The crypto market just shed $42 billion in 24 hours. But before you panic, this isn’t your typical bloodbath.

Market cap dropped from $3.73 trillion to $3.71 trillion as traders reacted to the Federal Reserve’s latest move. The interesting part? This dip might actually set up the next leg higher. Let me explain what’s really happening.

The Fed Cut Rates. Markets Freaked Out Anyway

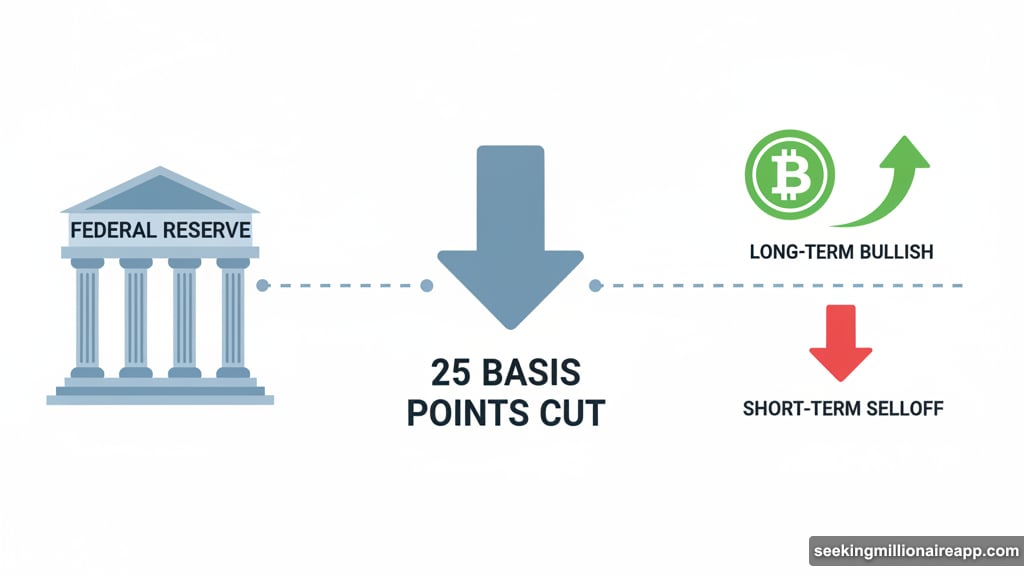

The Federal Reserve slashed interest rates by 25 basis points yesterday. That’s exactly what crypto bulls wanted. Lower rates typically push investors toward riskier assets like Bitcoin and altcoins.

So why did prices drop? Simple. Markets already priced in the cut weeks ago. Plus, traders needed an excuse to take profits after the recent rally. The Fed decision gave them that excuse.

Here’s the thing though. Rate cuts remain bullish for crypto long-term. They make holding cash less attractive and borrowing cheaper. That historically drives capital into speculative assets. So this selloff looks more like a breather than a trend reversal.

The total crypto market cap now sits at $3.71 trillion. It’s holding firm above the $3.67 trillion support level. That’s crucial. Break below that, and we could see a deeper correction to $3.60 trillion. But hold it, and we’re likely heading back toward $3.81 trillion.

Bitcoin Tests Critical Support at $110,000

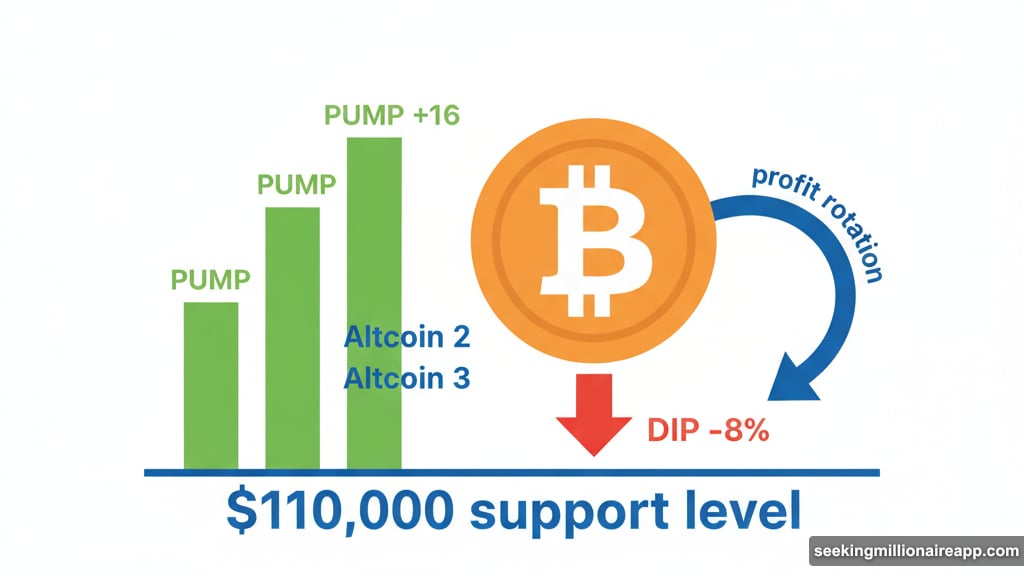

Bitcoin dropped to $110,773 in the last 24 hours. That put it right at the $110,000 psychological support level. This is make or break territory.

The Relative Strength Index (RSI) slipped below neutral. That signals bearish momentum is building. Not great news for bulls. If Bitcoin can’t bounce from here, the next stop is $108,000.

But there’s a flip side. The $110,000 level represents both technical support and a round number that traders watch obsessively. Those psychological levels often hold better than random price points. So a bounce seems equally likely.

If Bitcoin does recover, $112,500 is the first target. Breaking that opens the door to $115,000. That would completely erase this week’s losses and put bulls back in control.

My take? Watch how Bitcoin behaves over the next 48 hours. A decisive move above $112,000 means the bulls won. A drop below $109,000 means more pain is coming.

Altcoins Ignore Bitcoin’s Drama

Here’s where things get interesting. While Bitcoin stumbled, many altcoins actually posted gains. Pump.fun (PUMP) led the charge with a 16% surge.

That’s not normal behavior. Usually, altcoins follow Bitcoin down twice as hard. When they decouple and rise instead, it hints at something bigger brewing. Specifically, it suggests we might be entering altcoin season.

Altcoin season happens when smaller cryptocurrencies outperform Bitcoin for an extended period. It’s driven by investors rotating profits from Bitcoin into higher-risk, higher-reward tokens. The early signs are showing up now.

Pump.fun currently trades at $0.00534. It’s targeting resistance at $0.00563. Break that, and $0.00622 becomes realistic. However, short-term holders are selling into strength. If that selling pressure intensifies, PUMP could drop to $0.00460.

Solana also bucked the trend with a 9% gain. But long-term holders are taking profits aggressively. That creates conflicting signals. The price rises, but the smart money sells. Usually, the smart money wins eventually.

Big Money Keeps Moving Into Crypto

Despite the daily volatility, institutional adoption continues accelerating. Two major developments happened this week that barely made headlines but matter enormously.

First, Mastercard is reportedly close to acquiring crypto infrastructure firm Zerohash. The deal is valued between $1.5 billion and $2 billion. That would mark Mastercard’s biggest push into stablecoin settlement yet.

Why does this matter? Traditional payment giants like Mastercard don’t spend billions on crypto infrastructure unless they see massive future demand. This signals they expect stablecoin payments to become mainstream. Soon.

Second, Polygon Labs partnered with DeCard to enable USDT and USDC spending at over 150 million merchants globally. That’s real-world utility, not speculative trading. When you can spend your stablecoins at millions of stores, crypto stops being an experiment and becomes actual money.

These institutional moves won’t stop short-term volatility. But they’re building the foundation for long-term growth. The crypto market isn’t going away. It’s integrating into the traditional financial system piece by piece.

What Happens Next

Short-term, everything depends on Bitcoin holding $110,000. That’s the line in the sand. Hold it, and we likely rebound to $115,000 or higher. Break it, and $108,000 or lower becomes probable.

Medium-term, the Fed rate cut should prove bullish. Lower interest rates make crypto more attractive relative to savings accounts and bonds. That typically drives new capital into the market over weeks and months.

Long-term, institutional adoption continues regardless of daily price action. Companies like Mastercard spending billions to enter crypto tells you where this is headed. The infrastructure is being built for mass adoption.

My advice? Don’t panic over a $42 billion market cap drop when the total market is nearly $4 trillion. That’s roughly 1% volatility. Crypto markets regularly swing 5-10% in a day. This is actually pretty tame.

Focus on the bigger picture. Are you positioned for the next bull leg? Do you have exposure to both Bitcoin and promising altcoins? Are you taking profits on the way up, or just holding blindly?

The market will keep testing your patience. That’s literally its job. The question is whether you’ll let short-term noise shake you out of long-term positions. Most people do. Don’t be most people.