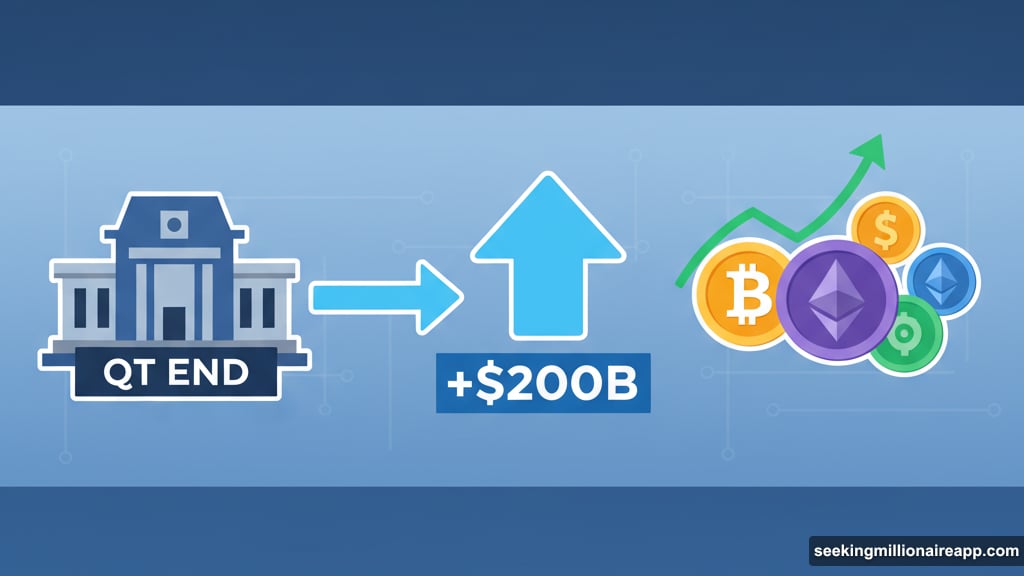

The crypto market just added $200 billion in 24 hours. Bitcoin broke through key resistance. And several altcoins posted double-digit gains.

What triggered this sudden reversal? The Federal Reserve ended quantitative tightening on Tuesday. That decision shifted risk sentiment overnight. Now traders are pouring capital back into digital assets after weeks of uncertainty.

Let’s break down what’s happening and whether this rally has staying power.

Total Market Cap Targets $3.16 Trillion

The total crypto market capitalization jumped to $3.10 trillion after the Fed announcement. That’s a massive recovery from the $2.90 trillion level just days earlier.

Markets responded strongly to the policy change. Plus, improved sentiment is driving significant inflows across major cryptocurrencies. The psychological boost matters as much as the technical setup right now.

However, bulls need to clear $3.16 trillion to confirm continued strength. Holding $3.09 trillion as support becomes critical for sustaining this momentum. Without that foundation, the rally risks losing steam.

If volatility returns or conditions deteriorate, the market could slip back through $3.05 trillion. A deeper drop toward $2.93 trillion would signal weakening demand and temporarily invalidate the bullish case.

Bitcoin Breaks Through $91,521 Resistance

Bitcoin climbed from $86,400 to $92,712 in the past day. That move pushed BTC above $91,521 for the first time in nearly two weeks. Buyers are clearly back after an extended consolidation period.

The breakout signals renewed strength. Yet sustainability depends on broader market conditions remaining supportive. So far, the setup looks encouraging for continued upside.

Next target? Bitcoin’s price could reach $95,000 if momentum holds. Flipping that level into support would confirm a stronger recovery structure. Meanwhile, traders are watching for any signs of exhaustion at current levels.

On the downside, losing $91,521 support would be problematic. A slip back toward $89,800 would signal fading demand. That would invalidate the short-term bullish outlook and expose BTC to deeper retracements.

Sui Surges 23% on Strong Demand

Sui emerged as one of the day’s top performers with a 23% gain. The altcoin now trades at $1.65, holding firmly above the $1.60 support level. That’s impressive strength compared to most other tokens.

Technical indicators are improving too. The RSI now sits near the neutral 50.0 mark after recovering from oversold territory. A decisive move above that level would confirm a shift from bearish to bullish sentiment.

If demand continues building, SUI could push past $1.75 toward the $2.00 region. The momentum is there. But altcoins can reverse quickly when traders take profits.

Conversely, weakness could send SUI below $1.60 support. That would open the door to a retest of $1.49. Losing that level would invalidate the bullish thesis entirely and expose the token to a decline toward $1.31.

Fed Decision Changes Everything

The Federal Reserve’s quantitative tightening program ended Tuesday. Markets interpreted this as a dovish pivot, even though the Fed didn’t announce rate cuts.

Why does this matter for crypto? Looser monetary policy typically benefits risk assets. Digital currencies tend to rally when liquidity conditions improve. So this policy shift directly impacts crypto valuations.

Moreover, the timing couldn’t be better for bulls. Crypto markets had been consolidating for weeks under pressure. The Fed decision provided the catalyst needed to break out of that range.

Still, one policy shift doesn’t guarantee sustained gains. Markets remain volatile. External factors like regulatory developments or macroeconomic data could still derail this rally.

Ethereum Upgrade Adds to Positive Sentiment

Ethereum’s Fusaka upgrade launches December 3rd. The update introduces PeerDAS technology to boost Layer 2 scalability significantly.

This is Ethereum’s second major upgrade of 2025. The previous Pectra fork triggered a 29% ETH rally earlier this year. That precedent has traders optimistic about potential price action following Fusaka.

Technical improvements often spark buying interest. Plus, successful upgrades reduce concerns about network capacity. That matters as more activity moves to Layer 2 solutions.

However, the rally hasn’t lifted ETH as much as other assets yet. Bitcoin and altcoins like Sui are leading this recovery. Ethereum may catch up if the Fusaka upgrade goes smoothly.

Regulatory Actions Target Scam Operations

US authorities seized a web domain linked to Burma’s Tai Chang compound this week. The action aims to disrupt regional fraud networks that have plagued crypto markets.

Separately, a sanctioned Cambodian financial group froze withdrawals amid rising regulatory pressure. Both US and UK authorities are intensifying scrutiny of suspected scam operations.

These enforcement actions benefit legitimate crypto markets. Removing bad actors improves industry reputation. That makes institutional investors more comfortable allocating capital to digital assets.

Yet regulatory uncertainty persists. Clear frameworks remain elusive in major markets. So traders balance optimism about current conditions against ongoing regulatory risks.

Key Levels to Watch

Bitcoin needs to hold $91,521 support to maintain bullish structure. A drop below that level would signal trouble and likely trigger selling pressure down to $89,800 or lower.

The total market cap must secure $3.09 trillion as stable support. Failing to hold that level could lead to a retest of $2.93 trillion. That would represent a significant setback for bulls.

For Sui, the $1.60 level is critical. Losing that support would invalidate the recent breakout and expose SUI to a decline toward $1.49 or even $1.31.

Meanwhile, resistance levels loom above current prices. Bitcoin faces $95,000. The total market cap targets $3.16 trillion. Sui aims for $1.75 and potentially $2.00. Breaking through these barriers confirms continued strength.

Momentum Shifts But Risks Remain

Markets are clearly improving after the Fed announcement. Momentum indicators are turning positive across major cryptocurrencies. Plus, buying pressure has returned after weeks of sideways trading.

However, volatility could resurface quickly. Crypto markets remain sensitive to macroeconomic developments and regulatory news. One negative headline can reverse gains rapidly.

That’s why securing current support levels matters so much. Without stable foundations, rallies fade fast. Traders who entered during the recovery need to watch for signs of exhaustion or renewed selling pressure.

The setup looks constructive for now. But maintaining discipline remains essential. Markets that rise quickly can fall just as fast when sentiment shifts again.