The total crypto market just shed $39 billion in 24 hours. Bitcoin sits trapped under resistance. And one major altcoin is bleeding 6% while you read this.

This isn’t a minor dip. Market conditions are deteriorating fast. So what’s actually driving the selloff? Let’s cut through the noise and examine the three forces pushing prices down right now.

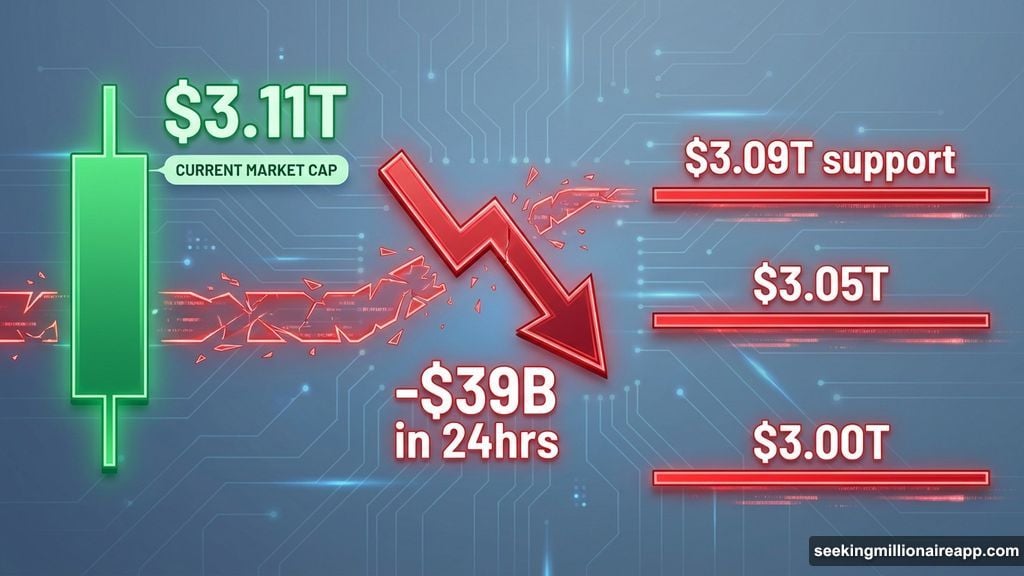

Total Market Cap Holding by a Thread

The entire crypto market now sits at $3.11 trillion, down from yesterday’s levels. But that’s not the scary part. What matters is the support zone directly underneath.

Right now, the market is clinging to $3.09 trillion support. This level represents a critical psychological barrier. If it breaks, the next stop is $3.05 trillion, followed by $3.00 trillion.

Here’s why that matters. Each support break triggers more selling. Traders see support fail and rush to exit positions before losses deepen. That creates a cascade effect, pushing prices lower faster than fundamentals alone would suggest.

Plus, the market just lost nearly 1.3% in one day. That might sound small. But at trillion-dollar scale, small percentages represent massive capital outflows. When billions leave the market quickly, it signals eroding confidence among large holders.

Bitcoin Stuck Under Downtrend Resistance

Bitcoin tells an even grimmer story. The king of crypto remains trapped beneath its established downtrend line.

Currently trading around $95,000, BTC needs to break above this technical barrier to restore bullish momentum. But so far, sellers keep pushing back every attempt at recovery. That creates a clear pattern: lower highs, consistent rejection, weakening buying pressure.

If conditions worsen, Bitcoin could crash through $91,521 support. From there, the path opens toward $89,800 and potentially $86,822. Those aren’t random numbers. They represent key support zones where buyers previously defended the price. Breaking them would signal serious technical damage.

Moreover, macro conditions aren’t helping. With broader market uncertainty and institutional caution rising, Bitcoin faces headwinds from multiple directions. The crypto doesn’t exist in a vacuum. When traditional markets stumble, crypto typically amplifies the pain.

On the flip side, a breakout above the downtrend could target $98,000. But that requires genuine bullish momentum, not just temporary relief rallies. Until we see sustained volume and conviction behind upward moves, the bearish structure remains intact.

Virtuals Protocol Collapsing Under Pressure

While Bitcoin struggles, Virtuals Protocol (VIRTUAL) is getting crushed. The altcoin dropped 6% in 24 hours, now trading at $0.923.

Technical indicators paint a bleak picture. The Parabolic SAR signals a continued downtrend, meaning the selling pressure hasn’t exhausted yet. Plus, VIRTUAL barely holds above $0.916 support. That’s a razor-thin margin.

If $0.916 breaks, the next support sits at $0.819. That represents nearly a 12% additional drop from current levels. For an altcoin already down significantly, further decline would devastate holders and potentially trigger stop-loss cascades.

Here’s what makes VIRTUAL’s situation particularly dangerous. Unlike Bitcoin, which benefits from institutional interest and brand recognition, altcoins like VIRTUAL rely heavily on retail sentiment. When that sentiment sours, these tokens can collapse fast.

The only silver lining? If buyers somehow defend $0.916 and push prices back above $1.000, the bearish thesis would weaken. But given current momentum, that outcome looks increasingly unlikely. Sellers control the action right now.

Industry Context Makes Things Worse

Beyond technical factors, fundamental developments are adding pressure.

Bitcoin mining profitability just hit record lows in late 2025. Hash rate revenues collapsed while operating costs surged. That pushed miner payback periods past 1,200 days, an unsustainable situation for most operations.

In response, about 70% of major mining firms shifted toward AI infrastructure. That’s a massive pivot away from pure Bitcoin mining. While smart from a business perspective, it signals declining confidence in crypto mining economics.

Meanwhile, institutional players are making moves that seem contradictory. Franklin Templeton just launched a Solana ETF, joining Grayscale, Fidelity, and 21Shares in the space. That should signal confidence, right?

Not necessarily. These firms are building infrastructure for when conditions improve. But their entry doesn’t automatically create demand. In fact, it might reflect preparation for a long-term game rather than near-term bullishness.

Three Possible Scenarios From Here

The market faces three potential paths forward, each with different implications.

First, continued decline. If the $3.09 trillion support breaks, we’re looking at extended losses across the board. Bitcoin could test $86,000, VIRTUAL might crash toward $0.819, and altcoins would likely see double-digit percentage drops. This scenario requires worsening sentiment and sustained selling pressure.

Second, stabilization. The market could hold current support levels and trade sideways for weeks. This would represent a pause before the next major move, giving traders time to reassess positions. Volume would likely drop, volatility would decrease, and prices would range-bound within established support and resistance zones.

Third, reversal. If bullish momentum returns, the total market cap could breach $3.16 trillion resistance and head toward $3.21 trillion. Bitcoin would need to break its downtrend and push past $95,000. VIRTUAL would have to reclaim $1.000. This scenario requires improving macro conditions and renewed capital inflows.

What Smart Money Is Watching

Professional traders aren’t just looking at price action. They’re monitoring specific indicators that signal what comes next.

Options data tells a fascinating story. Over $4 billion in Bitcoin and Ethereum options are set to expire soon. Traders are quietly positioning for a 2026 comeback, suggesting they expect short-term pain but long-term recovery.

That’s important context. While prices drop today, sophisticated investors are building positions for next year. They’re not panic selling into weakness. Instead, they’re using current prices as entry points for longer-term holds.

Volume patterns also matter. If selling volume remains elevated while prices stabilize, that suggests capitulation. Weak hands are exiting, leaving stronger holders in control. But if volume drops alongside prices, it indicates apathy rather than conviction, which can lead to prolonged stagnation.

The Honest Assessment

Current market conditions are objectively bad for short-term holders. Prices are falling, technical indicators show weakness, and sentiment is deteriorating.

But here’s what most analysis misses. These conditions are temporary. Every crypto bear market eventually ends. The question isn’t whether prices recover, but when and from what levels.

If you’re holding spot positions, panic selling now probably locks in losses at the worst time. Historical data shows that capitulation bottoms occur after maximum pain, not during initial declines.

If you’re trading with leverage, current conditions are treacherous. Volatility can spike suddenly, triggering liquidations even if your directional bias proves correct over longer timeframes. Risk management matters more than being right.

For new buyers, these prices might represent opportunity. But timing is everything. Catching falling knives hurts. Waiting for confirmed reversal signals might mean missing early gains, but it also avoids bleeding through continued declines.

The crypto market is down today because technical weakness, deteriorating sentiment, and industry headwinds are converging. Whether this marks the beginning of deeper correction or just another shakeout remains unclear. What is clear: the next few days will determine whether bulls can defend critical support or if bears drive prices significantly lower.