Forget gym selfies and travel photos. Your dating profile might need a new upgrade: proof you understand Bitcoin.

A new OKX survey of 1,000 Americans reveals something unexpected. Two-thirds of respondents find financial literacy attractive in a potential partner. Plus, understanding crypto and digital assets specifically makes you more appealing to over half of men and nearly half of women.

The shift feels significant. Money management evolved from awkward third-date conversation to genuine dating advantage. So what changed, and does it actually matter?

Financial Smarts Beat Flashy Spending

The numbers tell a clear story. About 66% of Americans now consider personal finance knowledge attractive in a romantic partner.

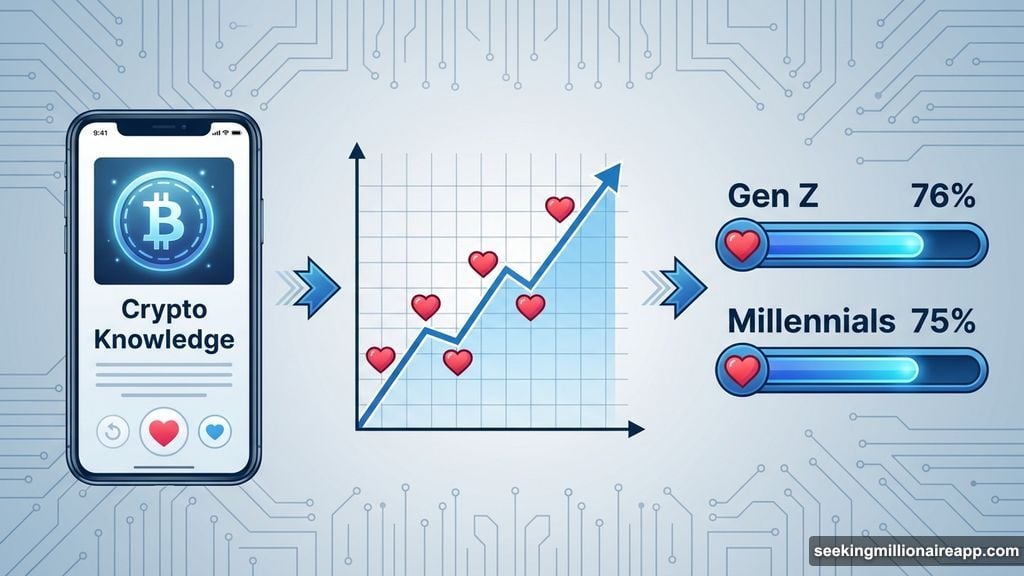

Yet the trend hits different across age groups. Among Gen Z, that figure jumps to 76%. Millennials follow closely at 75%. Meanwhile, older generations show less enthusiasm for financially savvy partners.

Gender patterns surprise too. Millennial women and Gen Z men both clocked in at 77%, the highest of any demographic. So regardless of gender, younger daters increasingly value partners who understand money.

Why the shift? An OKX spokesperson pointed to economic context. Gen Z grew up during financial instability—pandemic disruptions, mounting student debt, housing crises. For them, financial competence isn’t optional. It’s foundational to relationship success.

Crypto Knowledge Beats Crypto Ownership

Understanding digital assets matters more than actually owning them. That’s the unexpected finding from the survey data.

Over half of men (52-55%) and 49% of women said crypto knowledge makes someone more attractive. However, actually holding digital assets proves less impressive. Only 17% of Americans overall consider crypto ownership attractive.

The gap widens by generation. Among Millennials, 66% find crypto knowledge appealing. Gen Z follows at 65%. But Baby Boomers? Just 37%.

Meanwhile, 64% of all respondents feel neutral about someone owning crypto. They don’t penalize it. But they don’t reward it either.

“People evaluate competence and ownership differently,” the OKX spokesperson explained. “Most people aren’t penalizing ownership. They just don’t treat it as a bonus the way they treat knowledge.”

So demonstrating understanding beats showing off your portfolio. Knowledge signals adaptability and engagement with evolving financial systems. Ownership alone doesn’t carry the same weight.

Crypto as Valentine’s Gift Splits Generations

Would you want Bitcoin for Valentine’s Day? Most Americans remain unsure.

Overall, 21% said receiving crypto as a romantic gift would be a “turn-on.” That includes 25% of men and 17% of women. Meanwhile, 35% prefer traditional gifts, and 44% feel neutral.

But younger generations show real interest. Among Millennials, enthusiasm jumps to 34%. Gen Z follows at 31%, with Gen Z men leading at 39%.

The data suggests crypto gifting remains niche but gains traction among digital natives. Yet for most Americans, chocolates and flowers still win.

Few Actually Pay for Dates with Crypto

Despite growing interest, real-world crypto use in dating remains minimal. Only 5% of Americans have paid for a date using digital assets.

That figure climbs to 13% among Gen Z but drops below 1% for Boomers. An additional 6% contributed crypto after someone else paid the bill traditionally.

Barriers differ by generation. Among Gen Z who haven’t used crypto for dating expenses, 37% cited lack of access as the main reason. For Boomers, 65% said they wouldn’t feel comfortable paying that way regardless.

“This is an access problem rather than a demand problem,” the spokesperson noted. “What’s still being built is payment infrastructure at the point of sale.”

Until restaurants and bars accept tap-to-pay crypto as easily as credit cards, widespread adoption seems unlikely. The interest exists. The infrastructure doesn’t yet.

Financial Literacy Signals Stability

The survey reveals something deeper than crypto hype. Americans increasingly value financial competence in partners because traditional markers of stability keep shifting.

Steady paychecks matter less than adaptability. Understanding markets, engaging with new financial tools, and making informed decisions signal long-term reliability. That’s especially true for generations facing economic uncertainty as their baseline reality.

“What younger generations consider ‘stable’ is changing,” the spokesperson explained. “It’s about understanding how money works and staying curious about how finance evolves.”

So crypto knowledge matters not because Bitcoin itself attracts partners. It matters because understanding emerging financial systems demonstrates broader competence and adaptability.

Your dating success might not depend on your crypto portfolio. But understanding the technology behind it could absolutely help. Financial literacy evolved from boring necessity to genuine romantic asset.

Choose wisely whether to add crypto expertise to your dating profile. But ignore financial education at your own risk.