October just became the safest month for DeFi in years. Hackers stole only $18 million across 15 incidents. That’s an 85% drop from September’s carnage.

Sounds like victory, right? Not so fast. Security experts warn this calm won’t last. North Korea-backed attackers are testing new tactics that could make traditional defenses obsolete.

Let’s look at what actually happened and why you shouldn’t relax yet.

Three Hacks Accounted for Nearly Everything

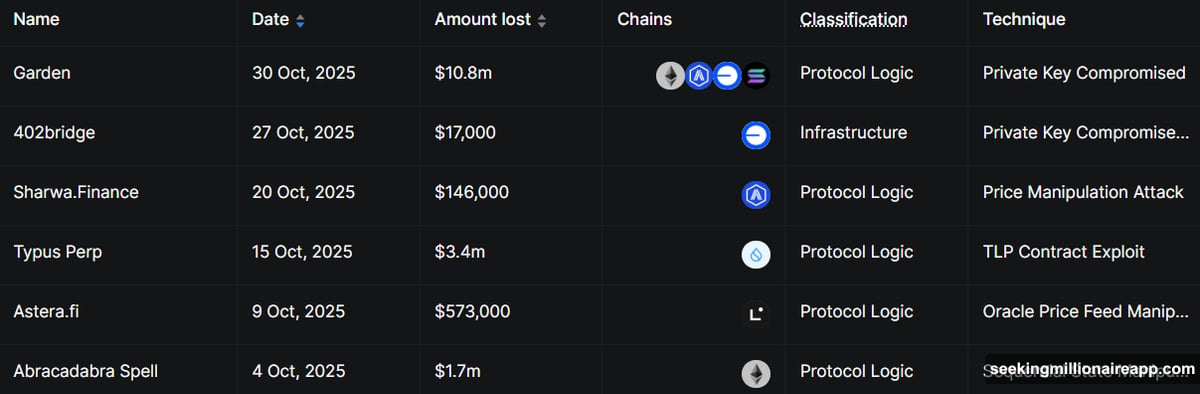

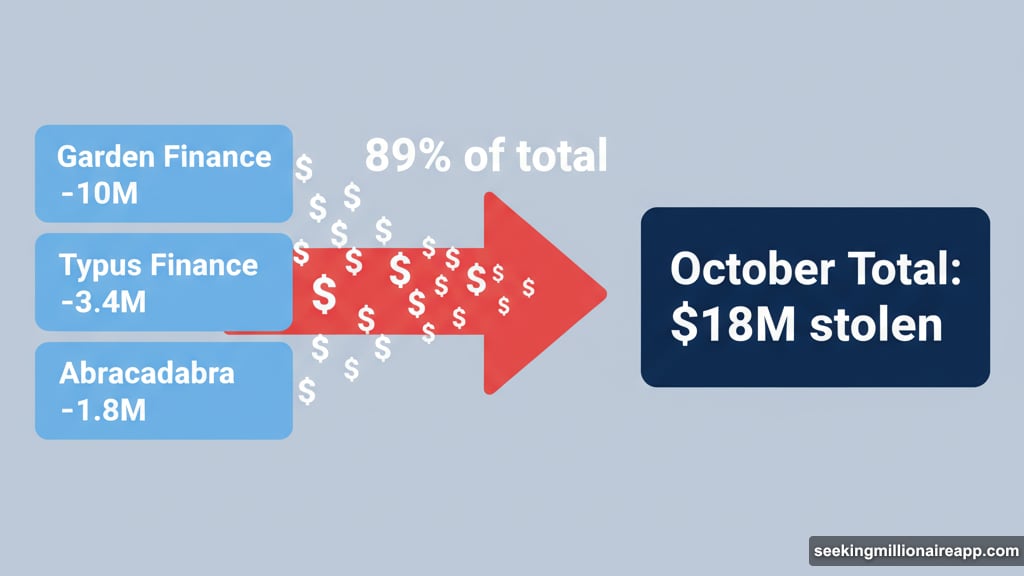

Garden Finance, Typus Finance, and Abracadabra got hit the hardest. These three protocols lost $16.2 million combined. That’s 89% of October’s total stolen funds.

Garden Finance took the biggest hit on October 30. Attackers compromised one of its Bitcoin peer-to-peer solvers and drained over $10 million. Without this last-minute breach, October would have recorded just $7 million in losses. That would mark the lowest monthly figure since early 2023.

Typus Finance lost $3.4 million on October 15. Hackers manipulated its oracle system on Sui blockchain. The exploit targeted a flaw in the platform’s TLP contracts. Plus, Typus’s native token crashed 35% after news broke.

Abracadabra suffered its third exploit since launch. This time, attackers stole $1.8 million in MIM stablecoins. They bypassed solvency checks through a smart contract vulnerability. That’s becoming a pattern for this protocol.

Why October Was So Quiet

Better security played a role. Many protocols strengthened their defenses after brutal summer losses. Bug bounty programs caught vulnerabilities before attackers could exploit them.

But timing matters too. Crypto markets stayed relatively calm in October. Lower activity means fewer opportunities for hackers. When transaction volumes drop, so do potential attack vectors.

Moreover, several major hacking groups shifted focus. According to blockchain security firm PeckShield, some North Korean threat actors redirected resources toward other targets. That temporary shift created breathing room for DeFi platforms.

Still, this doesn’t mean protocols are safe. The ecosystem remains vulnerable to sophisticated attacks.

New Attack Methods Are Coming

Here’s what worries security researchers. State-sponsored hacking groups, especially from North Korea, are testing dangerous new tactics. They’re embedding malicious code directly into blockchain networks.

This approach bypasses traditional security layers entirely. Instead of attacking smart contracts or front-ends, hackers compromise the underlying infrastructure. Think of it like poisoning the water supply rather than breaking into individual houses.

These embedded attacks remain largely theoretical. But cybersecurity experts have detected early experimentation. If successful, this tactic could render current defense mechanisms useless.

Additionally, AI-powered hacking tools are becoming more sophisticated. Automated systems can now scan thousands of contracts per day, identifying vulnerabilities faster than human auditors. That asymmetry favors attackers.

So October’s low numbers might reflect the calm before the storm.

DeFi Platforms Still Leak Money

Despite October’s improvement, the year’s total remains staggering. Through ten months, crypto hacks and exploits have drained over $1.2 billion from DeFi protocols. That’s roughly equal to 2024’s full-year losses.

Cross-chain bridges continue to be weak points. These protocols connect different blockchains, but that complexity creates security gaps. Attackers exploit these bridges repeatedly because the potential payoff justifies the effort.

Flash loan attacks persist too. Hackers borrow massive amounts of crypto without collateral, manipulate prices, then repay the loan within seconds. All profit, zero risk. Until protocols fix oracle vulnerabilities, these attacks will continue.

Furthermore, insider threats remain underestimated. Some exploits involve compromised team members or contractors with system access. Garden Finance’s October breach likely resulted from this type of internal compromise.

What Actually Protects Your Funds

Want to avoid becoming another statistic? Here’s what works based on real incident data.

Use established protocols with proven track records. New platforms promise higher yields but carry exponentially higher risk. Protocols that survived multiple market cycles tend to have better security practices. They’ve learned from past mistakes and invested in defense.

Diversify across multiple platforms. Don’t keep all your crypto in one protocol, regardless of its reputation. If you’re earning yield on $100K, split it across three to five vetted platforms. That limits your exposure if one gets compromised.

Watch for audit red flags. Check if a protocol has been audited by reputable firms like Trail of Bits, ConsenSys Diligence, or OpenZeppelin. But remember audits aren’t guarantees. Typus Finance was audited before its October exploit. Still, unaudited protocols carry even higher risk.

Enable all available security features. Use hardware wallets for significant holdings. Set up multi-signature requirements for large transactions. Enable withdrawal delays when platforms offer them. These steps won’t stop protocol-level hacks but protect against account compromises.

Monitor your positions actively. Check balances daily if you’re using DeFi protocols. Set up alerts for unusual activity. The faster you detect a problem, the better your chances of minimizing losses.

The Numbers Tell a Complicated Story

October’s decline looks impressive on paper. An 85% drop suggests massive improvement. But context matters.

September was exceptionally bad with $127 million stolen. Comparing to an outlier month inflates the improvement. Average monthly losses in 2025 hover around $80-90 million. So October sits well below average but isn’t necessarily proof of lasting change.

Moreover, the number of incidents stayed relatively constant. Fifteen separate hacks occurred in October versus eighteen in September. So attack frequency barely changed. Only the size of individual breaches decreased.

That suggests attackers are getting less efficient rather than less active. They’re still trying. They’re just failing more often or targeting smaller protocols. Neither trend guarantees future safety.

State Actors Change Everything

North Korea-backed hacking groups have stolen over $3 billion from crypto platforms since 2017. These aren’t amateur operations. They employ hundreds of skilled programmers working full-time to breach crypto systems.

Why? Because stealing crypto funds their nuclear weapons program and helps evade international sanctions. The financial incentive is enormous. Plus, crypto theft carries minimal consequences compared to traditional cybercrime.

These groups operate with patience and sophistication. They’ll spend months researching a single target before striking. They use social engineering to compromise employees. They plant sleeper agents who apply for jobs at crypto companies.

Traditional DeFi hacks exploit technical vulnerabilities. State-sponsored attacks exploit human and organizational weaknesses. That makes them much harder to prevent with smart contract audits or bug bounties.

So even if protocols perfect their code, the human element remains vulnerable.

Where Things Go From Here

Expect volatility in monthly hack totals. October’s calm doesn’t predict November’s outcome. DeFi security resembles an arms race. Defenders improve. Attackers adapt. The cycle continues.

Several positive trends are emerging though. Insurance protocols are maturing, offering some protection against losses. Real-time monitoring tools catch suspicious activity faster. Cross-chain communication standards are improving, reducing bridge vulnerabilities.

But the fundamental challenge remains. DeFi protocols hold billions in value with relatively small security teams. That imbalance attracts sophisticated attackers who probe defenses constantly.

Until the economic incentive for hacking decreases or consequences increase substantially, exploits will continue. October gave us a glimpse of what’s possible with better security. Whether that becomes the new normal depends on choices the industry makes now.

Stay vigilant. Use security best practices. And remember that in crypto, paranoia isn’t a bug. It’s a feature that keeps your funds safe.