Bitcoin broke a six-week ceiling. Altcoins surged across the board. And the total crypto market added nearly $90 billion in value over 24 hours.

What changed? Policy signals from an unexpected source triggered the rally. Plus, specific technical breakouts gave traders confidence to push prices higher. Let’s break down the catalysts driving today’s crypto gains.

Japan Suddenly Endorsed Crypto

Japan’s finance minister made waves by publicly endorsing cryptocurrency as an inflation hedge. That’s a big deal coming from a G7 economy.

The minister went further. He declared 2026 as Japan’s “Digital Year.” These weren’t casual remarks. They represented official policy direction from one of the world’s largest economies.

Markets responded immediately. Capital flowed back into crypto assets within hours of the announcement. Investor confidence improved as institutional buyers interpreted the comments as regulatory clarity and government acceptance.

Here’s why this matters more than typical announcements. Japan’s endorsement signals a shift in how major economies view crypto. Instead of treating digital assets as speculative tools, a developed nation just validated them as legitimate inflation protection. That changes the conversation entirely.

Bitcoin Cleared Key Resistance

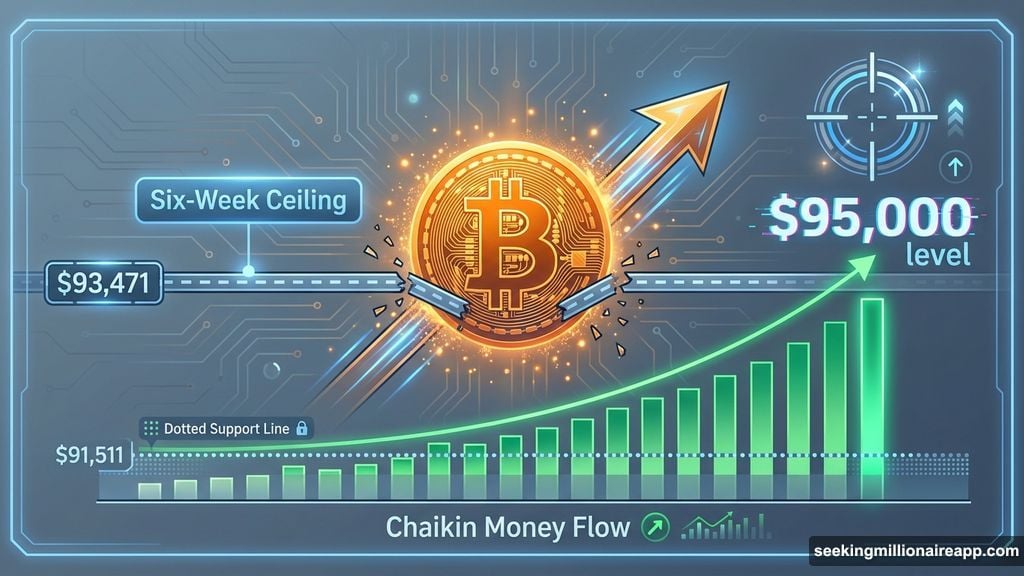

Bitcoin climbed over 2.5% to trade near $93,875. More importantly, it broke above $93,471 for the first time in six weeks.

That price level acted as a ceiling since late November. Multiple attempts to break through failed. But this time, BTC closed decisively above that barrier. Technical traders call this a confirmed breakout.

Now Bitcoin targets the psychological $95,000 mark. A move above that level would likely pull in additional buyers who’ve waited on the sidelines. The Chaikin Money Flow indicator shows capital actively flowing into BTC, confirming genuine buying interest rather than short squeezes.

However, risks remain. If early buyers take profits, BTC could slip back below $93,471. That would turn the former resistance into new support. A failure to hold would likely push prices toward $91,511, pausing the current rally.

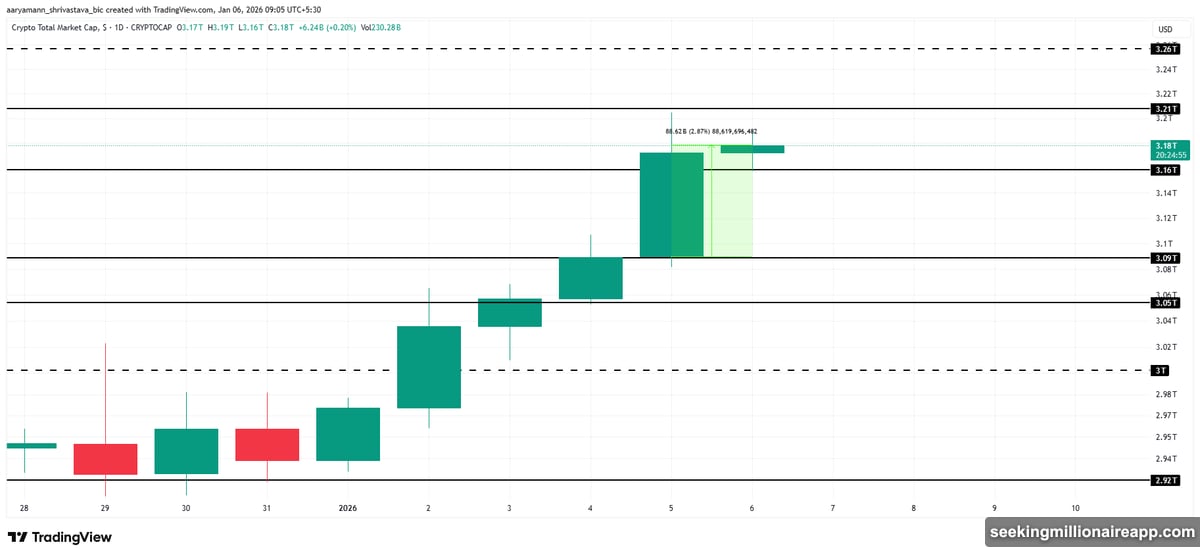

Total Market Cap Hit $3.18 Trillion

The entire crypto market gained $88 billion in market capitalization. Total market cap now sits at $3.18 trillion after breaking above the $3.16 trillion level that held prices down for weeks.

This wasn’t just Bitcoin. Altcoins contributed heavily to the gains. Broad-based momentum suggests investors are spreading capital across multiple assets rather than concentrating in BTC alone.

Yet the rally remains fragile. The $3.16 trillion level now serves as support. If profit-taking accelerates, losing this floor would likely trigger a retreat toward $3.09 trillion. Macro uncertainty could easily reverse current momentum.

Sui Emerged as Top Performer

Sui surged nearly 15% over 24 hours, making it the day’s best-performing major altcoin. SUI trades near $1.94, its highest price in almost two months.

The token now faces resistance at $1.96. A breakout would bring the $2.00 psychological level into reach. Capital inflows are strengthening, with the Chaikin Money Flow indicator moving firmly above zero. That confirms money is actively entering the token rather than just circulating among traders.

Still, momentum can reverse quickly in crypto. If capital inflows weaken, SUI could retreat to the $1.75 support level. That would invalidate the current bullish setup and shift focus to downside protection.

Other Market Catalysts Worth Noting

Bitmine Immersion Technologies disclosed holding 4.14 million ETH worth roughly $13.2 billion. That represents 3.43% of Ethereum’s total supply. Of that amount, 779,000 ETH is actively staked and generating yield.

Large holders making their positions public often impacts market psychology. Traders interpret substantial holdings as confidence signals, particularly when entities stake tokens for long-term yield rather than keeping them liquid for quick sales.

Meanwhile, a Polymarket trader earned hundreds of thousands by correctly betting on Nicolás Maduro’s capture ahead of public reports. The timing raised insider trading concerns. Blockchain analysis suggested possible links to wallets tied to a US envoy, though no definitive proof emerged.

Such incidents highlight ongoing challenges with prediction markets. While they often provide accurate signals, questions about information asymmetry and potential manipulation continue to dog the sector.

The Rally’s Durability Remains Uncertain

Short-term momentum looks strong. Bitcoin cleared resistance. Altcoins rallied. And Japan’s policy endorsement provided fundamental support beyond pure technical trading.

But crypto markets reverse quickly. The current rally depends on sustained capital inflows and stable macro conditions. If either weakens, prices could retrace recent gains within days.

What happens next likely depends on whether additional institutional capital enters the market. Japan’s endorsement may encourage other nations to clarify their crypto positions. That could extend the rally. Or profit-taking could emerge, triggering a pullback that tests recently broken resistance levels as new support.

For now, momentum favors buyers. Whether that lasts beyond this week remains an open question. Watch the $93,471 level for Bitcoin and $3.16 trillion for total market cap. Those are the lines that will determine if this rally has legs or runs out of steam.