December just became interesting for crypto traders. Three major blockchains are about to flood markets with $666 million worth of tokens.

That’s not a small number. Plus, this wave hits during already volatile December trading. So buckle up. Here’s what you need to know about the biggest unlocks hitting your portfolio this week.

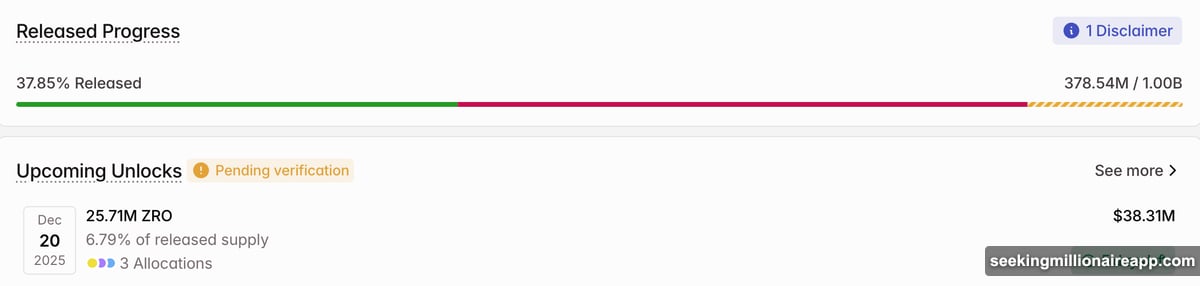

LayerZero Drops $38 Million in ZRO Tokens

LayerZero unlocks 25.71 million ZRO tokens on December 20. That’s worth roughly $38.31 million at current prices.

Here’s the breakdown. Strategic partners get 13.42 million tokens. Core contributors receive 10.63 million ZRO. The remaining 1.67 million goes to buyback programs.

Why does this matter? LayerZero connects different blockchains. It’s crucial infrastructure for cross-chain apps. But suddenly adding 2.57% to circulating supply could pressure prices short-term.

The unlock represents 6.79% of currently released tokens. That’s enough to move markets if recipients start selling immediately.

Arbitrum Releases 92 Million ARB on December 16

Arbitrum’s unlock happens first. December 16 brings 92.65 million ARB tokens to market.

The value? About $19.3 million. But here’s what makes this interesting. The unlock targets insiders, not public investors.

Team members, future employees, and advisors get 56.13 million tokens. Early investors receive the remaining 36.52 million ARB. These groups typically hold longer than retail traders. However, even partial selling from this supply could impact prices.

Arbitrum processes Ethereum transactions faster and cheaper. The Layer-2 solution handles significant DeFi volume. So this unlock affects a project many traders depend on daily.

Sei Hands Entire Unlock to Team Members

Sei takes a different approach. All 55.56 million SEI tokens go directly to the team.

The December 15 unlock is worth approximately $6.98 million. It represents 1.08% of released supply. Moreover, concentrating the entire allocation with team members might reduce immediate selling pressure.

Sei runs on Cosmos SDK. The blockchain targets DeFi applications specifically. Still, any unlock creates potential volatility as markets adjust to increased supply.

Why December Unlocks Hit Different

Token unlocks always matter. But December timing amplifies the impact.

Many investors close positions before year-end. Tax considerations drive selling. Plus, liquidity often drops during holiday weeks. That means less buying power to absorb new supply.

So these three unlocks could trigger sharper price moves than similar releases during other months. Smart traders watch unlock schedules closely for this exact reason.

Beyond these three, several smaller projects also release tokens this week. Lista DAO, ZKsync, and ApeCoin all contribute to the $666 million total. Each adds to overall market supply pressure.

How Unlocks Actually Work

Token unlocks aren’t automatic selloffs. But they create selling opportunities that didn’t exist before.

Take Arbitrum’s team allocation. Those tokens were locked previously. Recipients couldn’t sell even if they wanted to. Now they can. Whether they actually sell depends on individual circumstances and market conditions.

However, markets price in this possibility. Traders anticipate potential selling. So prices often drop before unlock dates as investors reduce positions proactively.

LayerZero’s structure is particularly interesting. Strategic partners and core contributors have different incentives. Partners might sell quickly to realize gains. Contributors might hold for project alignment. That uncertainty creates trading risk.

Smart Money Watches Supply Changes

Professional traders track token unlocks religiously. Here’s why.

Supply changes affect price discovery. More tokens available means more potential sellers. Plus, unlock schedules are public information. Everyone knows exactly when supply increases hit.

So unlocks become self-fulfilling in some ways. Expecting volatility, traders adjust positions. Those adjustments create the volatility they anticipated. It’s a cycle that compounds around major unlock events.

This week’s $666 million represents significant capital potentially entering circulation. Even if only 10-20% gets sold immediately, that’s tens of millions in selling pressure hitting markets simultaneously.

What Traders Should Actually Do

Don’t panic. But don’t ignore this either.

First, check your exposure to ZRO, ARB, and SEI. If you’re heavily invested in any of these, consider the risk of short-term price drops. You don’t need to sell everything. But maybe reduce position sizes if you’re overweight.

Second, watch price action around unlock dates. Volatility often spikes in the 24-48 hours surrounding releases. That creates both risks and opportunities depending on your trading style.

Third, remember that unlocks aren’t always negative. Sometimes markets already priced in the supply increase. Other times, recipients hold rather than sell. Each situation differs based on token holder incentives and broader market conditions.

The Bigger Picture Behind Token Economics

These unlocks highlight a fundamental crypto challenge. Projects need to reward teams, investors, and partners. But releasing large token supplies risks crashing prices.

LayerZero, Arbitrum, and Sei all chose gradual unlock schedules rather than releasing everything at once. That’s good tokenomics. Yet even gradual releases create periodic pressure points like this week.

Smart projects balance stakeholder rewards with market stability. These three generally do this well. Still, December’s timing and combined size make this week particularly noteworthy.

The best approach? Stay informed but don’t overreact. Token unlocks are scheduled events, not emergencies. They represent normal protocol operations, not existential threats.

Markets will absorb this supply. Prices might dip temporarily. But solid projects with genuine utility bounce back quickly. The tokens being unlocked don’t change the fundamental value of LayerZero’s interoperability, Arbitrum’s scaling solutions, or Sei’s DeFi infrastructure.

Trade smart. Manage risk. Watch the dates. And remember that every unlock eventually becomes circulating supply that markets learn to handle.