Bitcoin barely held $95,000 support while the broader market lost billions. Weekend trading offered no relief.

The total crypto market cap dropped $8.8 billion in 24 hours. Now it’s hovering around $3.19 trillion, testing critical support that could determine where prices head next week. Meanwhile, privacy coins like Dash got hammered, falling 12% as traders fled risk.

Let’s break down what’s actually happening and what levels matter now.

Bitcoin Clings to $95,000 Support

BTC trades near $95,109 at press time. That puts it right on top of the key $95,000 support zone that’s anchored price action for days.

Bitcoin tried to break through resistance earlier this week. But it failed. So momentum stalled out, leaving traders waiting to see if bulls can defend current levels or if another leg down is coming.

Here’s the setup. If Bitcoin bounces from $95,000, it could push toward $98,000. That’s where strong resistance sits. Breaking above $98,000 would open the door to $100,000, assuming buying pressure actually shows up next week.

But if $95,000 breaks, things get ugly fast. The next support sits at $93,471. Below that, $91,298 comes into play. A drop to either level would signal that bears are taking control and the recent bullish thesis is dead.

Market Cap Tests Critical $3.18 Trillion Floor

The total crypto market cap sits just above $3.18 trillion. This level matters because it’s held as support multiple times recently.

Weekend trading stayed relatively quiet. No major sell-offs. No big rallies either. Just consolidation as traders wait for the week ahead.

If sentiment improves when markets open Monday, the market cap could bounce to $3.21 trillion. That would reclaim a key resistance level and restore some near-term confidence. Plus, it would suggest capital is flowing back into crypto assets.

However, a break below $3.18 trillion changes everything. That would confirm renewed selling pressure and likely drag the market cap toward $3.14 trillion or lower. Such a move would reflect broader risk aversion across crypto markets.

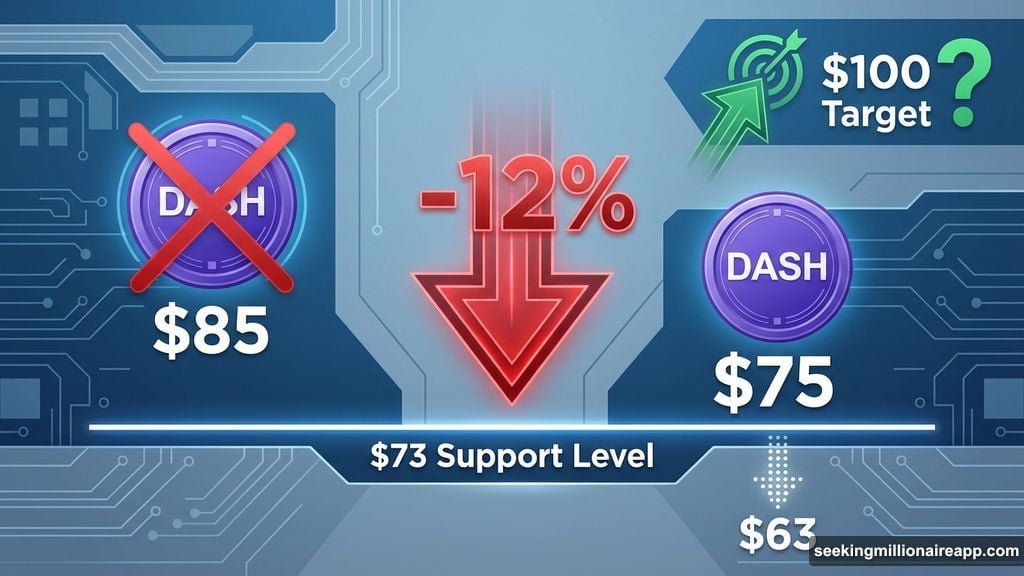

Dash Crashes 12% After Rejection at $85

Dash got crushed, falling to $75 after failing to break $85 resistance. The 12% drop in 24 hours ranks among the worst performances in the top altcoins.

Right now, DASH is defending $73 support. This level is critical. If it holds, price could stabilize and eventually attempt another run at $85. A successful break above $85 would target $100, restoring bullish momentum.

But if $73 breaks, expect a quick drop to $63. That would signal that short-term traders are exiting positions and buying pressure has dried up completely.

The privacy coin narrative still has support in crypto circles. But narratives don’t prevent drawdowns when capital flows turn negative. DASH needs fresh buyers to step in, or this correction continues.

Corporate Bitcoin Adoption Grows Despite Price Weakness

While prices struggled, Steak ‘n Shake announced a $10 million Bitcoin purchase. The fast-food chain is building a corporate crypto treasury, converting restaurant revenue into BTC as part of its “Bitcoin-to-Burger” strategy.

This follows similar moves by other companies building Bitcoin reserves. Corporate adoption continues expanding even during market weakness, suggesting long-term conviction remains strong despite short-term volatility.

Yet these purchases aren’t enough to move markets right now. Retail and institutional flows matter more for near-term price action. Corporate treasury moves support the bullish case over months and years, not days.

Solana CEO Pushes Back on ‘Ossification’ Vision

Anatoly Yakovenko, Solana’s CEO, rejected the idea that blockchains should eventually ossify and run without active developer influence. This directly challenges Ethereum co-founder Vitalik Buterin’s vision of Ethereum evolving into a self-sustaining protocol that no longer requires continuous updates.

Yakovenko argued that Solana must keep evolving to survive. In his view, static blockchains can’t adapt to changing user needs, competitive pressures, or technological breakthroughs.

This philosophical difference highlights competing visions for blockchain development. Ethereum aims for eventual stability. Solana prioritizes perpetual innovation. Neither approach is clearly superior, but each carries different trade-offs for users and developers.

What Happens Next Week

The setup is simple but critical. Bitcoin must hold $95,000 or risk a deeper correction. The broader market needs to stay above $3.18 trillion to avoid confirming a bearish trend.

For bulls, the path forward requires reclaiming $98,000 on Bitcoin and $3.21 trillion on the total market cap. Those moves would restore confidence and potentially spark a relief rally.

For bears, breaking support at $95,000 and $3.18 trillion opens the door to extended losses. If that happens, expect Bitcoin to test $93,471 and the market cap to slide toward $3.14 trillion.

Weekend consolidation set the stage. Now we wait to see which direction price breaks when volume returns.

Market conditions remain fragile. Both bulls and bears have clear levels to watch. Whichever side controls those levels next week will likely dictate short-term direction.