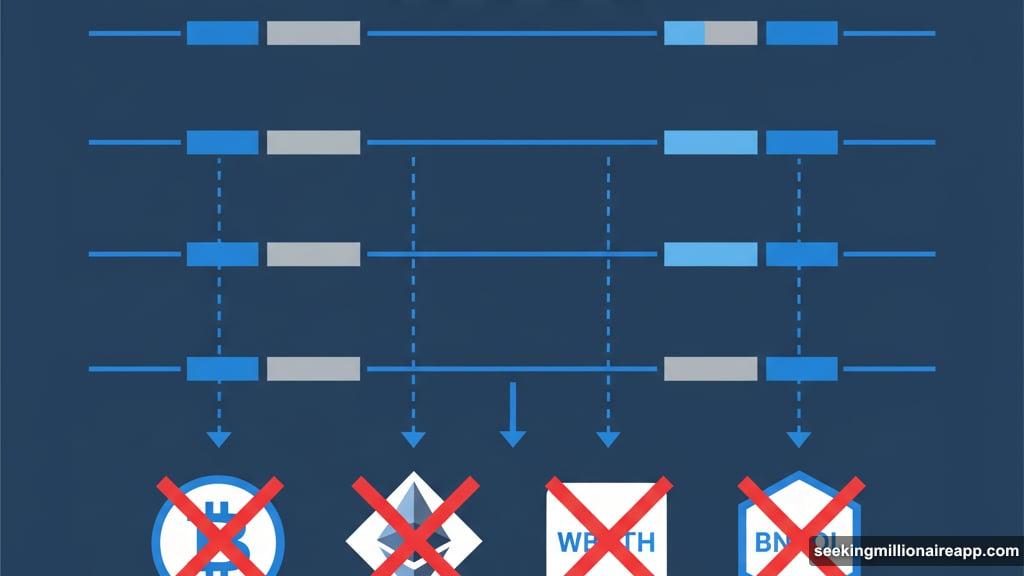

Initially, analyst Phyrex attributed the crash to inflation fears and Federal Reserve policy shifts. Bitcoin, Ethereum, WBETH, and BNSOL all faced rapid liquidations. Low liquidity made everything worse. Plus, Binance experienced temporary system issues that froze some accounts.

So far, this sounds like a typical market crash triggered by bad news. However, closer examination reveals patterns that don’t fit natural market behavior.

Analyst YQ discovered something troubling. Large transactions executed right before Oracle price updates. This timing created temporary mispricing that triggered liquidations across multiple assets simultaneously.

Meanwhile, several stablecoins lost their peg for brief periods. These depegs created perfect conditions for arbitrage bots and potentially malicious actors to profit from the chaos.

Too Many Coincidences to Ignore

“Is it coincidence that out of thousands of trading pairs, only the ones with announced updates experienced such extreme depegs?” YQ asked. “The probability seems vanishingly small.”

YQ identified suspicious profit patterns that raised even more red flags. Some traders made outsized returns on short positions. Others accumulated massive positions right at the price bottom. These weren’t normal trading profits — they looked more like heist-level returns.

Price discrepancies across different exchanges reached unprecedented levels. Normally, arbitrage traders keep prices aligned across platforms. But during Crypto Black Friday, those price gaps persisted long enough for certain players to profit enormously.

Kook Capital went further. They suggested Binance might have orchestrated the attack to damage competitor Hyperliquid. “It is my belief Binance carried this attack out themselves in an attempt to cause an industry-wide mass liquidation cascade,” Kook claimed.

Binance has since pledged to compensate affected users. But that doesn’t answer the deeper questions about what really happened.

A New Form of Market Manipulation?

If this was indeed a coordinated attack, it represents something new in crypto market manipulation. Instead of hacking systems or stealing private keys, the attackers weaponized market structure itself.

Traditional market crashes follow predictable patterns. Bad news triggers selling. Leveraged positions liquidate. Prices fall until buyers step in. Crypto Black Friday didn’t follow that script.

The synchronization of liquidations across platforms suggests coordination. The timing of large trades before Oracle updates indicates insider knowledge. The simultaneous stablecoin depegs across multiple assets points to deliberate action rather than random panic.

Not everyone agrees with the coordinated attack theory. Some analysts argue that excessive leverage combined with thin liquidity explains everything. When geopolitical fears hit a market overloaded with perpetual futures, cascading liquidations can occur naturally.

Yet even skeptics admit the timing and patterns seem unusual. Normal market crashes don’t target specific trading pairs with such precision. Natural panic doesn’t create profit opportunities this perfectly aligned for certain players.

What This Means for Crypto Infrastructure

Crypto Black Friday exposed dangerous fragilities in digital finance infrastructure. We’re building trillion-dollar markets on systems that remain alarmingly vulnerable to manipulation.

Major exchanges have pledged system audits and better risk management. Binance offered compensation. Other platforms promised similar measures. But these are temporary fixes that don’t address fundamental problems.

The crypto industry needs stronger on-chain oversight. Exchanges must improve liquidity transparency so traders can assess real market depth. Oracle governance requires tightening to prevent timing-based manipulation. Leverage mechanisms need better safeguards against cascade failures.

Most importantly, the community needs honest investigation into what happened. If this was natural market behavior, we need to understand why our systems allowed such extreme outcomes. If it was coordinated manipulation, we need to identify the perpetrators and prevent future attacks.

The Bigger Questions Nobody’s Answering

Here’s what troubles me most. The crypto industry spent years promising decentralization and transparency. We built systems supposedly resistant to the manipulation that plagues traditional finance.

Then $19.5 billion vanished in hours under circumstances that look increasingly like coordinated attack. And the best response we get is “we’ll improve our systems” without addressing whether those systems were deliberately exploited.

Investors deserve real answers. Did exchanges have advance knowledge of the liquidation cascade? Who profited from the perfectly timed trades before Oracle updates? Why did stablecoins depeg simultaneously across unrelated trading pairs?

Until we get those answers, every trader operates with uncertainty about whether the market is actually free or controlled by actors who can trigger crashes at will.

The trust Project guidelines require transparency. Yet the most important questions about Crypto Black Friday remain unanswered. That should concern everyone building or investing in this space.