The crypto market woke up Tuesday with unexpected momentum. Total market cap climbed past $2.93 trillion, and Canton token jumped 18.6% in 24 hours.

Why now? Three factors aligned to spark buying interest. Bitcoin held support levels that matter. Altcoins followed the momentum upward. And Canton specifically broke through technical barriers that traders watch closely.

But here’s the catch. This bounce sits at a critical inflection point. Markets can either build on this strength or lose it entirely within days.

Bitcoin Holds the Line at $88K

Bitcoin trades near $87,816 right now. That might not sound exciting, but it’s actually significant.

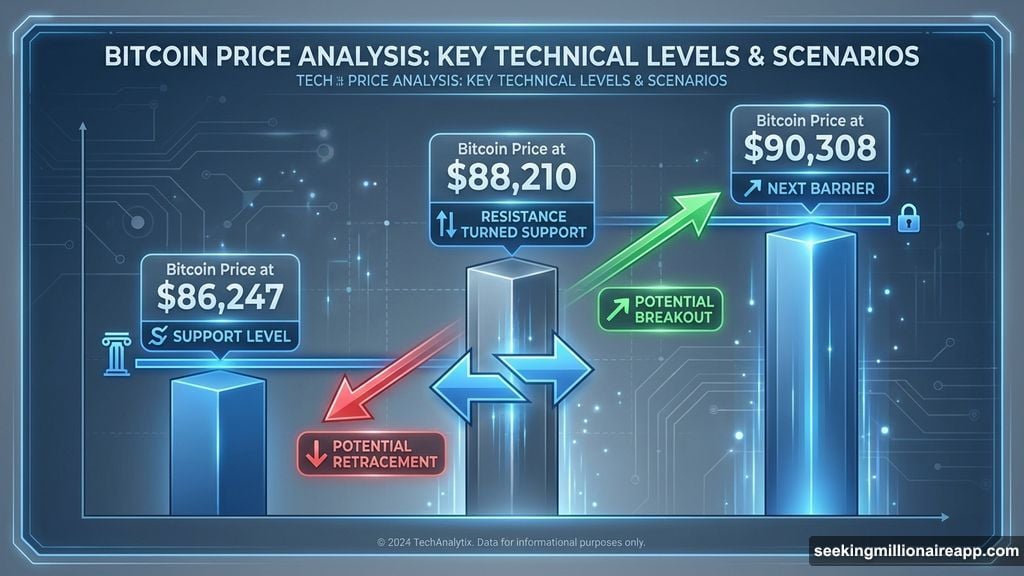

The $88,210 level acted as resistance earlier this month. Bitcoin couldn’t break through. So when price holds above that same level now, it signals strength. Markets turned resistance into support.

However, Bitcoin still faces pressure. To confirm this rally has legs, BTC needs to reclaim $90,308. That’s the next meaningful barrier. Breaking above it would inject real confidence into markets.

On the flip side, weakness lurks below. If Bitcoin slips under $88,210, traders will eye $86,247 next. Losing both support zones could trigger fresh selling pressure across the entire market.

Total Market Cap Tests Critical Threshold

The total crypto market capitalization sits at $2.93 trillion after adding $4.7 billion in 24 hours. Small gains, but they matter here.

For sustained recovery, markets need to reclaim $3.00 trillion. That’s not just a round number. It’s a psychological level that influences how investors think about risk.

Above $3.00 trillion, confidence tends to strengthen. New capital flows in. Projects get attention. Trading volume increases. Plus, holding above this level historically signals bullish momentum can continue.

Below it? Different story. If markets drop through $2.92 trillion support, the next stop is probably $2.85 trillion. That would mark a 2.7% decline from current levels and likely dampen the optimistic sentiment emerging today.

Canton Token Breaks Out

Canton (CC) led Tuesday’s gainers with an 18.6% surge to $0.107. The token now trades just below key resistance at $0.109.

Why Canton specifically? Technical factors converged. The token built a base of support, accumulated volume, and then pushed through overhead supply. Plus, broader market strength gave altcoins room to run.

If CC breaks above $0.109 with conviction, traders will target $0.118 next. That represents another 10% upside from current levels. Momentum indicators suggest buyers remain active, which could fuel additional gains.

But risks remain obvious. Losing $0.101 support would shift the short-term outlook bearish. A confirmed breakdown could send CC tumbling toward $0.089. That’s a 17% drop from current prices and would wipe out this week’s gains completely.

Market Structure Shows Mixed Signals

While Canton surges and Bitcoin holds support, the overall market structure tells a more nuanced story. Gains remain fragile.

Total market cap sits just $70 billion below the $3.00 trillion threshold. That’s close. But it’s also the same level that’s capped rallies multiple times since early December. Markets repeatedly failed to break through.

So this time could differ. Or it could repeat the same pattern. Without decisive volume and follow-through, these gains evaporate quickly.

Meanwhile, Bitcoin’s position above former resistance is constructive. Yet $90,308 looms as the real test. Until BTC clears that hurdle, skepticism remains justified about whether this rally can sustain itself.

Exchange Activity Hints at Caution

Tuesday’s price action occurred on moderate volume. Not weak, but not explosive either. That matters because sustainable rallies typically need expanding participation.

Right now, the gains look more like short-term traders taking positions rather than institutional money flooding back in. Both Canton’s surge and Bitcoin’s bounce could reverse without stronger conviction from larger players.

Plus, regulatory news remains quiet. No major positive catalysts emerged to justify today’s strength beyond technical factors. Markets are reacting to price levels and chart patterns, not fundamental developments.

That makes this rally more vulnerable to sudden reversals. One negative headline or failed breakout could trigger profit-taking that erases these gains within hours.

Three Scenarios Play Out From Here

Markets face three distinct paths over the next few days.

Best case: Bitcoin breaks through $90,308 and holds. Total market cap pushes above $3.00 trillion. Canton maintains momentum above $0.109. This scenario would confirm a genuine shift in sentiment and likely attract new buyers.

Base case: Markets consolidate near current levels. Bitcoin trades between $88,210 and $90,308. Canton bounces around $0.107. Total market cap hovers just below $3.00 trillion. This outcome suggests indecision, with neither bulls nor bears in full control.

Worst case: Bitcoin loses $88,210 support. Total market cap drops below $2.92 trillion. Canton falls back under $0.101. This would signal the rally failed and downside pressure resumes quickly.

What Traders Should Watch

Several factors will determine which scenario unfolds.

First, Bitcoin’s behavior at $90,308 resistance matters most. A clean break above with volume confirms strength. A rejection could trigger selling across altcoins.

Second, total market cap’s interaction with $3.00 trillion reveals whether this rally has institutional support. Reclaiming that level would be significant. Failing to reach it suggests retail-driven momentum that fades easily.

Third, Canton’s price action at $0.109 provides clues about altcoin strength. If CC breaks through, other mid-cap tokens might follow. If it stalls, expect profit-taking across speculative positions.

Fourth, watch for regulatory news or macro developments. Crypto remains sensitive to external factors. Any significant headlines could override technical patterns completely.

The Bigger Picture Remains Uncertain

Tuesday’s gains feel good after weeks of downward pressure. Canton’s 18% surge catches attention. Bitcoin holding support above $88,210 offers hope.

But context matters. Markets remain 7% below the December highs. Bitcoin trades 15% under its all-time peak. Most altcoins are down 30-50% from their recent tops.

So while today’s bounce is welcome, it’s too early to call a bottom or declare a new bull phase. Markets need sustained follow-through, not just one day of strength.

For now, cautious optimism makes sense. Watch the key levels. Monitor volume. Pay attention to how Bitcoin handles resistance. And don’t assume this rally continues without confirmation.

The next few days will reveal whether December 25th marked a turning point or just another temporary bounce in an ongoing correction.