The crypto market just bled $183 billion in a single day. Bitcoin crashed through $80,000. Meanwhile, River token lost half its value in two days.

What’s causing this panic? Three major factors converged at once. Plus, macro fears around a potential US government shutdown made everything worse. Let’s break down what happened and where prices might go next.

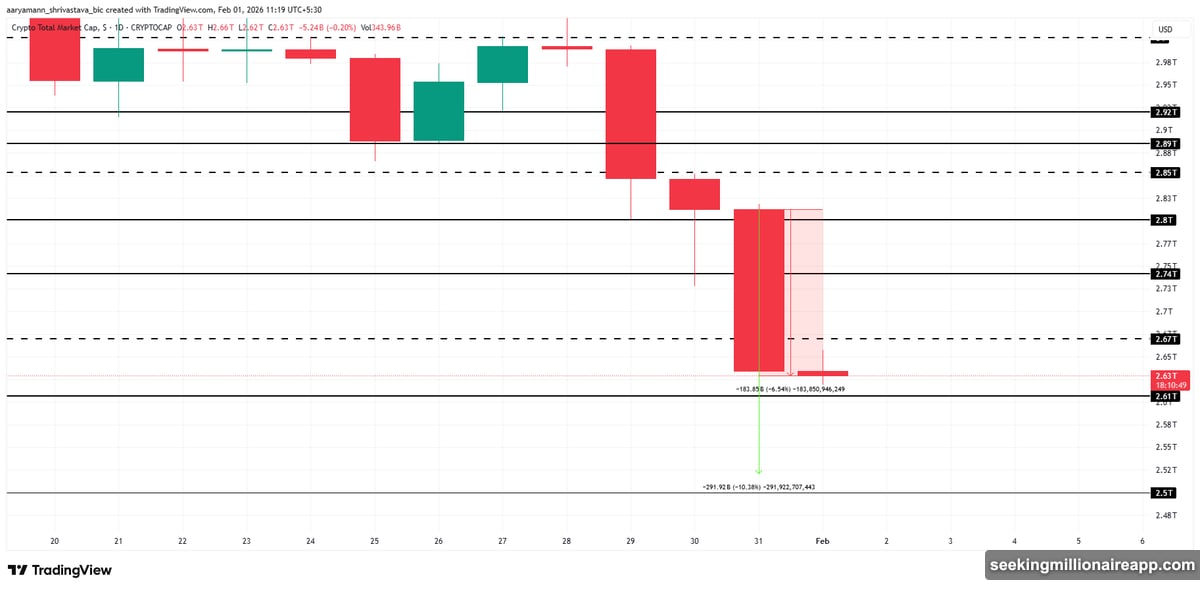

Bitcoin Validated Its Bearish Pattern

Bitcoin broke below $80,000 and confirmed a dangerous technical setup. The crypto king fell out of a broadening ascending wedge pattern. This formation typically signals a 12.6% decline ahead.

The breakdown wasn’t subtle. BTC dropped hard through critical support. Now it’s trading around $78,768. That’s below where most bulls wanted to defend.

Here’s what makes this concerning. The wedge pattern projects a target near $75,850. So Bitcoin could fall another $3,000 from current levels. That would represent a significant drop from recent highs.

Moreover, the psychological impact of losing $80,000 matters. That level acted as strong support for weeks. Breaking it destroys confidence and encourages more selling.

The Next Support Levels To Watch

Bitcoin now faces a crucial test at $78,363. Losing that level would fully validate the bearish pattern. Then the projected $75,850 target becomes likely.

But recovery remains possible. Bulls need to reclaim $82,503 first. Holding above that price would suggest stabilization. It would also reduce immediate downside risk.

For now, sellers control momentum. Every bounce gets sold. Until BTC closes back above $80,000, expect continued pressure. The market needs time to rebuild confidence.

Total Crypto Market Lost $291 Billion Intraday

The broader crypto market got hammered even harder. Total market capitalization crashed nearly $291 billion at the low. Prices recovered somewhat but still lost $183 billion for the day.

The total crypto market cap now sits near $2.63 trillion. That represents serious wealth destruction. Plus, downside risk remains elevated across all sectors.

What’s driving this collapse? Macro fears dominate everything. Concerns about a US government shutdown spooked investors. They’re dumping risk assets across the board.

Additionally, sentiment turned extremely fragile. Nobody wants to hold crypto right now. Fear of missing the bottom doesn’t matter when fear of losing more dominates.

Government Shutdown Fears Add Pressure

Washington dysfunction contributed to crypto’s pain. The threat of a government shutdown created uncertainty. That uncertainty pushed investors toward safety.

Crypto always suffers when macro risk increases. It’s still treated as a high-risk asset. So when traditional markets panic, crypto gets sold first.

The timing couldn’t be worse. Bitcoin was already showing weakness. The macro scare accelerated what was probably coming anyway.

Now the market faces dual pressure. Technical breakdowns combine with fundamental fears. That’s a dangerous mix for prices.

River Token Crashed 16% In One Day

River emerged as the day’s worst performer. The token dropped 16.6% over 24 hours. It’s trading near $19 after losing key technical support.

The damage extends beyond one day. River fell 50% over two days. That kind of decline destroys investor confidence. It also raises questions about the project’s stability.

Technical analysis shows River broke below its 50-day exponential moving average. This metric helps identify trend changes. Losing it suggests more pain ahead.

Without support at $19, River could fall toward $11. That would represent another 42% decline from current levels. Such a drop might trigger panic selling as investors bail out.

Can River Recover From Here?

Recovery remains possible but requires stabilization at $19. Holding that level might attract bargain hunters. They’d need to push price back above $27 to restore confidence.

Under better conditions, River could advance toward $36. That would invalidate the bearish setup. It would also signal renewed momentum.

But right now, conditions aren’t better. The broader market keeps selling off. River won’t buck that trend easily. Until crypto sentiment improves, expect continued weakness.

US Sanctions Hit Iranian Crypto Exchanges

Regulatory news added to market worries. The US Treasury sanctioned two crypto exchanges operating in Iran. Zedcex and Zedxion became the first platforms targeted for operating within Iran’s financial sector.

Officials claim these platforms processed billions tied to Iran’s Islamic Revolutionary Guard Corps. The sanctions signal tougher enforcement ahead. More action against sanction-evasion networks seems likely.

This development reminds everyone that regulatory risk remains real. Governments can shut down exchanges. They can freeze assets. That uncertainty weighs on prices.

Plus, it shows the US taking crypto regulation seriously. Exchanges operating in gray areas face real consequences. That makes some investors nervous about the entire sector.

What Happens Next For Crypto

The immediate outlook remains bearish. Bitcoin needs to reclaim $80,000 to restore confidence. Until then, expect continued downside pressure.

The total crypto market could slip below $2.61 trillion. That would open the door to $2.50 trillion. Such a decline would represent another 5% drop from current levels.

However, recovery scenarios exist. If sentiment improves next week, markets could stabilize. A move back above $2.67 trillion would signal buying interest returning.

The key variable is macro conditions. If government shutdown fears fade, risk assets might rebound. But if Washington drama continues, crypto stays under pressure.

For now, patience matters most. Trying to catch falling knives rarely works. Wait for clear support to hold before adding positions. The market needs time to find a bottom.

This selloff hurts. But crypto has recovered from worse. The question isn’t if prices recover. It’s when and from what level.