The crypto market just shed $48 billion in 24 hours. Bitcoin’s clinging to $95,000 by its fingernails. And Story token? Down 28% in a single day.

This isn’t your typical consolidation. Multiple pressure points hit simultaneously, triggering cascade selling across major assets. Let’s break down what’s actually happening and what comes next.

Bitcoin Loses Steam Above $95,000

Bitcoin trades around $95,583 right now. That sounds stable. But dig deeper and warning signs flash everywhere.

The Chaikin Money Flow just rolled over. This indicator tracks capital inflows and outflows. When it drops, fewer dollars chase Bitcoin. That creates selling pressure nobody wants to talk about.

Plus, BTC failed to crack $98,000 despite multiple attempts. Buyers exhausted themselves pushing toward six figures. Now they’re taking profits instead of adding positions.

Here’s the uncomfortable truth. If Bitcoin loses $95,000 support, the next stops are $93,471 and potentially $91,298. That’s 4-5% downside from current levels. Not catastrophic. But enough to shake out weak hands and trigger stop losses.

However, one scenario flips this bearish outlook. Should capital flows reverse before $95,000 breaks, Bitcoin could bounce hard. A clean reclaim of $98,000 would signal renewed strength and open the path back toward $100,000.

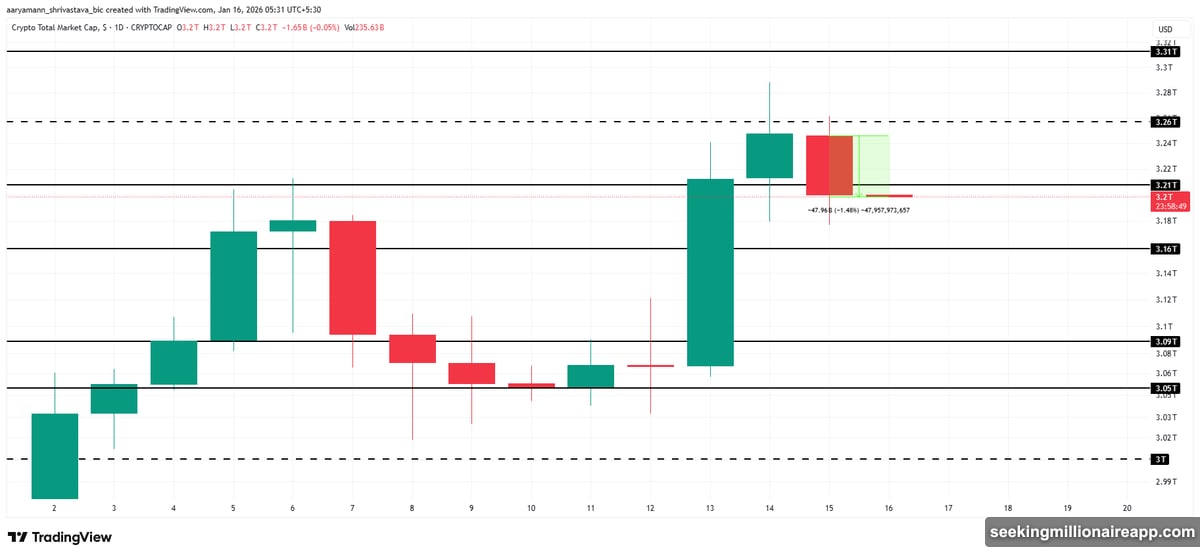

Total Market Cap Threatens Key Support

The total crypto market cap dropped to $3.20 trillion. That’s down from $3.26 trillion just yesterday.

Market exhaustion explains most of the decline. Recent rallies burned through available buying power. Now profit-taking dominates as traders lock in gains before deeper pullbacks arrive.

What happens next depends on one critical level: $3.16 trillion. This zone represents near-term support for the entire crypto market. Hold here and we get consolidation. Break below and accelerated selling follows.

Think about what $3.16 trillion breaking means. Every major altcoin loses support simultaneously. Bitcoin faces additional pressure. Risk appetite evaporates across the board. That’s when casual investors panic and smart money accumulates at lower prices.

But there’s an alternative path. If sentiment shifts quickly and buyers return, the market cap could stabilize. Recovery toward $3.26 trillion would restore confidence and signal the correction ended.

Story Token Collapses 28% in One Day

Story (IP) led today’s carnage with a brutal 28% drop. The altcoin now trades dangerously close to $2.50 support.

Why did IP crash so hard? Market-wide weakness amplified by thin liquidity and concentrated selling. When panic hits smaller altcoins, moves get exaggerated compared to Bitcoin.

The technical picture looks grim. Story risks breaking below its 50-day exponential moving average. That would confirm short-term bearish structure and open downside to $2.28, potentially $1.96.

Those aren’t random numbers. They represent volume clusters where previous buyers entered positions. Break through $2.50 and those buyers face losses, creating additional selling pressure as stops trigger.

Yet even here, reversal remains possible. A decisive bounce from $2.50 could push IP back toward $2.90. Reclaiming $3.29 would negate the bearish thesis entirely. But that requires sustained buying volume we’re not seeing yet.

Market Drama Gets Weird

Two bizarre stories emerged today that might explain some selling pressure.

First, Polymarket faces scrutiny after a wallet turned $30,000 into $400,000 betting on Venezuela’s Maduro being removed just before it happened. Now that same wallet bet on Iran’s Supreme Leader getting ousted. Suspicious timing raises insider trading concerns.

Second, former New York City Mayor Eric Adams launched an NYC token. Within hours, thousands bought in. Less than 24 hours later, over half sat underwater as the token collapsed. Rug pull accusations flew immediately.

These stories matter because they erode trust. When high-profile figures launch obvious cash grabs or suspicious betting patterns emerge, retail investors get spooked. That translates to reduced risk appetite across all crypto markets.

Three Scenarios From Here

Bearish case: Bitcoin breaks $95,000, triggering cascade selling to $91,298. Total market cap crashes through $3.16 trillion. Story token hits $1.96. This outcome occurs if current weakness persists and no buying support materializes.

Neutral case: Markets consolidate in current ranges for days or weeks. Bitcoin holds $95,000 but can’t reclaim $98,000. Total market cap bounces between $3.16-3.26 trillion. Story stabilizes around $2.50. Requires balanced buying and selling with no clear victor.

Bullish case: Capital flows reverse sharply. Bitcoin reclaims $98,000 and pushes toward $100,000. Market cap recovers to $3.26 trillion and beyond. Story bounces decisively from $2.50 back to $3.29. This needs renewed risk appetite and sustained inflows.

Which scenario plays out depends entirely on what happens in the next 48-72 hours.

What Smart Money Does Now

The obvious move is waiting. Market structure remains fragile. Chasing rallies in this environment burns capital quickly.

Instead, watch those key levels obsessively. Bitcoin at $95,000. Total market cap at $3.16 trillion. Story at $2.50. Clear breaks below these zones signal deeper corrections ahead. Decisive holds suggest bottoms forming.

For aggressive traders, this volatility creates opportunity. Selling rallies and buying dips works in range-bound markets. But position sizing matters more than usual. When volatility spikes, smaller positions protect capital while maintaining exposure.

Long-term holders face simpler decisions. If your thesis hasn’t changed, short-term price action shouldn’t matter. Bitcoin’s fundamentals didn’t deteriorate overnight. The market just needed to breathe after recent gains.

But here’s what bothers me most. These coordinated selloffs often precede either major breakouts or deeper corrections. We’re at an inflection point where the next move determines the next several weeks of price action.

Choose your positions carefully. Set clear invalidation points. And don’t let emotion override strategy when everyone’s panicking or celebrating.