BlockFills just hit pause on client withdrawals. Instantly, crypto Twitter erupted with panic and FTX comparisons.

But hold on. Before declaring another crypto apocalypse, let’s examine what actually happened here. The details matter more than the headlines suggest.

What BlockFills Actually Did

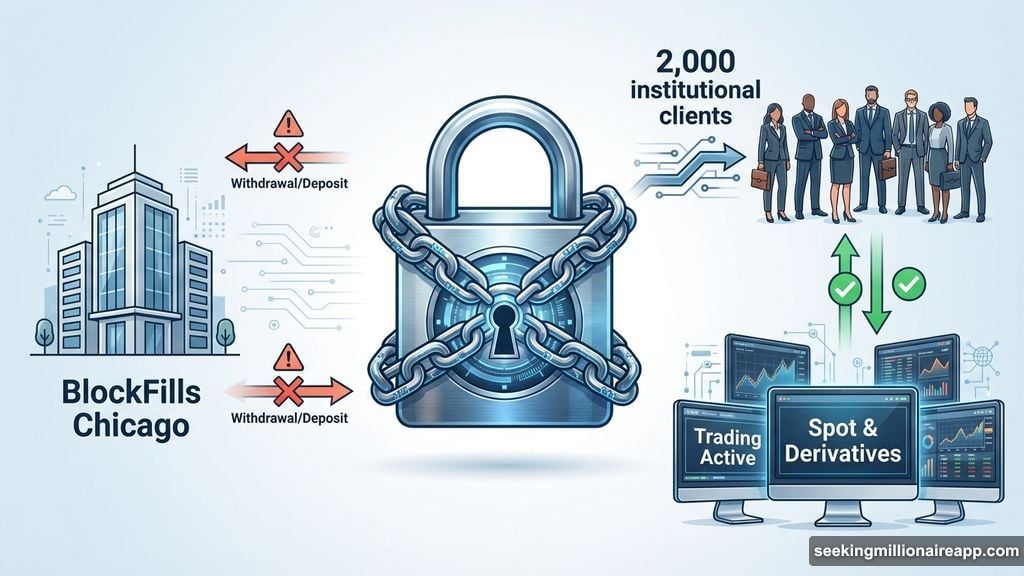

Last week, the Chicago-based crypto lender suspended both deposits and withdrawals. The company cited “recent market and financial conditions” as the reason. Their stated goal? Protecting clients and the firm during turbulent times.

Here’s the interesting part. Trading stayed open. Clients can still open and close positions in spot and derivatives markets. That’s unusual for a company in serious financial distress.

BlockFills serves roughly 2,000 institutional clients. We’re talking crypto hedge funds and asset managers, not retail investors. In 2025, they processed $60 billion in trading volume. So this isn’t some small operation.

Why Everyone’s Freaking Out

The crypto community has PTSD. And honestly? Fair enough.

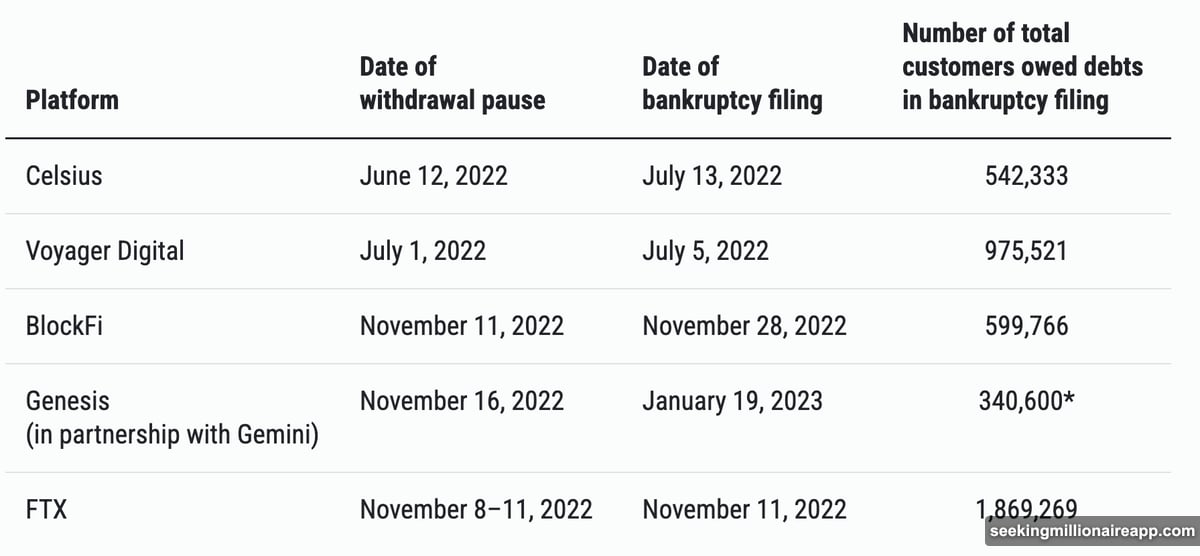

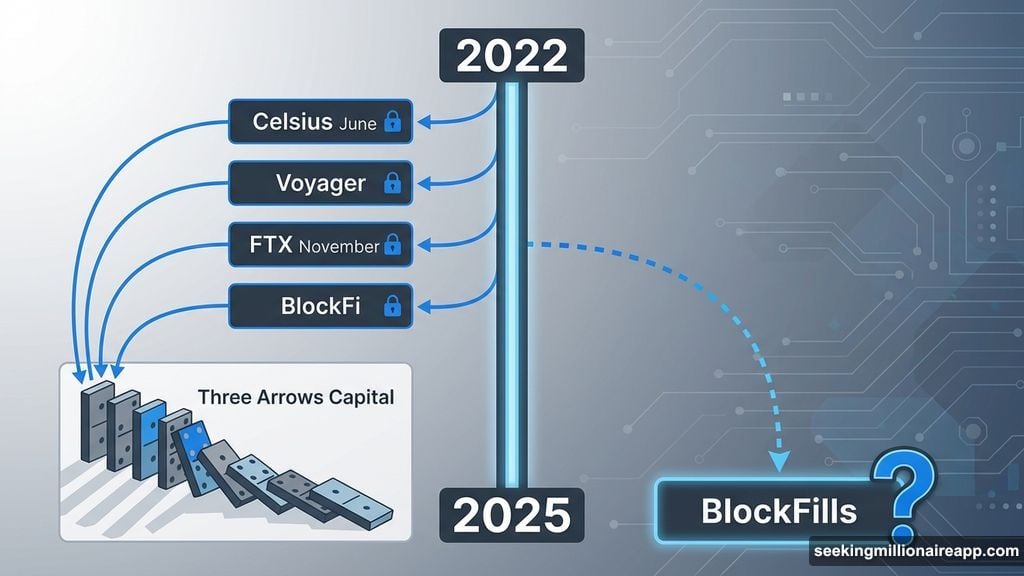

Remember 2022? Celsius froze withdrawals in June. BlockFi followed in November. Voyager went down. Then FTX spectacularly imploded, taking billions with it. Each withdrawal freeze preceded a bankruptcy filing.

Those failures weren’t isolated incidents either. They cascaded. FTX’s collapse dragged down BlockFi. Three Arrows Capital’s death spiral hit multiple lenders. The domino effect devastated the entire market.

So when BlockFills announces a withdrawal freeze, people understandably assume the worst. Pattern recognition kicks in. Social media amplifies the fear. Within hours, theories about insolvency spread everywhere.

The Crucial Difference This Time

Yet several factors suggest BlockFills faces different circumstances than those 2022 failures.

First, trading remains active. Companies on the brink of bankruptcy typically shut everything down immediately. They can’t maintain operations while insolvent. BlockFills keeping markets open signals they’re managing liquidity issues, not total collapse.

Second, they’re communicating. Management held information sessions with clients. They’re answering questions directly. Compare that to FTX, where Sam Bankman-Fried went silent as everything burned.

Third, no evidence of fraud has emerged. The 2022 disasters often involved misuse of client funds or hidden leverage. BlockFills hasn’t been accused of either. Their issue appears related to market volatility, not criminal activity.

Industry experts are urging caution about jumping to conclusions. One crypto executive noted this looks like “model risk, not systemic risk.” Other major platforms like FalconX and Coinbase Prime continue operating normally. If this were truly systemic, we’d see widespread freezes.

Market Conditions Are Brutal Right Now

Context matters. The crypto market is getting hammered.

Total cryptocurrency market cap has dropped over 22% since January. Bitcoin crashed to around $60,000 last Friday, its lowest point since October 2024. That’s roughly 50% below Bitcoin’s $126,000 all-time high from last October.

This isn’t 2022-level carnage. But it’s serious enough to strain leveraged positions and stress liquidity providers. BlockFills operates in derivatives markets, which amplify both gains and losses. When volatility spikes, these positions require more capital to maintain.

So BlockFills pausing withdrawals might be exactly what they claim: a defensive move to preserve capital during extreme market stress. Not ideal, obviously. But potentially rational risk management rather than a bankruptcy warning sign.

The Precedent Problem

Here’s my concern. Withdrawal freezes, even temporary ones, erode trust.

Crypto’s entire value proposition includes permissionless access to your assets. When platforms can arbitrarily lock your funds, that promise breaks. Doesn’t matter if the freeze proves temporary. The precedent damages confidence.

Plus, how do clients distinguish legitimate defensive pauses from bankruptcy precursors? They can’t, really. Not in real-time. By the time the truth emerges, it’s often too late to protect yourself.

This creates perverse incentives. The moment any platform shows weakness, rational clients should rush to withdraw. That bank-run dynamic makes every liquidity crisis potentially fatal, even for fundamentally sound companies.

What Happens Next

BlockFills says they’re working with investors and clients to resolve the situation. Management promises regular updates. But promises mean nothing until withdrawals resume.

The best-case scenario? Markets stabilize. BlockFills restores liquidity. Withdrawals reopen within weeks. Clients get their funds. Everyone moves on, slightly shaken but intact.

Worst case? The freeze extends indefinitely. More clients demand withdrawals. Pressure builds. Eventually, bankruptcy lawyers get involved. We’ve seen this movie before.

My gut says BlockFills survives this. The continued trading operations suggest they’re managing through difficult conditions, not hiding insolvency. But I’ve been wrong before. And in crypto, even educated guesses carry massive uncertainty.

Watch their communications closely. If updates stop, that’s a red flag. If trading gets restricted, that’s worse. If other platforms start showing similar stress, then maybe systemic concerns are justified.

For now though, this looks like one firm dealing with market volatility. Uncomfortable? Absolutely. Another FTX? Probably not.

But ask me again in a month. In crypto, everything can change overnight.