The crypto market just added $211 billion in 24 hours. After 12 days of brutal losses, Bitcoin finally broke above key resistance levels. This sparked a relief rally across digital assets.

Bitcoin now trades near $69,972. It’s testing $70,000 support for the first time since the recent sell-off. Meanwhile, XDC Network surged 23% to lead altcoin gains. Markets are cautiously optimistic heading into the weekend.

Let’s break down what drove this recovery and whether it can hold.

What Sparked the Rally

Multiple factors aligned to trigger Friday’s rebound. Market sentiment improved as selling pressure eased. Bitcoin’s bounce from the $65,000 zone attracted fresh buyers. Plus, altcoins followed suit once BTC stabilized above key levels.

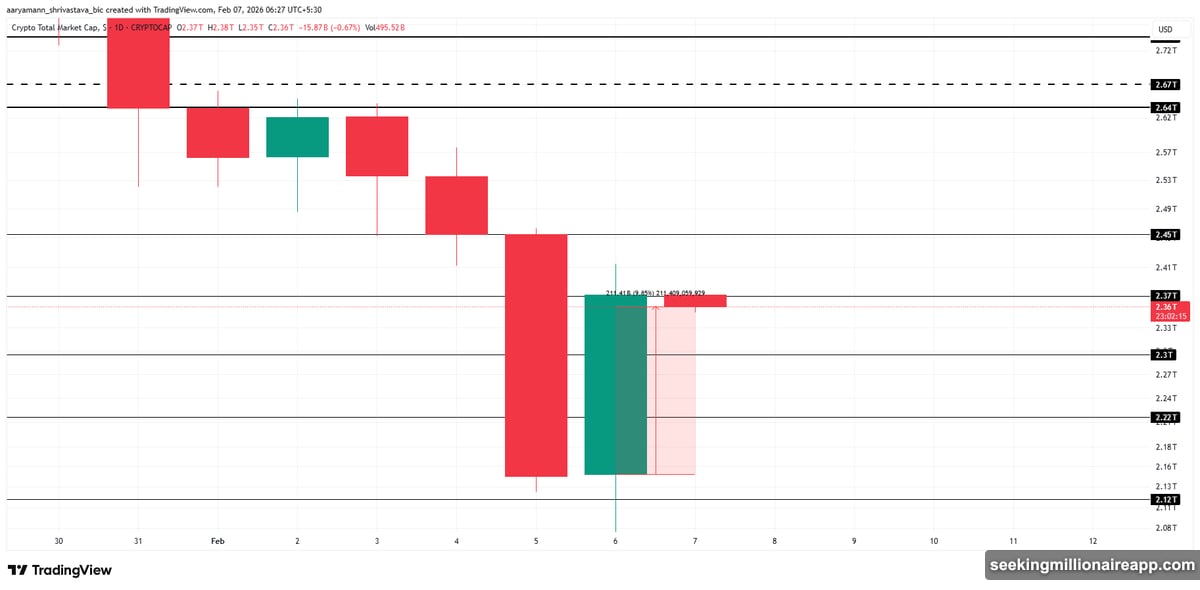

The total crypto market cap now sits at $2.36 trillion. That’s just below the critical $2.37 trillion resistance. Flipping this level into support would confirm strengthening momentum. So far, bulls are pushing hard to reclaim lost ground.

Technical indicators show improving conditions. Oversold readings from earlier in the week reversed sharply. Volume picked up as buyers stepped in. This combination suggests more than just a dead cat bounce.

Bitcoin’s Path Forward

Bitcoin needs to secure $70,000 as support. That’s the immediate test facing bulls right now. A successful flip would mark early recovery stages and restore buyer confidence.

The next target sits at $75,000. Breaking through would confirm improving momentum. Beyond that, Bitcoin could realistically test $80,000 if buying pressure persists. However, each level will face resistance from traders who bought higher and want to exit.

Failure carries consequences. If Bitcoin can’t hold $70,000, it risks sliding back toward $65,000 or lower. That would invalidate the bullish thesis. Worse, it could trigger another wave of panic selling and prolong market uncertainty.

XDC Network Leads Altcoin Surge

XDC jumped 23% to trade near $0.0370. That makes it Friday’s top performer among major altcoins. The rally reflects renewed buying interest after weeks of consolidation.

Now XDC targets $0.0413. But first, it must clear $0.0392 resistance. Rising inflows and sustained investor participation could provide the catalyst. A decisive breakthrough would validate bullish continuation and strengthen recovery prospects.

Downside risk remains present. Losing $0.0370 support would push XDC back toward $0.0345. Breaking below that exposes price to a deeper pullback near $0.0299. So holding current levels is critical for maintaining momentum.

Market Context Matters

Remember, this recovery follows a sharp Thursday sell-off. Bitcoin briefly approached $60,000 during that dip. The speed of the collapse rattled investors and tested their conviction.

Metaplanet’s CEO Simon Gerovich acknowledged shareholder pain during the volatility. His firm tracks Bitcoin closely. The company reaffirmed its long-term strategy despite short-term price swings. That kind of institutional commitment helps stabilize sentiment during rough patches.

Meanwhile, Vitalik Buterin donated to Shielded Labs for Zcash development. This signals continued innovation despite market turbulence. Privacy-focused projects like Zcash benefit from such high-profile support. It reminds traders that crypto development continues regardless of price action.

Weekend Test Ahead

Closing the week in positive territory matters. It would improve sentiment heading into the weekend. Bitcoin historically shows lower volume on Saturdays and Sundays. So holding gains now sets up better conditions for next week.

The total market cap hovers near $2.36 trillion. Bulls need to push above $2.37 trillion and hold it. That would confirm the relief rally has legs. From there, targeting $2.45 trillion becomes realistic.

But fragile investor sentiment could derail progress. Any negative news over the weekend might trigger profit-taking. Traders who bought the dip may exit quickly if momentum fades. So the next 48 hours will test market conviction.

What This Means for You

Don’t get too excited yet. One green day doesn’t make a trend. Bitcoin still faces major resistance levels ahead. Plus, broader market conditions remain uncertain.

If you’re holding crypto, watch the $70,000 level closely. A clean break above with strong volume suggests continuation. But rejection could signal another leg down. Set alerts and manage risk accordingly.

For those considering entries, wait for confirmation. Let Bitcoin prove it can hold $70,000 as support. Chasing pumps often ends badly. Better to miss the first 10% than catch a falling knife.

The market finally caught a break after 12 days of pain. Whether this relief rally evolves into sustained recovery depends on follow-through. Monitor volume, key resistance levels, and weekend price action. Those factors will determine if bulls can maintain control or if bears return with vengeance.