The crypto market just shed $3 billion in 24 hours. But here’s the weird part: Bitcoin barely budged.

While most altcoins got hammered, BTC held firm above $95,000. That disconnect tells us something important about where money’s flowing right now. Plus, one altcoin completely collapsed after a failed rally attempt.

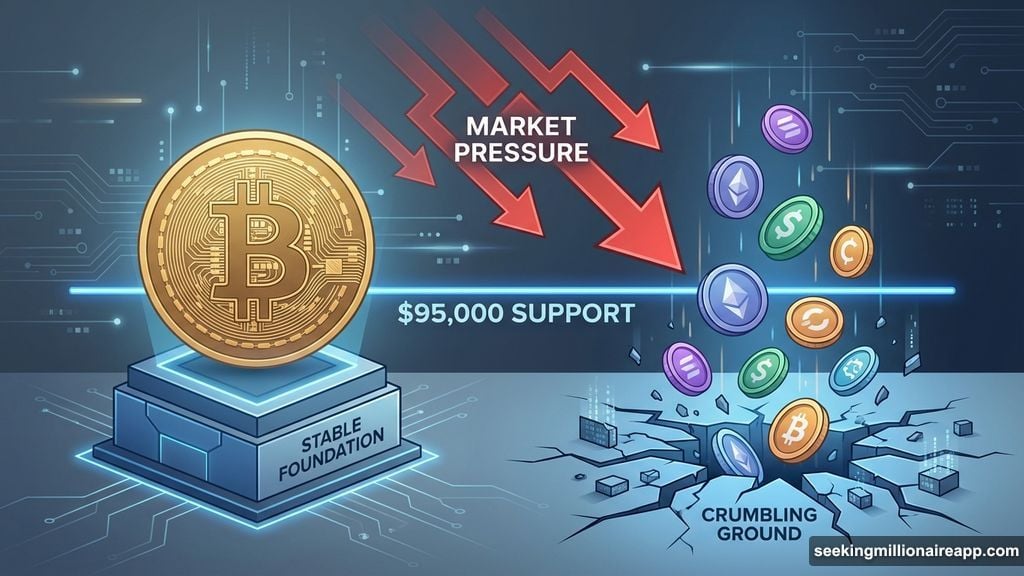

Bitcoin Refuses to Break Down

Bitcoin’s showing unusual strength during this pullback. Most traders expected BTC to follow the broader market lower. Instead, it’s defending $95,000 like a brick wall.

That resilience matters. When Bitcoin holds support during market weakness, it signals sustained institutional demand. Big players are still buying the dip. So even as retail traders panic sell altcoins, smart money keeps accumulating BTC.

The price action remains stuck between $95,000 and $98,000. Neither bulls nor bears can gain control. But the RSI indicator shows strengthening momentum on the upside. That could fuel another push toward $98,000 resistance soon.

However, risks remain. If short-term holders start taking profits, selling pressure could intensify. A break below $95,000 would expose Bitcoin to a drop toward $93,471. Losing that level would flip momentum bearish and invalidate the current bullish setup.

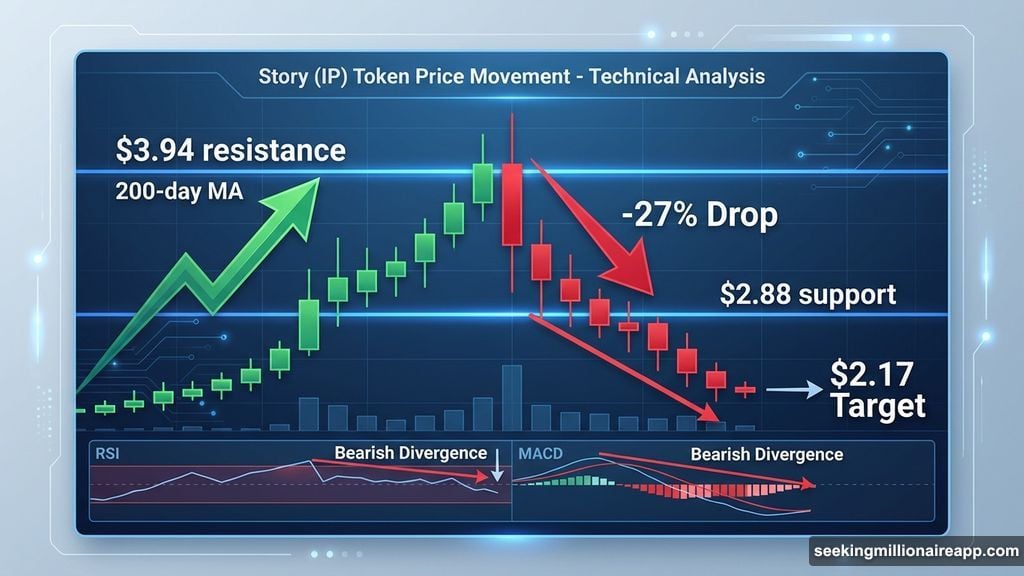

Story Token Crashes 27% After Failed Breakout

Story (IP) emerged as the day’s biggest loser, plunging 27% to just $2.88. The altcoin tried breaking above $3.94 resistance but got brutally rejected.

What caused the collapse? IP ran straight into the 200-day moving average, a major long-term resistance level. When price couldn’t break through, momentum evaporated fast. Traders who bought the rally rushed to exit, creating a cascade of selling.

Now IP trades below the critical $2.88 support. That exposes further downside risk toward $2.17. Falling beneath the 50-day moving average would seriously damage recovery prospects. The technical picture looks increasingly bearish for Story holders.

Still, a bounce remains possible. If selling pressure eases and holders stop dumping, IP could stabilize. Reclaiming $3.29 would signal renewed strength. A sustained move back toward $3.94 would restore the bullish structure completely. But that scenario requires buyers to step up aggressively.

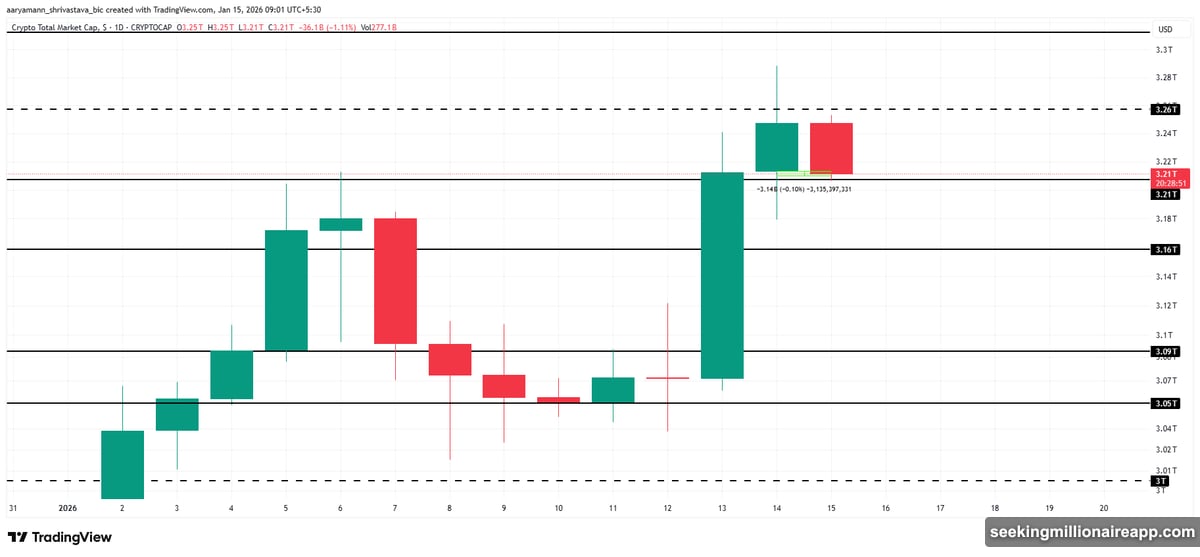

Market Cap Struggles Near $3.21 Trillion

The total crypto market cap sits at $3.21 trillion after losing $3 billion. That’s a modest pullback considering the sharp rally before it. Short-term traders booking profits drove most of the decline.

Despite the selling, the limited drawdown suggests the broader market structure remains intact. The $3.21 trillion level has emerged as immediate support. Buyers defended this zone multiple times recently. So it’s become a critical battleground for the next move.

Failure to break above $3.26 trillion resistance capped upside momentum. If selling continues, market cap could slip below $3.21 trillion and retest $3.16 trillion support. That would extend the current consolidation phase.

But recovery is definitely possible if buying interest returns. Holding above $3.21 trillion would restore investor confidence. Sustained support here could enable another upside attempt, limiting downside risk for the broader crypto market.

Altcoins Lead the Decline

While Bitcoin showed resilience, altcoins got crushed. That divergence reveals where the real weakness sits right now.

Profit-taking concentrated in smaller tokens as traders rotated back to Bitcoin. Many altcoins rallied aggressively before this pullback. So the correction makes sense from a technical perspective. Traders simply locked in gains after strong moves.

The altcoin sell-off also signals shifting risk appetite. When markets get uncertain, capital flows toward Bitcoin and stablecoins. Smaller tokens get hit hardest during these rotations. That pattern played out perfectly over the past 24 hours.

What Happens Next?

The crypto market sits at a crossroads. Bitcoin’s strength suggests bulls aren’t done yet. But altcoin weakness shows caution spreading through the market.

Key levels to watch: Bitcoin must hold $95,000 support. A break lower would intensify selling pressure across the board. For the total market cap, $3.21 trillion remains critical. Losing that support could trigger a deeper correction toward $3.16 trillion.

On the flip side, breaking above $98,000 (Bitcoin) and $3.26 trillion (market cap) would restore bullish momentum. Those breakouts would likely pull altcoins higher and reignite the rally.

The next few days matter. Price action during this consolidation will determine whether bulls can push higher or if bears take control. Watch those key support levels closely. They’ll tell you which scenario is unfolding.