Donald Trump returned to the White House promising crypto-friendly policies. The market responded with excitement. Then reality hit.

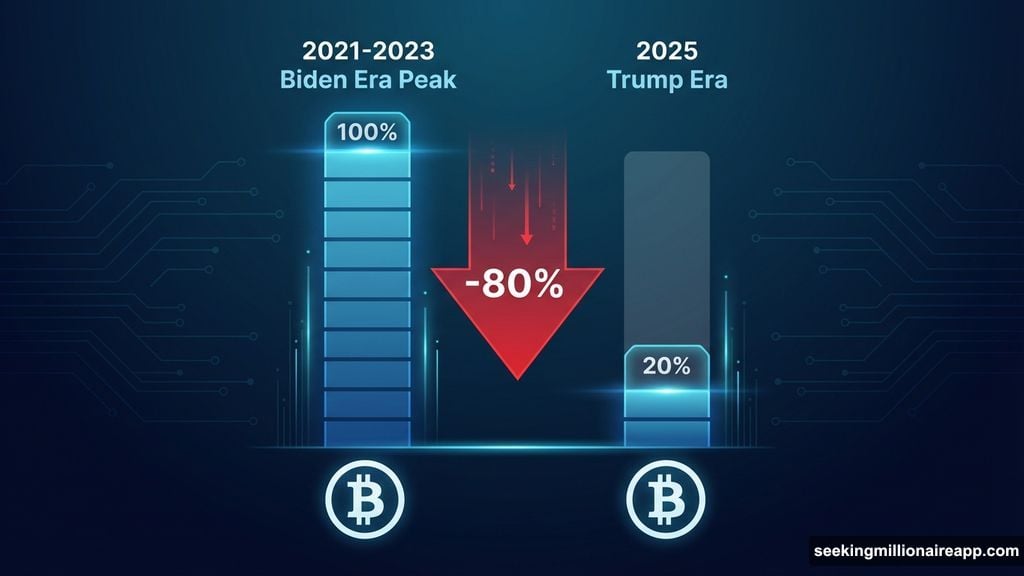

Despite everything lining up for a massive bull run, crypto is ending 2025 at just 20% of its peak from the Biden years. That’s not a typo. With the most crypto-friendly president in history, the market is down 80% from where it stood under his predecessor.

Something fundamental has changed in how crypto works, and most investors are still playing by old rules that no longer apply.

Everything Was Supposed to Work This Time

The setup looked perfect. Pro-crypto regulations, Bitcoin ETFs pulling in billions, Michael Saylor buying Bitcoin like it’s going out of style, and even nation-states accumulating crypto reserves. Plus, traditional markets are hitting all-time highs. Gold and silver are soaring. Stocks are running.

Yet crypto is bleeding.

Ran Neuner, analyst and host of Crypto Banter, put it bluntly: “It’s time to acknowledge and admit the crypto market is broken.” He listed all the catalysts that should have triggered a rally—abundant liquidity, favorable regulation, institutional adoption through ETFs, and aggressive accumulation by major players.

None of it mattered. The market ended 2025 lower than it started, sitting at a fraction of its Biden-era peak.

So what gives? Either someone is systematically suppressing prices through structural selling, or crypto is setting up for what Neuner calls “the mother of all catch-up trades.” There’s no middle ground.

The Market Didn’t Break, It Just Changed

Not everyone agrees crypto is broken. Market commentator Gordon Gekko argues the pain is deliberate. “Nothing is broken; this is just how market makers intended. Sentiment is at its lowest in years. Leverage traders are losing everything,” he wrote on X.

His point hits harder when you compare Trump’s first term to now. Back in 2017 to 2020, crypto thrived in a regulatory vacuum. Retail speculation ran wild. Leverage was everywhere. Momentum pushed prices far beyond any reasonable valuation.

Under Biden, everything changed. The market became institutionalized. Enforcement-first regulation constrained risk-taking. ETFs, custodians, and compliance frameworks reshaped how capital flows through crypto.

Here’s the irony: All the bullish catalysts everyone wanted—ETFs, institutional adoption, regulatory clarity—arrived during this more constrained era. But they came with strings attached.

ETFs unlocked access, but mostly for Bitcoin. Institutions allocated capital, but they hedged and rebalanced mechanically. Liquidity exists, but it flows into traditional finance wrappers rather than on-chain ecosystems.

The result is scale without the reflexive momentum that drove previous bull runs. Crypto got what it asked for, just not in the way it expected.

Bitcoin Survives While Altcoins Collapse

The structural shift has been brutal for altcoins. Analyst Shanaka Anslem argues that a unified crypto market no longer exists. Instead, 2025 has split into “two games.”

First, institutional crypto: Bitcoin, Ethereum, and ETFs with crushed volatility and longer time horizons. This is where patient capital lives.

Second, attention crypto: Millions of tokens competing for fleeting liquidity. Most collapse within days. This is pure speculation on speed.

Capital no longer rotates smoothly from Bitcoin into altcoins like it did in previous cycles. The “altseason” everyone keeps waiting for may never come.

“Your only choices now: Play institutional crypto with patience and macro awareness, or play attention crypto with speed and infrastructure,” Anslem wrote. Holding altcoins on thesis for months is now the worst possible strategy.

“You are not early to the altseason. You are waiting for a market structure that no longer exists,” he added.

Trader Lisa Edwards supports this view. “Things shift, cycles change, money moves in new ways. If you are waiting for the old altseason, you will miss the stuff that is actually running right in front of you.”

The numbers back this up. Quinten François notes that 2017 had a few hundred coins competing for capital. By 2021, that number grew to a few thousand. Now in 2025, more than 11 million tokens exist.

That fragmentation makes a broad-based altseason like 2017 or 2021 essentially impossible. The market is too crowded, too diluted, and too fast-moving for the old patterns to repeat.

Macro Pressures Keep Building

Meanwhile, traditional market pressures continue weighing on sentiment. Bitcoin slid toward its 100-week moving average, reflecting renewed concerns about AI bubble fears, uncertainty around future Federal Reserve leadership, and year-end tax-loss selling.

Nic Puckrin, investment analyst and co-founder of Coin Bureau, warns that Bitcoin could briefly dip below $80,000 if selling accelerates. “This all makes for a lacklustre end to 2025,” he said.

The tax-loss harvesting is particularly painful. Investors who bought during the Trump rally are now selling at a loss to offset gains elsewhere. That creates selling pressure right as holiday liquidity dries up.

Plus, the Federal Reserve’s messaging remains hawkish. Rate cuts aren’t coming as fast as markets hoped. Higher rates for longer means risk assets like crypto face continued headwinds.

So even with a pro-crypto president, the macro environment is working against digital assets. That combination of structural changes and macro pressures explains why crypto can’t catch a bid.

Two Paths Forward, Both Uncomfortable

Crypto now faces two possible futures. First, someone or something is systematically suppressing prices. This could be large holders distributing, institutional hedging programs, or simply too much supply hitting the market from airdrops and token unlocks.

If that’s true, prices stay low until the selling exhausts itself. That could take months or even years. Patience is required, but conviction gets tested when nothing works.

Second, crypto is setting up for a violent catch-up rally. All the fundamentals are in place. Capital is available. Institutional infrastructure is built. Eventually, prices have to reflect that reality.

If this scenario plays out, the rally will be fast and brutal. Anyone waiting on the sidelines will miss the move entirely. That’s how markets work after prolonged compression.

Which path is correct? Nobody knows. What’s clear is that Trump-era expectations are colliding with Biden-era market structure, and the old playbook no longer applies.

Investors betting on a 2017 or 2021-style bull run are playing a game that doesn’t exist anymore. The market has evolved. Capital flows differently. Attention spans are shorter. Token supply is astronomical.

Success now requires understanding these new dynamics rather than hoping for a return to the old ones. That means focusing on Bitcoin and Ethereum for patient capital, or playing the attention game with memecoins and viral tokens.

Holding mid-cap altcoins and waiting for a broad rotation is the worst possible strategy. That trade doesn’t work in a market with 11 million tokens.

The question isn’t whether crypto is broken. The question is whether investors will adapt to how it works now, or keep waiting for a market structure that no longer exists.