The crypto market bounced back today, but don’t break out the champagne just yet.

The total crypto market cap added $19 billion over the past 24 hours, pushing TOTAL to $2.29 trillion. That sounds impressive on paper. But the gains tell a cautious story — sentiment is improving, not surging. Meanwhile, Bitcoin keeps stalling at a ceiling it simply can’t crack, and one smaller altcoin is stealing the spotlight entirely.

Here’s what’s actually moving the market right now.

Total Market Cap Rebounds but Misses the Bullish Threshold

That $19 billion gain matters. It shows buyers haven’t completely walked away.

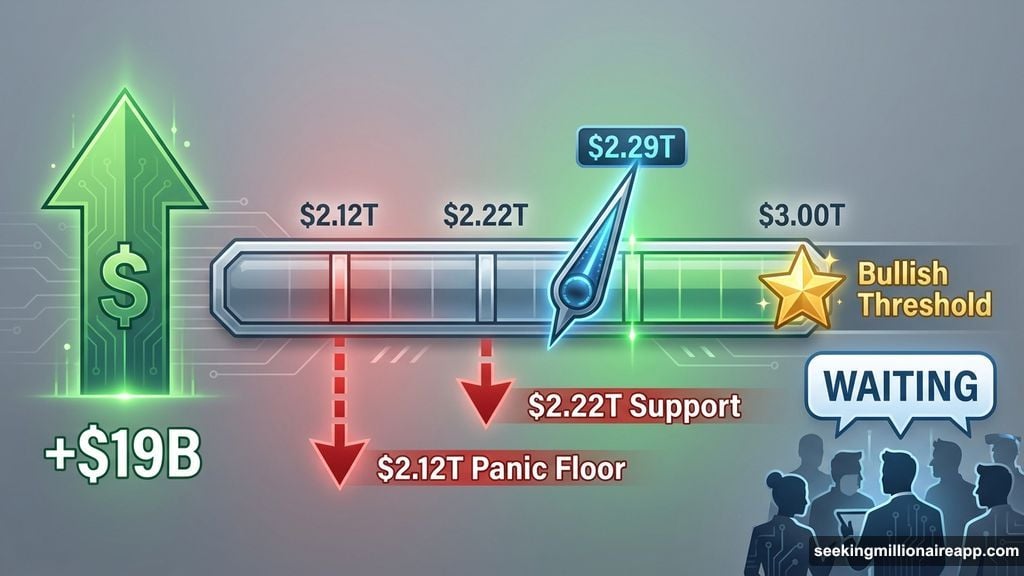

But context is everything. TOTAL sitting at $2.29 trillion is still a long way from the $3.00 trillion level that analysts watch as the true bullish signal. Crossing that mark — and holding it as support — would restore the kind of confidence that drives sustained rallies. Right now, neither macroeconomic signals nor institutional positioning is giving traders much reason to commit.

So the market is treading water. Not panicking. Not charging forward. Just… waiting.

And waiting has a downside risk. If TOTAL fails to push higher and gets rejected near current resistance levels, the next stop could be $2.22 trillion. Losing that floor would open the door to $2.12 trillion, with panic selling potentially accelerating the slide. Nobody wants that, but it’s the realistic scenario if momentum fades.

Bitcoin Keeps Running Into the Same Wall

Bitcoin is trading at $67,360 as of this writing. It’s been stuck in this range for nearly two weeks.

The $70,000 level is doing what it always does — acting as a brick wall. Psychologically and technically, it’s the barrier Bitcoin keeps bouncing off. Every time BTC gets close, traders hesitate. Institutional buyers hold back. The breakout never comes.

For bulls, the math is simple. A clean close above $70,000 that flips that level into support would almost certainly attract fresh buying from both retail and institutional investors. That’s the catalyst the broader market is waiting on.

But there’s a floor holding things together too. The $65,000 support level has done solid work lately, cushioning pullbacks and keeping sharper drops at bay. Lose $65,000, though, and the near-term bullish case falls apart fast. Accelerated selling pressure would likely follow.

So Bitcoin sits between two critical levels, refusing to commit either direction. For traders, that kind of indecision is frustrating. For patient investors, it might just be an opportunity.

Kite Hits an All-Time High With a 16.6% Surge

While Bitcoin disappoints, Kite (KITE) is having a very different kind of day.

KITE surged 16.6% over the past 24 hours, touching a new all-time high of $0.256 before settling around $0.254. Strong investor demand and consistent buying pressure powered the breakout. It’s the kind of move that reminds altcoin traders why smaller tokens can outperform even during sluggish Bitcoin periods.

The next milestone? $0.300. Hitting that target would mark yet another all-time high and signal that the buying momentum has real legs. Getting there will take continued capital inflows and sustained spot demand from both short-term traders and long-term holders who believe in the project.

There’s a catch, of course. KITE is showing overbought conditions. When tokens run this hot this fast, profit-taking is always lurking around the corner. If buying pressure softens even slightly, a pullback toward the $0.207 support level becomes realistic. That wouldn’t erase the bullish structure necessarily — but it would test whether recent gains have a solid foundation underneath them.

What’s Moving in the Background

Two broader news stories are worth watching alongside the price action.

Kraken acquired token management platform Magna, a move clearly aimed at strengthening its competitive position ahead of a planned IPO. The deal lets Kraken support token issuers earlier in their development lifecycle, which could give the exchange a meaningful edge in future token listings. Smart timing for a company preparing to go public.

Meanwhile, Nvidia is reportedly finalizing a $30 billion investment in OpenAI. That number sounds massive, but it actually replaces a previously proposed $100 billion multi-year partnership — so in relative terms, it’s a scaled-back deal. A significant chunk of the capital would flow back into AI infrastructure, including Nvidia’s own GPUs. The arrangement values OpenAI at $830 billion, which tells you everything about where AI investment appetite stands right now.

These stories matter for crypto because AI infrastructure spending and institutional moves around tech ecosystems influence sentiment across digital assets more than most traders acknowledge.

The market today is a mixed bag. TOTAL is recovering but still needs a lot more to flip convincingly bullish. Bitcoin is stuck in neutral. And KITE is reminding everyone that opportunity in crypto rarely travels in a straight line or follows the obvious path.

Keep your support levels close and your position sizes reasonable. Days like this reward patience over impulsiveness.