The crypto market just shed nearly $100 billion in 24 hours. Bitcoin dropped hard. Altcoins followed. Now everyone’s watching one number: $90,000.

What triggered this selloff? Profit-taking hit a tipping point. After weeks of climbing, investors decided to cash out. Plus, the entire market reached saturation levels that couldn’t sustain momentum. When Bitcoin stumbles, everything else tumbles harder.

Bitcoin Slides Below $91K Support

Bitcoin crashed to $90,949 in the latest trading session. That’s a brutal rejection from the $93,471 support level it tried to hold earlier this week.

Here’s the problem. BTC hasn’t tested $90,000 as actual support yet. So we’re entering uncharted territory for this price cycle. If sellers keep pushing, the next meaningful support sits at $89,241. That means another potential 2% drop from current levels.

Moreover, institutional investors appear to be stepping back. Recent data shows Bitcoin lost market share in 2025 as altcoins captured attention. However, when BTC falls, those same altcoins typically fall harder. The correlation remains brutal during downturns.

But there’s a recovery scenario. If Bitcoin reclaims $91,511 as support, bulls might regain control. Holding above this level would allow BTC to retest $93,471. That would invalidate the bearish thesis and restore confidence across the broader market.

Story Protocol Gets Crushed Below $2

IP took the worst beating of the day, dropping 7.7% to $1.97. The token couldn’t hold the psychologically important $2.00 level.

Now attention shifts to $1.87 support. That’s the last meaningful barrier before IP risks sliding to $1.71. So far, the token has avoided complete collapse thanks to relatively stable conditions across altcoins. Yet that stability feels fragile.

IP tried breaking above $2.02 multiple times in recent weeks. Each attempt failed. So even if buying interest returns, that resistance level presents a significant challenge. Reclaiming $2.02 would signal renewed strength and open the path toward $2.22.

Still, the pattern suggests IP struggles with momentum. Past failures at key resistance create skepticism among traders. Without a clear catalyst, recovery looks uncertain in the near term.

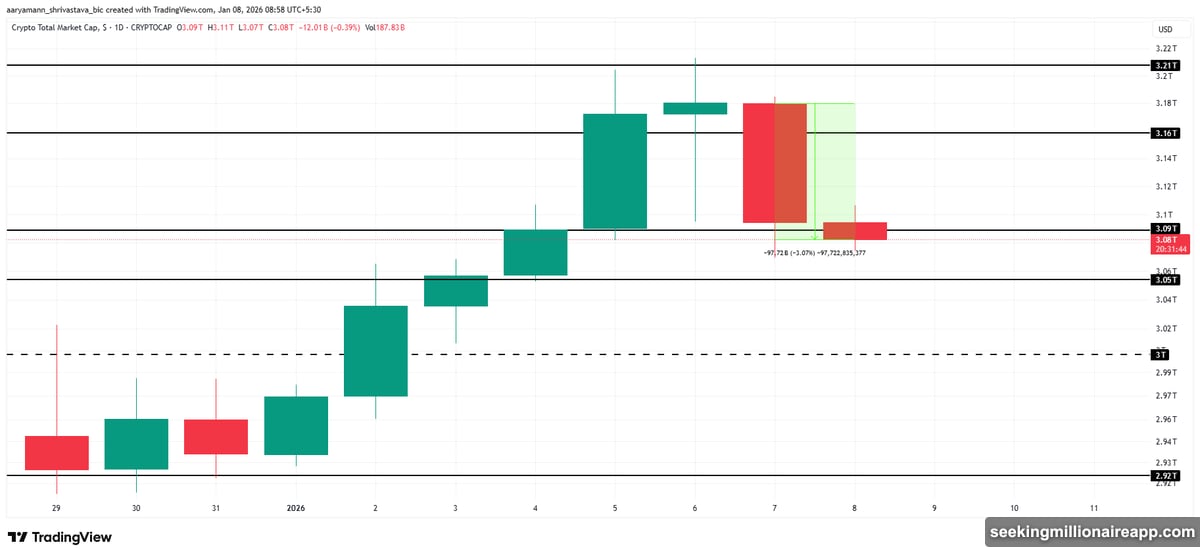

Total Market Cap Drops to $3.08 Trillion

The entire crypto market capitalization fell from $3.18 trillion to $3.08 trillion. That $97 billion evaporated as profit saturation finally caught up with recent gains.

This pullback wasn’t unexpected. Markets can’t climb indefinitely. After sustained upside momentum, selling pressure naturally increases. Traders who bought weeks ago decided now was the time to lock in gains.

Currently, TOTAL hovers near $3.09 trillion. But that level looks vulnerable. Under current conditions, a slide toward $3.05 trillion support appears increasingly likely. Breaking that floor would expose the market to deeper losses.

However, recovery remains possible if sentiment stabilizes. Reclaiming $3.09 trillion as firm support would restore confidence. Such a move could enable the market to rebound toward $3.16 trillion. But that requires selling pressure to ease and broader conditions to improve.

What’s Driving the Selloff

Three factors converged to trigger this downturn.

First, profit saturation reached critical levels. Investors who entered weeks ago watched their positions appreciate significantly. Many decided to book gains rather than risk giving them back. That creates downward pressure as sell orders pile up.

Second, institutional appetite cooled. Recent filings show growing interest in crypto products like spot Ethereum ETFs. Morgan Stanley and Bank of America expanded crypto access. Yet actual capital deployment appears to be slowing. Institutions talk about crypto more than they invest in it right now.

Third, regulatory uncertainty persists. Coinbase CEO Brian Armstrong recently defended yield-sharing stablecoin features while facing pressure from banking lobbies. Regulatory debates create hesitation among larger investors. When uncertainty rises, capital flows to safer assets.

Critical Levels to Watch

For Bitcoin, $90,000 represents the line in the sand. Breaking below this level would trigger stop-loss orders and potentially accelerate the decline. The next support after that sits at $89,241.

On the upside, BTC needs to reclaim $91,511. Holding above this price would suggest the worst is over. It would also allow traders to retest $93,471 with confidence.

For the broader market, $3.05 trillion is the key support level. Losing this zone would confirm deeper weakness. However, stabilizing above $3.09 trillion would indicate resilience and potential for recovery.

IP faces its own battle at $1.87. Holding this support is critical to avoid sliding toward $1.71. Reclaiming $2.02 would be the first sign of renewed strength.

The Bigger Picture

This selloff feels like a healthy correction after strong gains. Markets don’t move in straight lines. Pullbacks are normal and often necessary.

Yet the speed of this decline raises questions. Did too many investors leverage their positions? Are stop-losses creating a cascade effect? The answers will emerge over the next few days.

For now, patience matters more than panic. If you’re holding Bitcoin or altcoins, ask yourself: Did the fundamental thesis change? For most investors, the answer is no. This looks like profit-taking, not a fundamental shift.

Watch those critical support levels. They’ll tell you whether this is a minor correction or the start of something worse. Right now, the market is testing resolve. How it responds will determine what happens next.