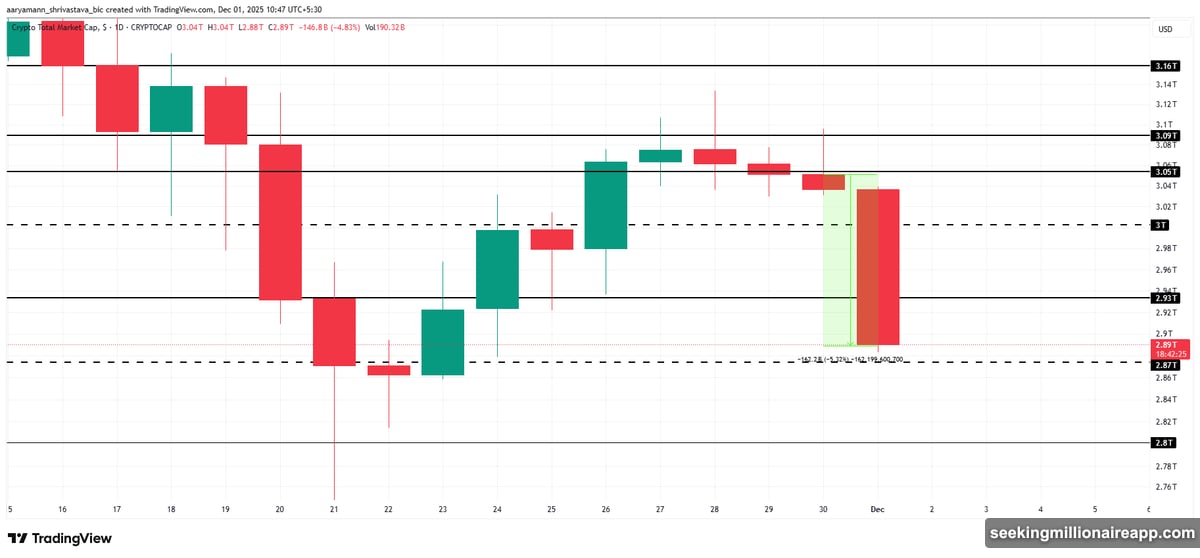

The crypto market bled heavily today. Over $162 billion vanished in 24 hours, dragging the total market cap down to $2.89 trillion.

Bitcoin slipped below $86,000. Altcoins crashed harder, with Zcash leading the carnage at a brutal 20% drop. So what triggered this massive sell-off, and where do things go from here?

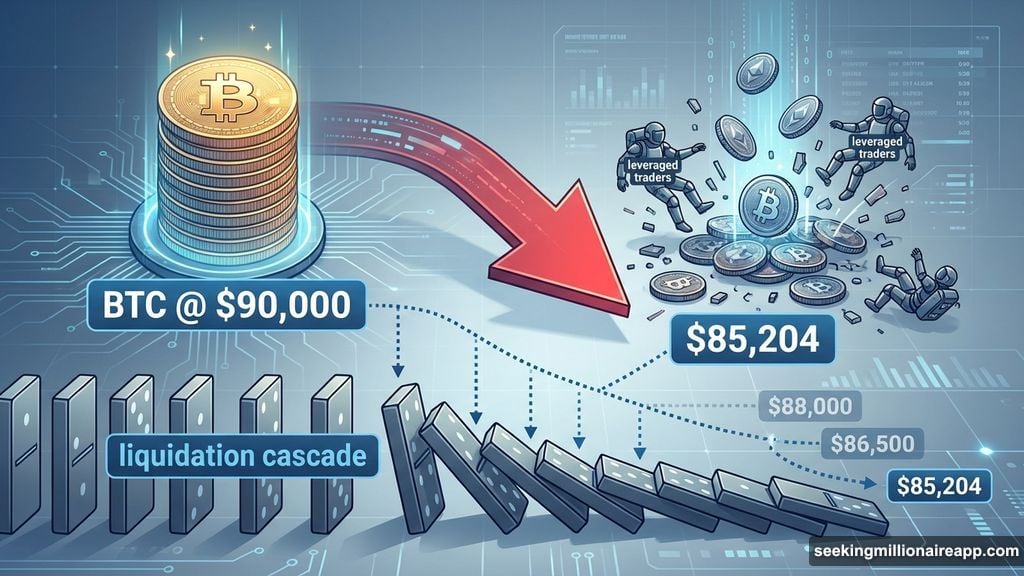

Mass Liquidations Sparked the Crash

A wave of forced liquidations kicked off the decline. When leveraged positions get liquidated, it creates a domino effect that pushes prices lower across the board.

Bitcoin couldn’t hold its ground. It fell from stable levels above $90,000 to test support at $85,204. Moreover, the selling pressure spread quickly to altcoins, amplifying losses throughout the market.

The total crypto market cap now sits precariously above $2.87 trillion. That level represents critical support. If it breaks, expect another leg down toward $2.80 trillion.

Here’s the thing. These cascading liquidations happen when too many traders bet on price increases using borrowed money. Once prices start falling, margin calls force automatic selling. That selling drives prices lower, triggering more liquidations. It’s a vicious cycle.

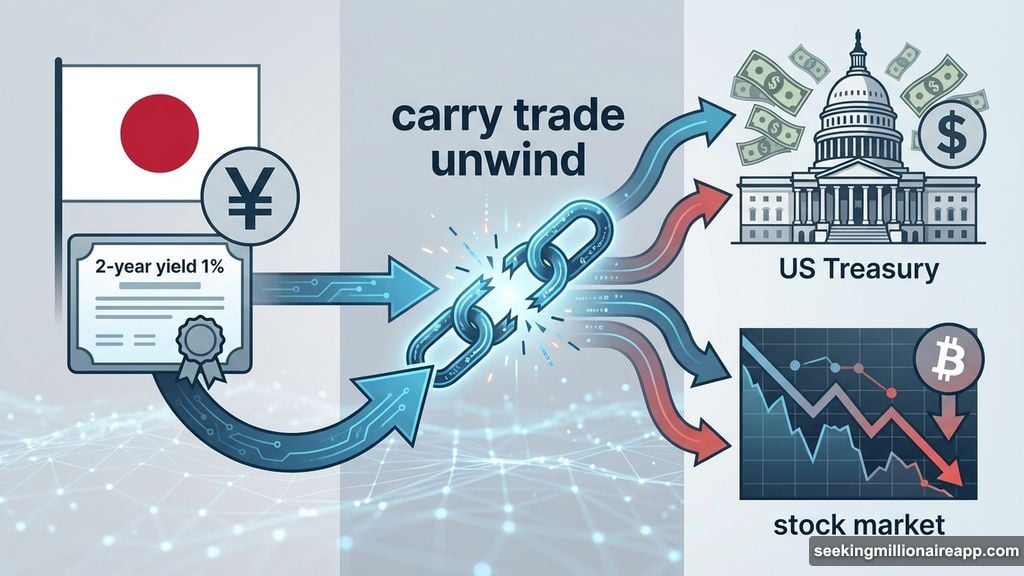

Global Markets Added Fuel to the Fire

External factors didn’t help. Foreign investors are pouring record amounts into US equities and Treasury bonds. That shift in capital flow reduces liquidity available for riskier assets like crypto.

Plus, US consumer debt hit all-time highs. High debt levels signal potential economic stress, making investors more cautious about speculative investments. So money moves out of volatile markets first.

Japan threw another wrench into the mix. Their 2-year bond yield reached 1% for the first time since 2008. The Bank of Japan hinted at rate hikes, threatening decades of yen carry trades.

What’s a carry trade? Investors borrow cheap yen, convert it to other currencies, and invest in higher-yielding assets. When Japanese rates rise, those trades unwind. That forces global deleveraging across stocks, bonds, and crypto.

These macro factors create a hostile environment for crypto. When traditional markets shift, digital assets often suffer disproportionately.

Bitcoin Tests Critical Support at $85,204

Bitcoin dropped 5% today and trades at $85,801. It’s clinging to the $85,204 support level by a thread.

A breakdown below $85,000 would be significant. That opens the door to $82,503, the recent intra-day low. Losing that support could push Bitcoin toward $80,000, extending the correction further.

The chart doesn’t look great. Bitcoin fell from comfortable levels above $89,000 to this precarious position in less than a day. Momentum shifted decisively bearish.

However, support levels can hold. If buyers step in at $85,204, Bitcoin could rebound toward $89,800. Breaking that resistance would signal a broader recovery and restore some confidence.

But honestly? The odds favor more downside in the short term. Selling pressure remains heavy, and macro headwinds persist.

Zcash Crashes 36% in One Week

Zcash got demolished. It fell 20% today and trades at $364, barely holding above $344 support.

The damage extends beyond today’s crash. ZEC dropped 36% over the past week, falling from $572 to an intra-day low of $351. That’s a catastrophic decline for any asset.

Altcoins typically amplify Bitcoin’s moves, both up and down. When BTC weakens, smaller coins suffer disproportionately. ZEC’s drop reflects this dynamic perfectly.

If $344 support breaks, expect a move toward $300. That would mark a complete breakdown in ZEC’s recent price structure.

On the flip side, a recovery toward $400 would be the first sign of stabilization. Breaking $442 would invalidate the bearish setup entirely. But given current conditions, that seems unlikely in the near term.

What Happens Next

The market sits at a critical juncture. Total crypto market cap holding above $2.87 trillion is essential for preventing deeper losses.

Bitcoin needs to reclaim $85,204 support convincingly. A bounce here could trigger short-covering and stabilize prices. But a breakdown would likely accelerate selling across the entire market.

Meanwhile, macro factors continue to weigh on risk assets. Japanese rate hikes, record US debt levels, and capital flowing out of crypto create a challenging backdrop.

So what should you do? If you’re holding, prepare for more volatility. Support levels could break, extending this correction. If you’re considering entries, wait for clear signs of stabilization before committing capital.

The crypto market has survived worse crashes. But this one isn’t over yet. The next few days will determine whether we’ve seen the bottom or just the beginning of a deeper decline.