Here’s a thought that might shift how you see the entire cryptocurrency space. What if the confusing, terrifying experience of crypto isn’t a bug? What if it’s a feature — just one designed for a completely different kind of user?

That’s exactly what Haseeb Qureshi, managing partner at Dragonfly, argues. And honestly? The logic is hard to dismiss.

The “Broken” Experience That Isn’t Actually Broken

Most people who’ve spent time in crypto know the feeling. That cold sweat before signing a transaction. The paranoia about checking wallet addresses three times. The quiet dread of stale approvals or accidental drainer contracts.

It feels broken. But Qureshi says the system is working exactly as designed. The problem is that it was never designed around humans in the first place.

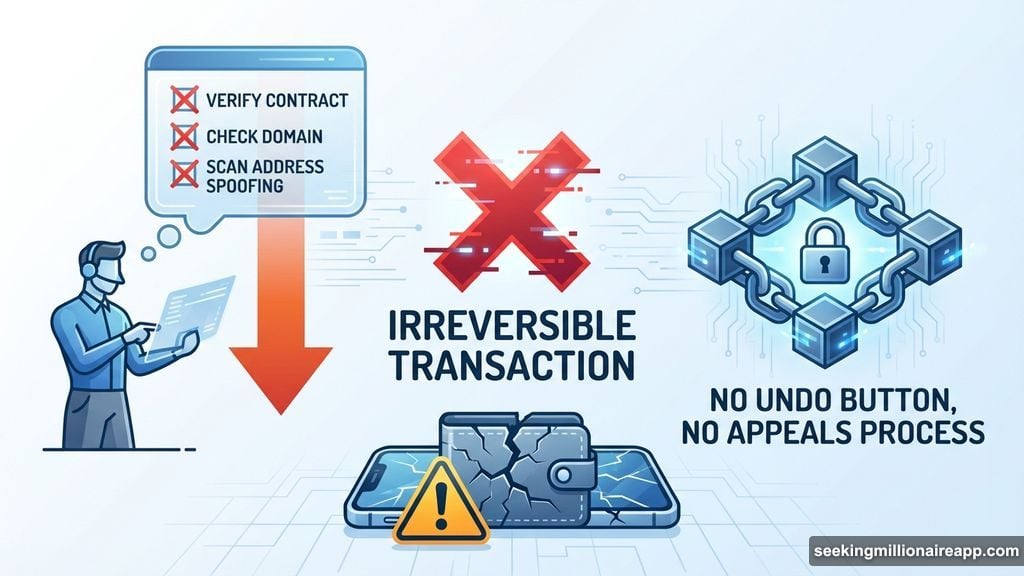

In a detailed post on X, he laid out the core argument. Blockchain systems are deterministic. They execute logic precisely and permanently, with no room for forgiveness, no undo button, and no appeals process. That’s not a flaw in the code. It’s the point.

Human brains, however, are wired for forgiveness. We make mistakes. We fatigue. We skip steps we know we should follow. As Qureshi put it: “We know we should verify the contract, double-check the domain, and scan for address spoofing. We know we should do all of it, every time. But we don’t. We’re human. And that’s the tell.”

Banking Was Built With Your Mistakes in Mind

To understand why crypto feels so foreign, it helps to look at what traditional banking actually is.

Banks aren’t elegant technology. They’re slow, expensive, and frustrating in their own ways. But they’ve been refined over hundreds of years specifically to handle human error. Fraud protection. Chargebacks. Dispute resolution. Account recovery. Every one of those features exists because humans mess up constantly, and the system adapted to absorb that reality.

Qureshi makes the contrast sharp and clear: “The bank, terrible as it is, was designed for humans. The banking system was specifically architected with human foibles and failure modes in mind, refined over hundreds of years. Banking is adapted to humans. Crypto is not.”

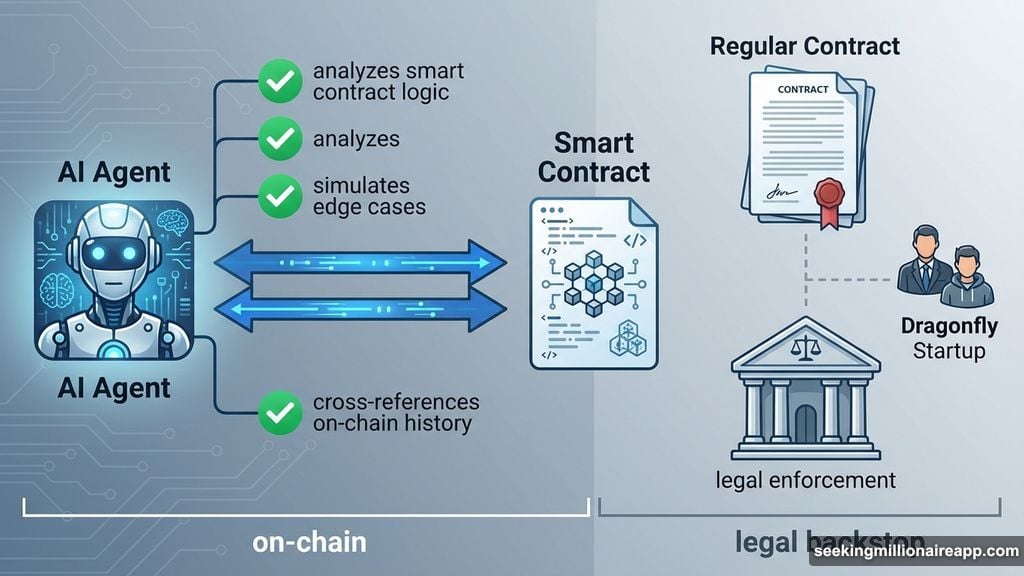

Even Dragonfly itself — a crypto-native investment firm — still uses traditional legal contracts when closing deals with startups. Not smart contracts. Regular contracts, often running alongside any on-chain agreements, because neither party feels safe without that legal backstop.

That’s not a technical critique of blockchain. It’s a social one. And it cuts deeper.

AI Agents Don’t Flinch at Blind Signing

So if crypto wasn’t built for humans, who was it built for?

Qureshi’s answer: AI agents. And when you think about it, the fit is almost suspiciously perfect.

AI agents don’t get tired. They don’t skip verification steps. They can analyze smart contract logic, simulate edge cases, cross-reference on-chain history, and execute transactions in milliseconds — without emotional hesitation, without fatigue, and without the cognitive shortcuts that make crypto dangerous for humans.

Long cryptographic addresses? No problem. Immutable transactions? That’s a feature, not a terrifying trap. Automated enforcement with no appeals? Exactly what a machine needs for reliable, predictable operation.

As Qureshi explained: “Crypto is self-contained, fully legible, and completely deterministic as a system of property rights around money. It’s everything an AI agent could want from a financial system. What we as humans see as rigid footguns, AI agents see as a well-written spec.”

That reframing is striking. Every friction point humans struggle with becomes an asset for machines.

The Self-Driving Wallet Future

Qureshi’s forecast for what comes next is bold. He predicts that the crypto interface of the future will look like a “self-driving wallet” — where AI agents handle all financial activity on your behalf. You set intentions. The agent handles execution, verification, and risk management.

Beyond personal finance, he sees autonomous agents transacting directly with each other. No humans involved. Crypto’s always-on, permissionless infrastructure becomes the backbone of a machine-to-machine economy. Banks and legal systems remain relevant for humans, while the deterministic world of blockchain quietly runs the machine layer underneath.

Bankless founder Ryan Adams echoes this view. He argues that what looks like terrible user experience for humans might actually be optimal design for AI agents. His prediction is even more specific: billions of AI agents, each with crypto wallets, eventually scaling into the trillions.

“AiFi is the next frontier of DeFi,” Adams wrote. “The dry tinder is quietly collecting but at some point it will ignite.”

Binance co-founder CZ put it even more plainly: “The native currency for AI agents is going to be crypto.”

The Comparison That Puts It All in Perspective

Qureshi is careful not to oversell the timeline. Big technological shifts almost always require complementary breakthroughs before they reach scale.

GPS existed for years before smartphones made it part of daily life. TCP/IP underpinned the internet long before browsers made it accessible to ordinary people. The technology sat ready, waiting for the right interface.

“For crypto,” Qureshi says, “we might just have found it in AI agents.”

It’s a compelling parallel. The infrastructure has been in place. The friction that made it feel wrong for human adoption might simply reflect the fact that the right interface hadn’t arrived yet.

This Thesis Has Real Limits, Too

It’s worth being honest about the counterarguments, because they matter.

Even if AI agents become the primary users of crypto, liability doesn’t disappear. When an autonomous agent makes a bad trade, loses funds, or exploits a protocol, a human or institution still bears the legal and financial consequences. That keeps traditional legal systems relevant regardless of how automated the execution layer becomes.

Smart contracts are also deterministic, but not infallible. Exploits happen. Governance failures happen. Systemic risk doesn’t vanish just because the code runs cleanly.

There’s also a bigger strategic question. If AI becomes the dominant interface for crypto, does the average person ever interact with blockchain directly? Or does it quietly fade into backend infrastructure — powerful but invisible — rather than becoming the parallel financial system its early advocates imagined?

That outcome might be perfectly fine from a utility standpoint. But it’s very different from the original vision.

The honest answer is that we don’t know yet how this plays out. But the machine-native thesis deserves serious attention, because it reframes a decade of “why isn’t crypto more usable?” into something much more interesting: maybe it was never supposed to be.