Bitcoin broke $90,000 on Saturday. The total crypto market added $48 billion in 24 hours. Plus, meme coins like BONK surged 22%.

What drove this sudden strength? Three distinct factors converged. Let’s break down why crypto bulls finally caught a break after weeks of consolidation.

Bitcoin ETFs Sparked The Rally

Money flooded back into Bitcoin ETFs on Friday. Spot Bitcoin funds recorded $471 million in inflows on the first trading day of 2026.

That’s massive institutional demand. Moreover, it reversed weeks of cautious positioning. Funds that sat idle during the holidays are now flowing back into crypto exposure.

These inflows provided crucial support at key technical levels. When Bitcoin approached $90,000, ETF buying absorbed selling pressure. So price broke through resistance instead of stalling like previous attempts.

Institutions clearly view current prices as attractive entry points. Their conviction matters because it signals sustained demand beyond retail speculation.

Technical Breakout Confirmed Bullish Structure

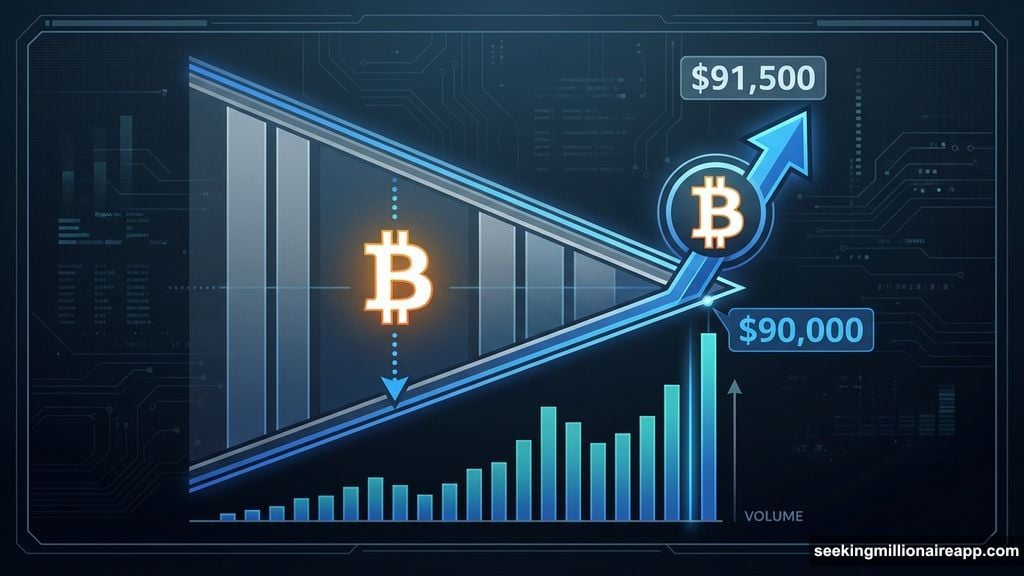

Bitcoin completed a six-week descending wedge pattern. This formation typically resolves upward when price breaks above the upper trendline.

The breakout happened cleanly above $90,000. Volume surged alongside price, confirming genuine buying interest rather than a false breakout. Now Bitcoin trades near $91,500 with eyes on $92,031 resistance.

Technical traders piled in once the pattern confirmed. Stop losses from short positions added fuel to the move. Momentum indicators like RSI pushed into bullish territory, attracting trend-following algorithms.

If Bitcoin holds above $90,979 support, the next target sits at $95,000. That’s based on measuring the wedge height and projecting from the breakout point.

However, failure to maintain support would invalidate the pattern. In that case, expect a retreat toward $90,000 or lower.

Improving Risk Appetite Lifted All Boats

The broader crypto market benefited from renewed risk-on sentiment. Total market cap reached $3.08 trillion, just below the $3.09 trillion resistance level.

Global markets showed strength Friday. Traditional risk assets like equities rallied, creating a positive backdrop for crypto. When macro conditions improve, capital flows into higher-risk, higher-reward investments.

Altcoins participated strongly in the rally. BONK led gainers with a 22% jump to $0.00001140. The meme coin sector benefited from post-holiday liquidity returning to speculative corners of the market.

This broad-based participation suggests genuine strength. When only Bitcoin rallies, it often signals defensive positioning. But when altcoins surge alongside BTC, it indicates aggressive risk-taking across the crypto spectrum.

Political Risk Could Derail Momentum

One wildcard threatens this rally. The US conducted military action in Venezuela over the weekend. Global markets haven’t fully digested this geopolitical development.

Monday’s traditional market open will reveal investor reaction. A negative response would pressure risk assets broadly. Crypto markets would face spillover effects as ETFs record outflows.

Such conditions could drag total market cap below $3.05 trillion. That would expose the market to deeper pullback toward $3.00 trillion support.

Conversely, if markets shrug off the news, crypto could extend gains. Breaking above $3.09 trillion would open the path toward $3.16 trillion.

The next 24-48 hours are critical. Crypto needs traditional markets to hold steady or rally. Any sharp equity selloff would almost certainly reverse Friday’s crypto gains.

Meme Coins Flash Overbought Warnings

BONK’s explosive rally pushed its RSI above 70. This overbought reading suggests profit-taking could start soon.

Meme coins tend to overshoot in both directions. The 22% gain happened fast, driven by FOMO and short squeeze dynamics. But these moves rarely sustain without consolidation.

If BONK slides below $0.00001103 support, the bullish case weakens. Traders should watch for volume on any pullback. Declining volume suggests temporary profit-taking. Heavy volume indicates genuine distribution.

The broader meme sector shows similar heat. When speculative corners get this hot this fast, corrections typically follow within days.

Smart traders are taking profits on strength rather than chasing. The risk-reward at current levels favors waiting for pullbacks.

Watch These Levels This Week

Bitcoin needs to hold $90,979 to validate the breakout. Loss of this support invalidates the bullish wedge pattern and suggests more consolidation.

Total market cap faces resistance at $3.09 trillion. Clean break above this level would confirm continuation toward $3.16 trillion.

For altcoins, watch how they perform if Bitcoin pulls back. Strong altcoins should hold support even when BTC dips. Weak ones will crash back to recent lows.

The real test comes Monday when traditional markets react to weekend news. Crypto’s fate depends heavily on whether risk appetite persists or collapses.