The total crypto market cap shed another $25 billion in just 24 hours. That’s not a small dip — that’s real money leaving the space fast.

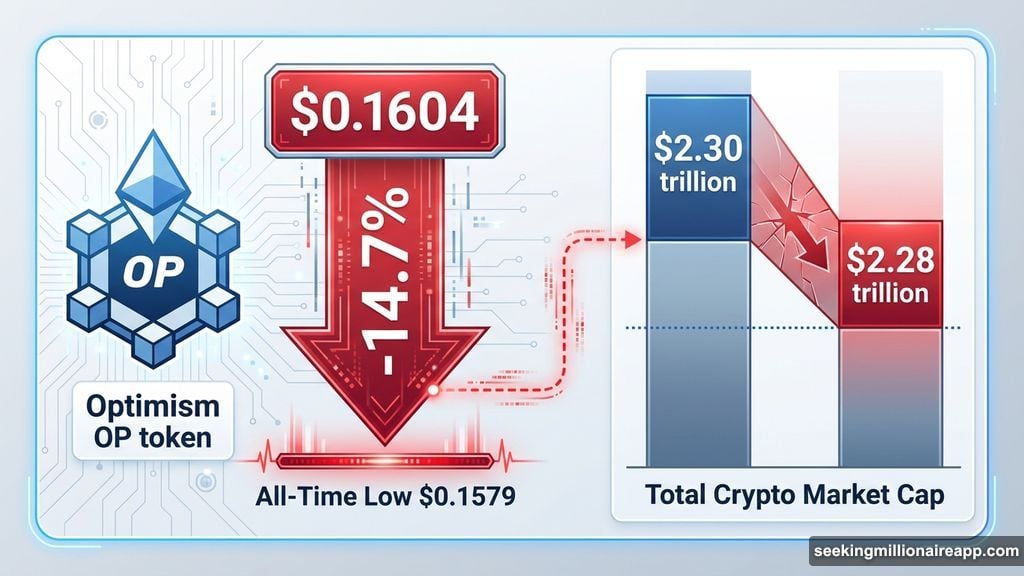

Right now, the market sits at $2.28 trillion, just below the $2.30 trillion support level. And with Bitcoin stuck in consolidation mode and Optimism (OP) cratering toward an all-time low, today’s session is giving crypto holders plenty to worry about.

Here’s what’s actually driving the slide.

The Total Market Cap Breaks Below Key Support

The broader crypto market has been bleeding quietly. TOTAL — the metric that tracks the combined value of all cryptocurrencies — dropped below $2.30 trillion and is struggling to find its footing.

What makes this tricky is the lack of a clear catalyst either way. The Federal Reserve released meeting minutes from its January 27-28 session, but markets barely flinched. That muted reaction tells you something: investors aren’t convinced things are getting better, but they’re not panicking either.

So what we’re left with is a market drifting sideways with a bearish lean. Volatility is low. Momentum is absent. And that kind of environment tends to favor the sellers.

If selling pressure keeps up, the market cap could retest $2.28 trillion as a consolidation zone. But flip the script — if equity markets strengthen or institutional money starts flowing back in — a push above $2.30 trillion could reignite bullish interest. Breaking that level cleanly opens the door toward $2.37 trillion.

Bitcoin Consolidation Tightens Near $67K

Bitcoin is doing what it does in uncertain markets: absolutely nothing dramatic. BTC is trading around $66,871, sandwiched between resistance at $70,000 and support near $67,674.

The broader structural demand zone sits around $65,000, and that’s the level everyone is watching. Below that, $62,892 becomes the next line of defense.

The real concern right now is the Chaikin Money Flow (CMF) indicator. CMF measures buying and selling pressure using both price movement and trading volume. When it prints below zero — which it currently does — that means capital is leaving Bitcoin, not entering it. Spot demand is weak. Conviction on the buy side is missing.

That’s not a recipe for a rally.

Still, sentiment can shift fast in crypto. If the CMF reverses and fresh inflows start showing up, $70,000 gets back in play. A clean break and hold above that level would be meaningful — it would point toward $72,294 and signal that the short-term bearish phase is genuinely over.

For now though, Bitcoin is waiting. And so is everyone else.

Optimism Drops 14.7% and Approaches All-Time Low

If Bitcoin’s performance looks frustrating, spare a thought for Optimism (OP) holders. The Ethereum layer-2 token dropped more than 14.7% in a single day, falling to $0.1604. Its all-time low sits at $0.1579 — close enough to touch.

That kind of decline isn’t just a bad day. It reflects persistent selling from short-term holders who bought higher and are now cutting losses. When that distribution pressure keeps up, prices can fall further and faster than most people expect.

A fresh all-time low looks increasingly likely. If selling continues, OP could slide toward the $0.1500 level, which would mark a significant new low and reinforce an already ugly technical picture.

There’s one small silver lining. The Relative Strength Index (RSI) — a momentum indicator that signals when assets are overbought or oversold — is approaching oversold territory. That doesn’t guarantee a bounce. But historically, extreme RSI readings often precede short-term recoveries as bargain hunters step in.

If buyers do show up, OP could recover toward $0.1817. That would ease the immediate pressure and help stabilize the token, at least temporarily.

Two Stories Adding Pressure to Market Sentiment

Beyond the charts, two headlines are adding noise to an already skittish market.

First, YZi Labs — the investment arm formerly known as Binance Labs — accused asset manager 10X Capital of failing to meet SEC disclosure requirements around ownership stakes. Regulatory friction between major crypto players never helps broader sentiment.

Second, Gemini parted ways with three senior executives: its CFO, CLO, and COO. That’s a significant leadership shakeup. Combined with broader workforce cuts, it’s raising questions about where Gemini is headed. Markets don’t love uncertainty, and this announcement added to the exchange’s recent stock decline.

Neither story is catastrophic on its own. But stacked together during an already soft market, they add to the weight.

What to Watch Going Forward

The macro picture holds most of the cards right now. Stronger equity performance or a shift in Federal Reserve tone could bring institutional buyers back to crypto and support a recovery. Without that external push, the path of least resistance looks tilted downward.

For Bitcoin, the $65,000 support zone is the line in the sand. Losing it would be a bearish signal that accelerates the current slide. Holding it — and reclaiming $70,000 — would suggest the consolidation is healthy rather than the early stages of a deeper correction.

For OP specifically, the near-term risk of a new all-time low is real. If you’re holding, the RSI divergence is worth watching closely. It won’t save the token from macro headwinds, but it could signal a short-term floor.

Crypto markets are rarely boring for long. The calm we’re seeing now likely won’t last — the question is just which direction breaks first.