The crypto market added a modest $4.58 billion on Thursday as macro tensions cooled slightly. Bitcoin continues to struggle beneath the critical $90,000 level while LayerZero surged 17%, leading altcoin gains.

Global risk appetite improved after Greenland-related geopolitical concerns eased. Gold hit fresh all-time highs, spreading bullish sentiment across risk assets. Yet Bitcoin’s recovery remains fragile, trapped in a narrow range as investors wait for clearer signals.

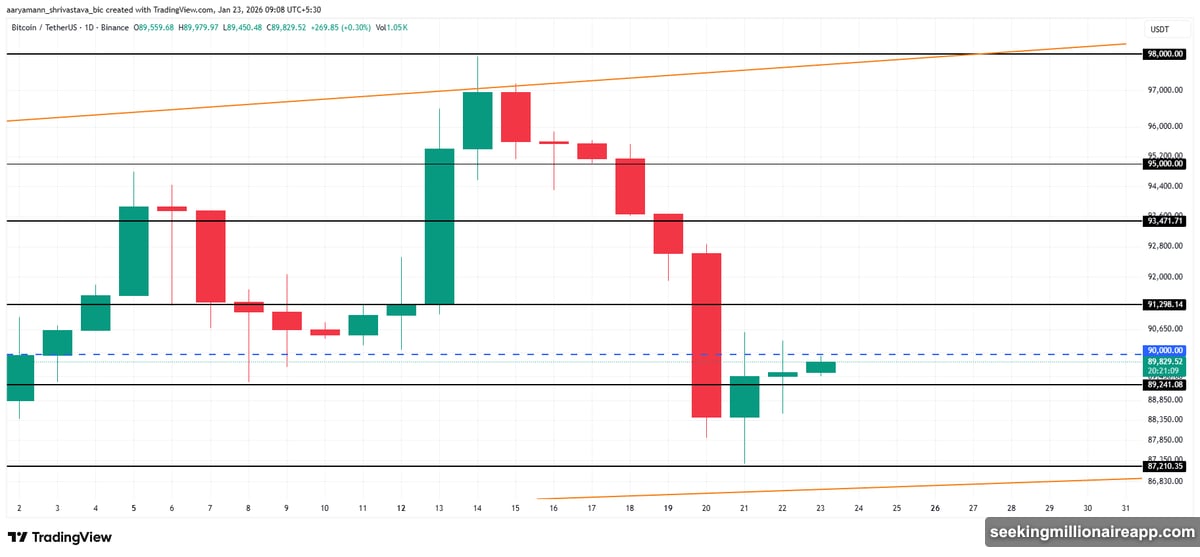

Bitcoin Can’t Break Through

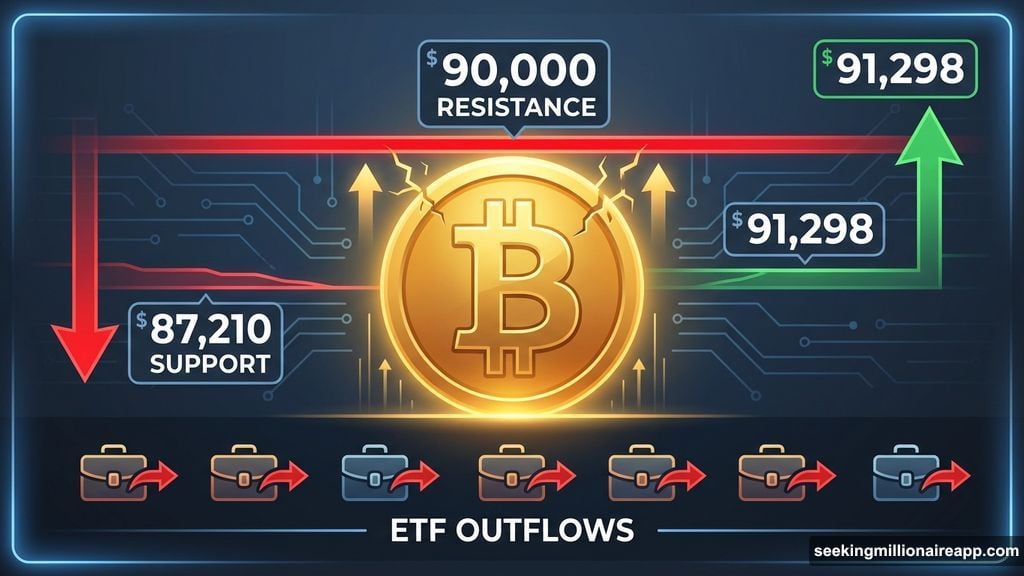

BTC trades near $89,829 right now. The psychological $90,000 barrier keeps rejecting price attempts to break higher.

So what’s holding it back? Spot Bitcoin ETFs continue bleeding capital. Without fresh institutional demand, bulls lack the firepower to punch through resistance. Plus, cautious sentiment keeps traders on the sidelines.

A confirmed move above $90,000 would change everything. That breakout could trigger momentum buying, pushing Bitcoin toward $91,298. But until BTC reclaims that level, the recovery story remains incomplete.

Downside risks linger too. If ETF outflows persist, Bitcoin might slide back to $87,210 support. That would invalidate the bullish setup and reinforce consolidation.

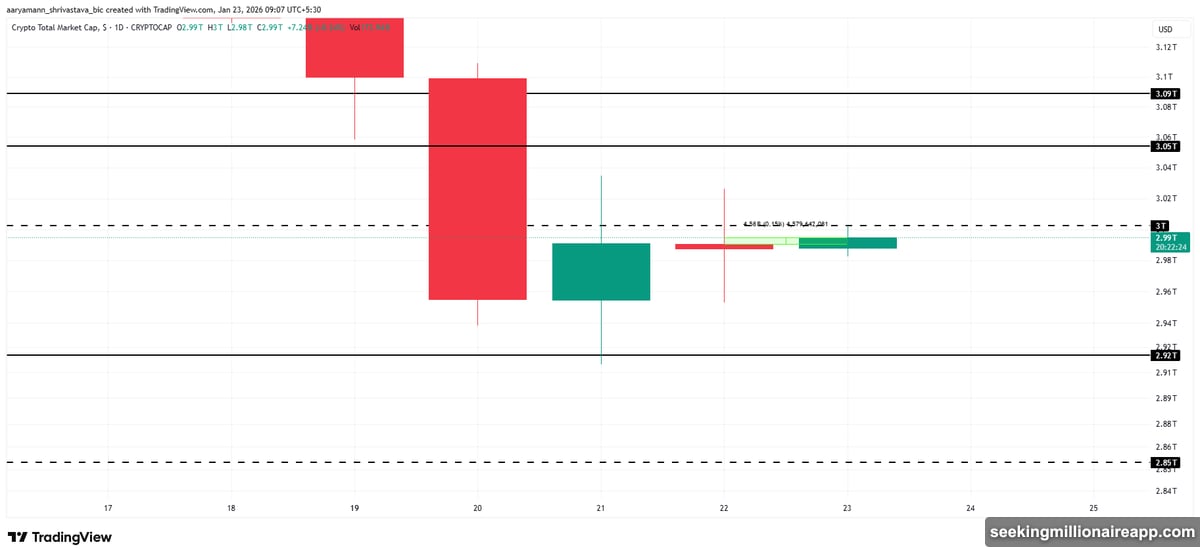

Total Crypto Market Cap Eyes $3 Trillion

The broader market sits just below $3 trillion after Thursday’s gains. That round number acts as immediate resistance.

Breaking above $3 trillion would signal renewed confidence. Moreover, fresh capital inflows could follow, potentially driving the total market cap toward $3.5 trillion in coming weeks. However, the move isn’t guaranteed.

Market structure remains fragile. If investor sentiment flips bearish again, the breakout attempt fails. Under that scenario, TOTAL could retreat to $2.92 trillion support, trapping short-term bulls.

LayerZero Leads Altcoin Rally

ZRO posted the strongest performance among major altcoins, jumping 17.7% in 24 hours. The token benefited from capital rotation into higher-risk assets as market sentiment improved.

Technical indicators support continued upside. The Parabolic SAR sits below price candles, typically signaling trend continuation. If momentum holds, ZRO could extend gains toward $2.50 resistance.

But profit-taking could derail the rally. A break below $2.00 support would weaken the bullish structure. That would likely pull ZRO back to $1.72, invalidating near-term upside targets.

Macro Backdrop Improves Slightly

Thursday brought encouraging signals beyond crypto. Gold’s new all-time high reflected persistent inflation concerns but also safe-haven demand. Meanwhile, easing Greenland tensions reduced geopolitical uncertainty slightly.

These factors helped risk assets stabilize. Yet the improvement remains modest. Investors aren’t rushing back into speculative positions. Instead, they’re testing waters cautiously, waiting for stronger confirmation before committing capital.

The crypto market needs sustained macro support to build momentum. One positive day doesn’t establish a trend.

Crypto News Roundup

BitGo made its NYSE debut Wednesday under ticker BTGO. The stock surged initially but closed near its IPO price, valuing the company around $2.2 billion. That lukewarm reception suggests investors remain cautious about crypto-adjacent stocks.

Meanwhile, South Korean prosecutors reportedly lost seized Bitcoin worth approximately $48 million in a suspected phishing attack. The incident exposed serious gaps in law enforcement crypto custody practices. It also raises questions about government agencies’ ability to safely manage digital assets.

What Comes Next

Bitcoin’s immediate path depends entirely on $90,000. Break above? Momentum shifts bullish. Reject again? Downside risks increase.

The total crypto market cap faces similar dynamics at $3 trillion. A confirmed breakout would attract fresh capital. Failure reinforces consolidation and potentially triggers deeper pullbacks.

For now, markets remain stuck in wait-and-see mode. Macro conditions improved slightly but not enough to spark conviction. Until either bulls or bears gain clear control, expect choppy price action and limited directional moves.

Watch spot Bitcoin ETF flows closely. Continued outflows signal institutional caution persists. Any reversal to inflows could provide the catalyst needed for a sustained recovery attempt.

The crypto market inched higher, but real recovery requires more than a single day’s gains.