The crypto market just shed $14 billion in 24 hours. Bitcoin stalled below $94,000. Meme coins like BONK crashed 12% after spiking.

So what actually happened? Traders took profits after nearly a week of gains. That’s normal after a rally. But the speed of the reversal caught many off guard, especially in overbought altcoins.

Plus, two major news items hit simultaneously. Grayscale launched a new Bittensor Trust, driving institutional interest in AI crypto. Meanwhile, Trump made claims about Venezuelan oil transfers that sparked speculation about Bitcoin reserves moving to the US.

Let’s break down what’s moving prices right now.

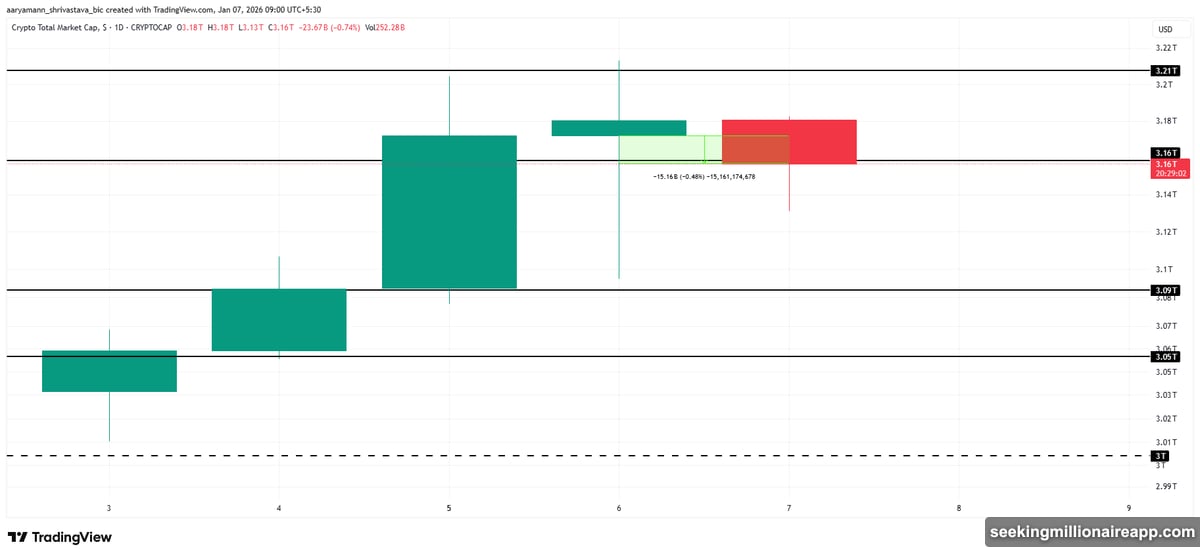

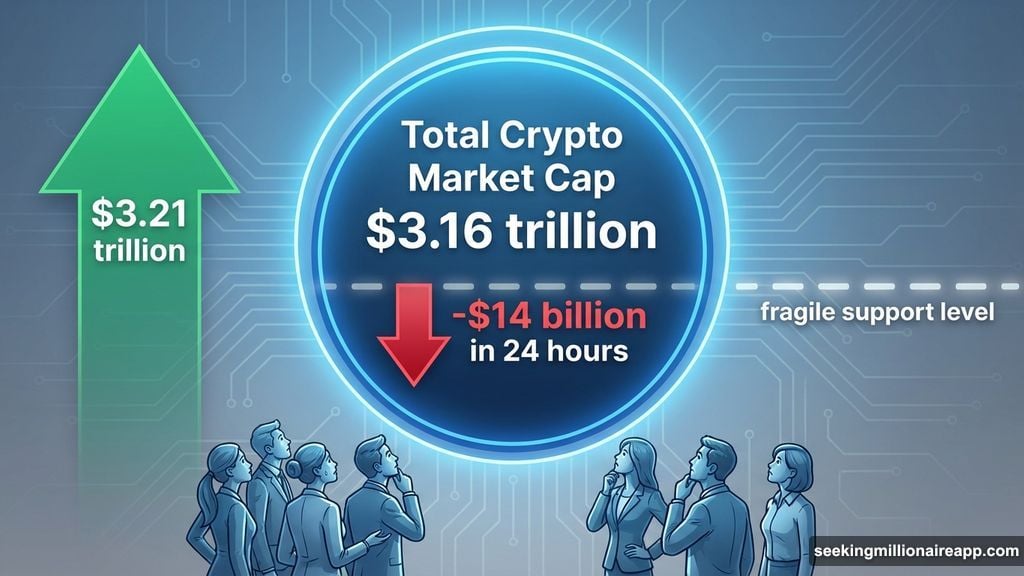

Total Market Cap Loses Support

The total crypto market cap dropped to $3.16 trillion. That level now acts as fragile support after holding most of the day.

Importantly, selling pressure stayed controlled. Investors aren’t panic-selling. Instead, they’re taking a cautious stance, likely waiting for clearer signals before adding exposure again.

The market tried to reclaim $3.21 trillion resistance earlier but failed. Now it’s consolidating around $3.16 trillion while participants reassess risk. Broader macro weakness weighed on digital assets, limiting any meaningful recovery attempts.

Here’s what matters next. If holders return to accumulating instead of distributing, the market could bounce back toward $3.21 trillion. But that requires improving sentiment and stable capital flows. Without those conditions, sideways trading continues.

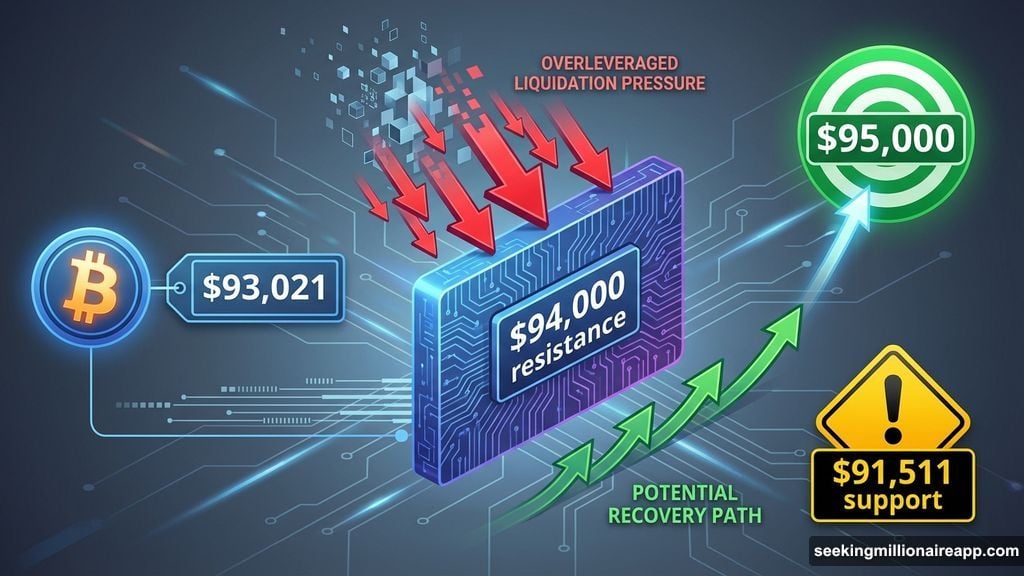

Bitcoin Struggles Below $94,000 Resistance

Bitcoin trades near $93,021 at the time of writing. It nearly slipped under $91,511 support during intraday weakness, showing how fragile short-term momentum has become.

The dip came from broader market sell-offs and liquidation-driven pressure. Overleveraged positions got flushed out, creating cascading selling. Bitcoin has since stabilized, but recovery remains tentative at best.

If sentiment doesn’t improve, renewed selling could push BTC back toward $91,511 again. That level needs to hold. A breakdown opens the door to deeper losses and tests buyer conviction across the market.

However, a shift back to bullish positioning changes everything. Stronger demand could help Bitcoin reclaim $93,471 as support. Securing that level opens a path toward $95,000 and restores upside momentum that’s been missing for days.

BONK Crashes After Overbought Spike

BONK experienced violent volatility over the past 24 hours. The meme coin spiked to $0.00001340 intraday before reversing sharply lower.

Price failed to hold above $0.00001216 resistance. That level now reinforces itself as a key barrier limiting short-term upside. BONK currently trades near $0.00001174, hovering just above $0.00001103 support.

Here’s the problem. BONK got severely overbought during its spike. When momentum reversed, profit-takers rushed for exits simultaneously. That created the sharp 12% drop from the intraday high.

If current conditions persist, $0.00001103 support faces a retest. A breakdown could expose BONK to further downside, with $0.00001009 emerging as the next logical support zone. That’s another 6% drop from current levels.

But a recovery in bullish sentiment would change the outlook entirely. Renewed buying pressure could push BONK back above $0.00001216. Securing this level may open a path toward $0.00001353, invalidating the bearish thesis and shifting momentum back to buyers.

Institutional Interest Heats Up

Grayscale launched the Grayscale Bittensor Trust yesterday, providing regulated exposure to the decentralized AI network. The announcement drove TAO to a multi-week high.

Trading volume exceeded $230 million as institutional interest in AI-focused crypto assets surged. This marks another step in crypto’s evolution beyond just currency and DeFi applications.

Meanwhile, Trump’s comments about Venezuelan oil transfers sparked speculation. He said Venezuela’s interim authorities would send 30 to 50 million barrels of oil to the US following Nicolás Maduro’s capture.

The move has traders wondering if other Venezuelan assets could transfer next. Specifically, possible Bitcoin reserves held by the country. If those reserves move, it could impact BTC supply dynamics and price action in the coming weeks.

Market Faces Critical Decision Point

Short-term momentum remains fragile across crypto. Bitcoin needs to reclaim $93,471 to restore bullish structure. The total market cap must hold $3.16 trillion to prevent deeper losses.

Altcoins face even more uncertainty. Many got overbought during the recent rally. BONK’s sharp reversal shows what happens when profit-taking hits overleveraged positions simultaneously.

The next few days matter. If sentiment improves and buyers return, the market could bounce back toward recent highs. But if selling pressure intensifies, we’re looking at deeper retracements across the board.

Watch Bitcoin’s behavior at $91,511 support. That’s your canary in the coal mine. If it breaks, expect cascading liquidations and a rush to exit risk assets. If it holds and bounces, the recovery attempt continues.