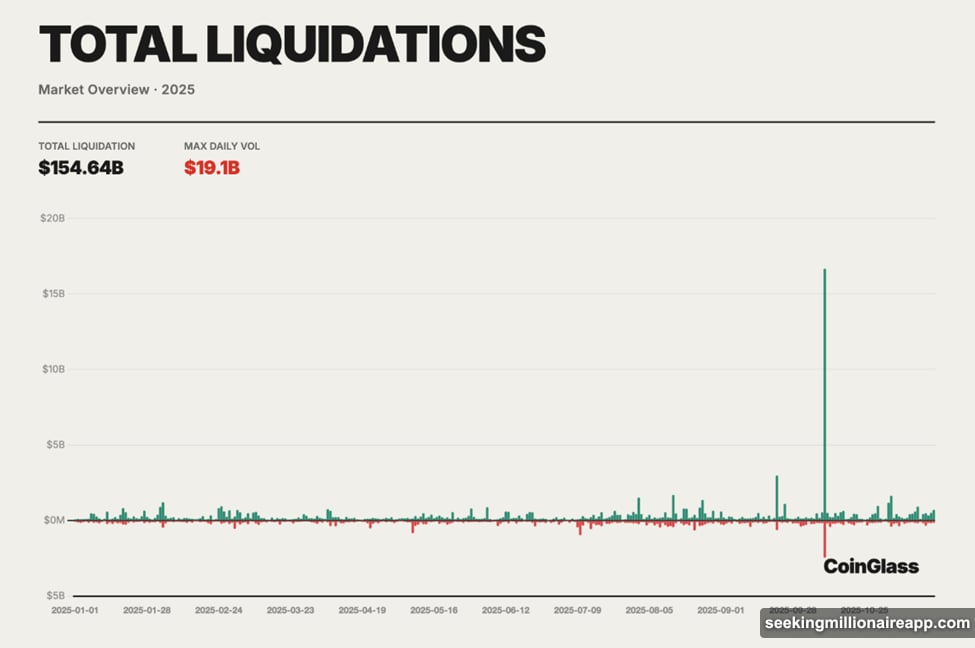

Crypto futures markets turned into liquidation engines last year. More than $154 billion vanished through forced position closures.

That’s not a typo. Over $400 million in forced liquidations happened every single day throughout 2025. Plus, October 10-11 alone wiped out $19 billion in just 24 hours—the largest single liquidation event in crypto history.

Three specific mistakes drove most of these losses. Each was predictable. Each was preventable. Yet traders kept making them anyway.

Extreme Leverage Turned Futures Into Suicide Machines

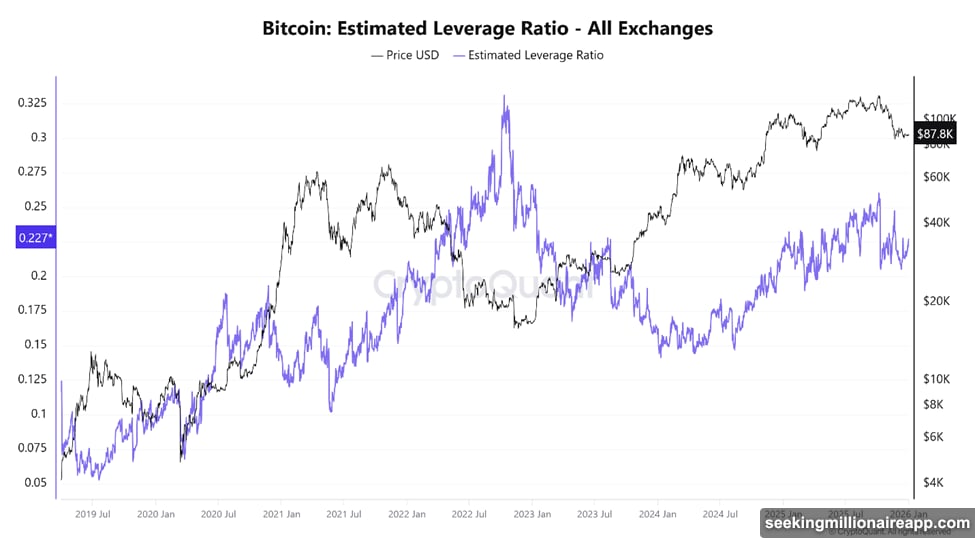

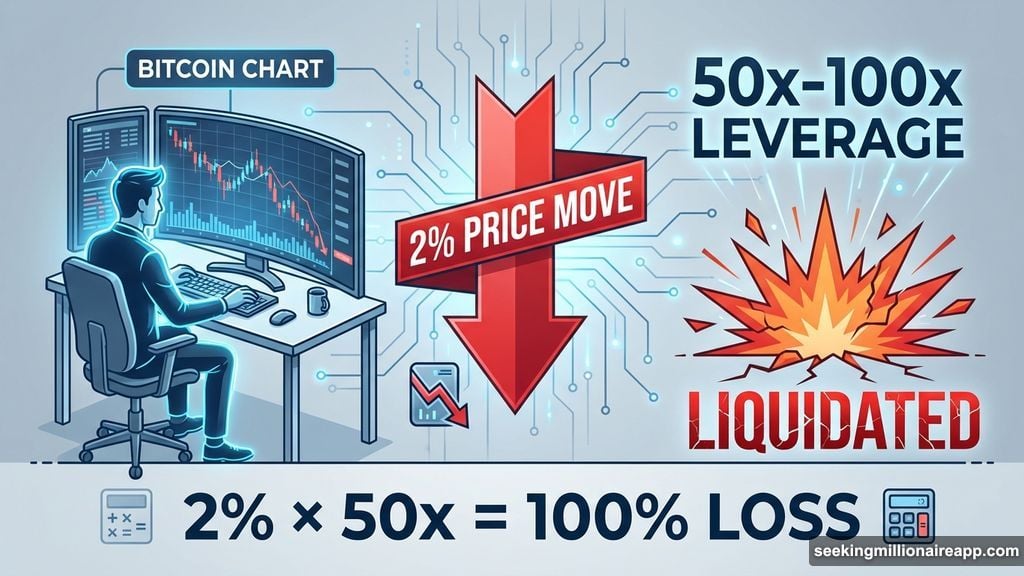

Leverage amplified every loss in 2025. Coinglass data shows traders routinely operated at 50x or even 100x leverage on major exchanges.

Think about what that means. A 2% price move against your position equals total account destruction. No second chances. No recovery. Just liquidation.

Bitcoin’s estimated leverage ratio hit record highs in early October, right before the market collapsed. Total futures open interest exceeded $220 billion at the time. Everyone was betting with borrowed money simultaneously.

The math becomes brutal when leverage concentrates. Long positions accounted for 80-90% of liquidations during the October crash. When prices dropped, forced selling triggered more liquidations, which pushed prices lower, which triggered more forced selling.

This wasn’t trading anymore. It became a mechanical extraction process.

Leverage Actually Capped the Bull Market

Here’s the part nobody wants to hear. Some analysts argue excessive leverage actively suppressed crypto’s growth potential.

Had that $154 billion stayed in spot markets instead of evaporating through futures, total crypto market cap might have reached $5-6 trillion. Instead, it stalled near $2 trillion.

Leverage-induced crashes kept resetting bullish momentum throughout the year. Every rally got cut short by cascading liquidations. The casino wasn’t just taking money—it was killing the game itself.

One researcher put it plainly: “Most people are not trading anymore. They are feeding liquidation engines.”

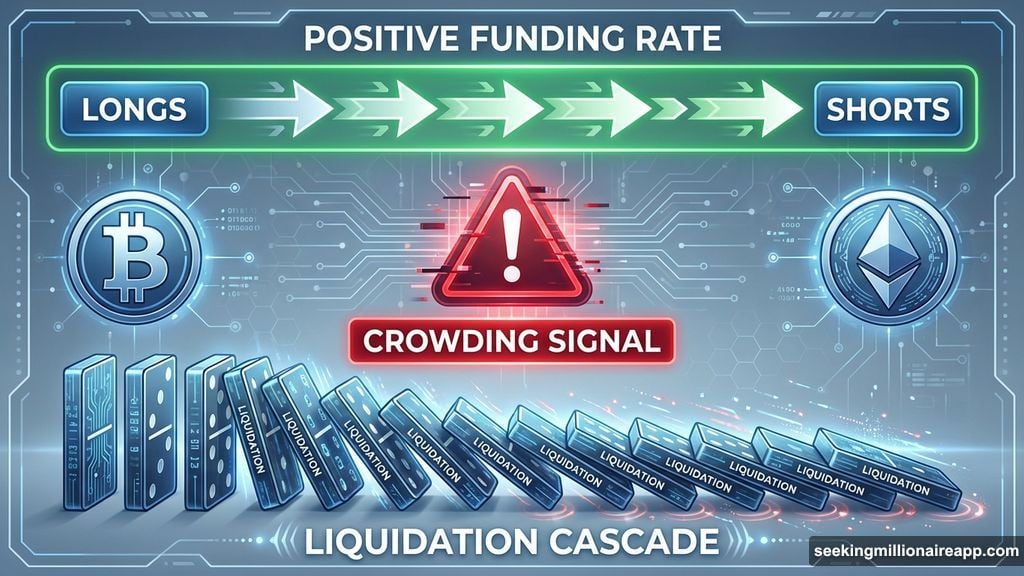

Funding Rates Screamed Warnings Nobody Heard

Funding rates reveal market imbalances before prices react. Positive funding means longs pay shorts—too many bulls. Negative funding means shorts pay longs—too many bears.

Throughout 2025, traders ignored these signals completely.

During extended rallies, BTC and ETH funding stayed persistently positive. Longs kept bleeding capital through funding payments, yet interpreted this as trend confirmation rather than crowding warnings.

Hyperliquid and other DEX perpetual platforms processed over $1.2 trillion monthly in volume by year’s end. Funding extremes became more pronounced, not less.

Then the feedback loops emerged. Negative funding episodes triggered massive spot borrowing to fund short positions. Aave and Compound utilization rates spiked above 90%, driving borrowing costs sharply higher.

Traders thought they were collecting funding on perps while shorting spot. Instead, they were losing money on both sides—funding payments on futures plus rising interest on borrowed collateral.

The market was literally paying you to notice the imbalance. Most traders took the payment and ignored the warning.

Short Squeezes Punished the Obvious Trades

Sustained negative funding created perfect conditions for violent rallies. When everyone crowds the same side, the market eventually punishes that positioning.

That’s exactly what happened repeatedly in 2025. Shorts piled in during consolidation phases, funding turned deeply negative, then sudden price spikes forced massive covering.

Funding rates weren’t inefficiencies to exploit. They were the market telling you a structural imbalance existed. Ignoring them meant taking real, hidden risk.

ADL Wiped Out Profitable Positions Without Warning

Auto-deleveraging destroyed strategies that should have worked. ADL is an exchange emergency mechanism—when insurance funds deplete, profitable traders get forcibly closed to cover losses.

During October’s liquidation cascade, ADL triggered across multiple venues simultaneously. Insurance funds couldn’t absorb the damage, so exchanges started closing positions based on profit and leverage.

Here’s the nightmare scenario that actually happened: Traders running hedged positions got their shorts closed first, then immediately liquidated on their longs as prices dropped further.

Perfect hedge. Executed correctly. Wiped out anyway.

“Imagine getting your short closed first and then getting liquidated on your long. Rekt,” noted Nic Pucrin, CEO of Coin Bureau, describing the October crash.

ADL operates at single-market level, ignoring portfolio-wide exposure. You might be perfectly hedged across instruments, but ADL breaks that hedge without asking permission.

Stop Losses Are Your Only Real Protection

Manual stop-losses became the only defense against ADL. Exchange mechanisms protect the platform, not your account.

Some newer on-chain platforms rejected ADL entirely, opting for socialized loss mechanisms instead. Those systems defer and distribute losses rather than crystallizing them instantly through forced closures.

For retail traders, the lesson hit hard. ADL isn’t a safety feature. It’s a platform survival tool that prioritizes exchange solvency over trader fairness.

Without strict, manually placed stop-losses, you’re exposed to total wipeout regardless of leverage discipline or risk management.

Why 2026 Could Repeat the Same Disaster

Futures markets aren’t going anywhere. They provide liquidity and price discovery that spot markets can’t match.

But structure matters more than conviction. Over-leverage turns normal volatility into account annihilation. Funding rates reveal problems long before prices crash. Exchange risk mechanisms serve platforms first, traders second.

That $154 billion wasn’t lost to bad luck. It was tuition paid for ignoring market mechanics.

The question for 2026 is simple: Will traders finally learn, or will liquidation engines keep extracting capital from the same repeated mistakes?