The crypto market just posted its first real rebound in two weeks. After bleeding value for days, the total market cap climbed $75 billion in 24 hours.

Bitcoin held a crucial support level while altcoins showed signs of life. Axie Infinity led the charge with a 27% surge. But the question everyone’s asking is simple: will this bounce stick, or are we headed back down?

Let’s break down what actually moved the needle and where things might go from here.

Selling Pressure Finally Ran Out of Steam

The crypto market cap hit $2.96 trillion after weeks of grinding lower. That’s not just a number on a chart. It’s the first time in 14 days that buyers actually showed up with enough force to push prices higher.

What changed? Selling pressure exhausted itself. Markets can only fall so far before the sellers run out. When that happens, even modest buying interest can trigger sharp rebounds.

This time, the bounce came after multiple failed attempts to push lower. Traders who were waiting on the sidelines saw the weakness and started entering positions. That early buying sparked additional momentum, creating a self-reinforcing rally across major cryptocurrencies.

However, rebounds like this need follow-through. Without sustained buying, early gains evaporate fast. So far, the bounce looks legitimate based on volume patterns and price action. But confirmation only comes if the market holds these levels over the next few days.

Bitcoin’s $87,000 Floor Held Strong

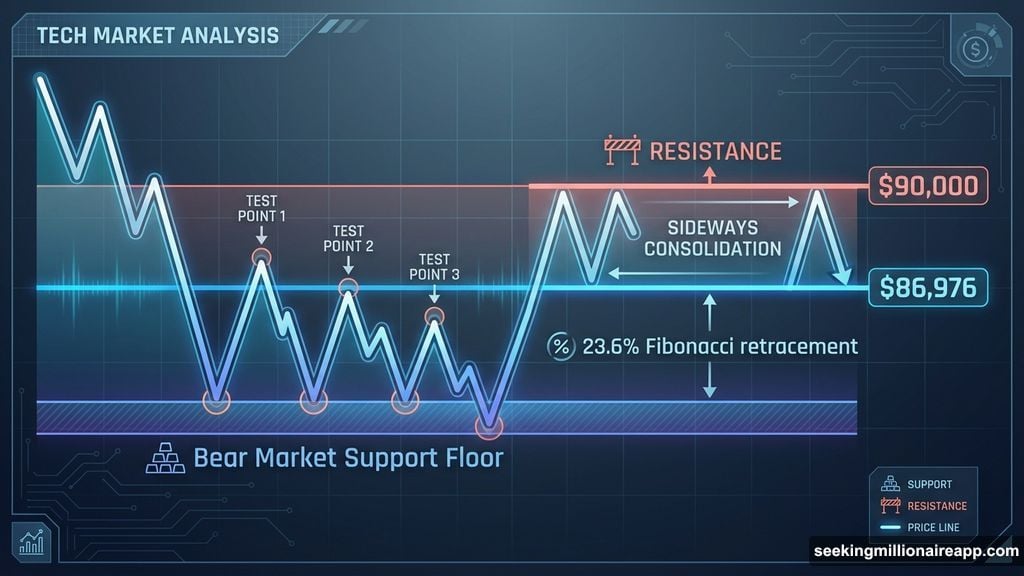

Bitcoin sits near $88,630 right now. That’s just above the 23.6% Fibonacci retracement level at $86,976. Technical traders watch these levels closely because they often act as make-or-break zones during volatile periods.

The $86,976 level represents what many consider a bear market support floor. Bitcoin tested this zone multiple times over the past week. Each time, buyers defended it. That defense prevented a deeper crash and kept the door open for recovery.

Plus, defending this support matters beyond just price action. It preserves market structure. Break below it, and Bitcoin could easily slide to $84,694 or lower. That would trigger stop losses and force more selling.

For now, Bitcoin is consolidating. The price lacks strong momentum in either direction. Buyers aren’t pushing aggressively toward $90,000. Sellers aren’t forcing new lows either. This stalemate suggests both sides are waiting for clearer signals before committing capital.

Meanwhile, the $90,000 resistance looms overhead. Breaking through requires genuine buying pressure, not just short covering. If Bitcoin can reclaim that level and hold it, the market structure improves dramatically. Until then, expect choppy sideways trading.

Axie Infinity Outperformed Everything

Axie Infinity jumped to $2.60, delivering a 27% gain while most of the market struggled. That’s the kind of move that catches attention and draws in momentum traders looking for quick profits.

AXS now faces resistance at $2.92. Bulls need to break through this level to maintain the rally. So far, momentum looks solid. Volume supports the move, suggesting real buying interest rather than just a short squeeze or technical bounce.

Yet resistance zones like $2.92 often trigger profit taking. Traders who bought lower start locking in gains. That selling pressure can stall rallies temporarily. If AXS consolidates here without breaking resistance, it signals healthy price action. Sharp rejections would raise concerns about momentum fading.

Looking higher, the next target sits at $3.40. Reaching that level requires sustained demand and broader market support. If Bitcoin stabilizes and the overall crypto market holds gains, AXS could push toward $3.40 over the coming weeks.

But there’s downside risk too. Failure to reclaim $2.92 would weaken the bullish case. Under that scenario, AXS might retrace gains and delay any move higher. Momentum stocks like this can reverse just as quickly as they rally.

Banking Problems Still Plague Crypto

While prices rebounded, structural problems persist. A UK survey revealed that major banks block or delay about 40% of payments to crypto exchanges. That’s a massive barrier to entry for retail investors.

Banks cite regulatory concerns and money laundering risks. Fair enough. But the effect is clear: fewer people can easily buy crypto. That limits market growth and creates friction that traditional finance doesn’t face.

This banking hostility hits crypto exchanges hard. Payment failures are rising, making the UK one of the toughest markets globally for crypto banking access. Other regions face similar challenges, though perhaps not as severe.

Moreover, regulatory uncertainty keeps banks cautious. Without clear rules, they’d rather block crypto transactions than risk regulatory penalties. Until governments provide clearer frameworks, this banking friction will continue limiting crypto adoption.

The irony? Crypto was supposed to eliminate reliance on traditional banks. Instead, most people still need bank accounts to enter the crypto market. That dependency gives banks significant power to restrict access.

What’s Next for the Market

The $3.00 trillion market cap level sits just ahead. Breaking through would flip this psychological barrier into support. That’s the kind of technical event that often attracts additional buying interest.

If confirmed, the broader crypto market could extend gains toward $3.05 trillion. That would reflect renewed confidence from both retail and institutional investors. Volume patterns would need to support the move for it to hold.

But recovery remains fragile. If follow-through weakens, profit taking could quickly erase recent gains. Under that scenario, the total market cap might retreat toward $2.92 trillion or lower.

Bitcoin’s role is critical here. As the dominant cryptocurrency, its price action sets the tone for everything else. If Bitcoin can’t sustain momentum above $88,000 and push toward $90,000, altcoins will struggle to maintain their rallies.

Altcoin performance also matters. Strong gains in projects like Axie Infinity suggest risk appetite is returning. That’s healthy for the overall market. But isolated rallies don’t guarantee broad-based recovery.

The Bigger Picture

This bounce feels different from recent failed attempts. Selling exhaustion is real. Support levels held. Buying interest increased. Those are positive signs.

Yet caution remains warranted. Banking restrictions limit new money entering the market. Regulatory uncertainty keeps institutions hesitant. Macro conditions remain challenging with interest rates elevated.

So treat this rebound as a possible turning point, not a confirmed trend change. Watch how Bitcoin handles the $90,000 resistance. Monitor whether altcoin rallies broaden beyond isolated performers. Pay attention to volume and whether buying pressure sustains.

Markets rarely move in straight lines. Even strong rebounds face tests and pullbacks. The question isn’t whether crypto can rally. It’s whether this rally has the foundation to build something more durable.

Right now, the evidence points to stabilization rather than a new bull run. That’s progress after weeks of decline. But the next few days will determine whether buyers can actually follow through or if sellers will regain control.