Something’s brewing beneath the surface. While most traders watch and wait, crypto whales just dropped millions into three specific tokens.

The Federal Reserve meets December 9-10. Markets are pricing in a 25 basis point rate cut at 94% probability. That’s liquidity coming back into play. And some whales aren’t waiting for the announcement to position themselves.

Let me show you what they’re buying and why the charts back up their moves.

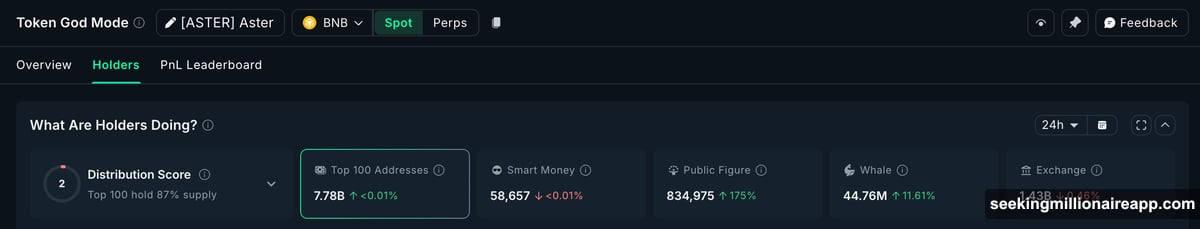

Aster Whales Add $4.34 Million Despite Price Drop

Aster is down 4% today and bleeding 10% over the past month. Yet whales just increased their holdings by 11.61%, stacking 4.67 million more ASTER tokens near $0.93.

That’s $4.34 million in fresh whale money flowing into weakness. This kind of accumulation during drawdowns often signals conviction that conditions flip once the Fed speaks.

The chart tells me why they’re buying. Between November 3 and December 7, Aster’s price formed a higher low while the RSI printed a lower low. That’s hidden bullish divergence, a technical setup that flags trend continuation when selling pressure fades.

This exact pattern showed up between November 3 and 29. Aster rallied 22% afterward. Whales remember. They’re betting it happens again if the Fed delivers that rate cut and risk appetite returns.

Plus, ASTER is coiling inside a triangle pattern. Price compression like this usually precedes larger moves. The first resistance sits at $1.01. Break that level and $1.08 opens up. A stronger push could stretch toward $1.40.

But this setup dies if Aster drops below $0.89. That would expose $0.84 and kill the bullish structure whales are playing.

Pippin Sees $9.75 Million Whale Accumulation in One Week

Pippin whales went aggressive. Holdings jumped 18.2% over the past seven days, adding 53.9 million PIPPIN tokens worth roughly $9.75 million at current prices.

Top 100 addresses also expanded positions by 3.96%. When both whales and mega holders accumulate during consolidation, it usually means they smell a move coming.

The chart structure backs that read. Pippin is up 3.06% today after a quiet week, yet it’s still riding a 400% gain over the past month. Right now, price action resembles a bull flag, the continuation pattern that forms when strong rallies pause to digest gains.

Whales positioning into this pause suggests they expect volatility after the Fed meeting. PIPPIN needs to reclaim $0.21 and $0.26 to confirm flag strength. The real breakout confirmation comes above $0.34, which has capped price since Pippin topped.

Price just broke the upper flag trendline. But I need a clean daily close above $0.21 before calling this confirmed. If PIPPIN slides under $0.14, the setup weakens. A drop below $0.10 breaks the flag completely and exposes support near $0.08.

For now, whales are treating this consolidation as opportunity, not exhaustion.

Chainlink Whales Stack 850,000 LINK as Divergence Forms

Chainlink whales increased holdings by 28.93% over seven days, adding roughly 850,000 LINK tokens. At current prices, that’s about $11.5 million in fresh whale capital.

Top 100 addresses boosted supply by 0.62% while exchange balances dropped 3.09%. Both data points hint at accumulation from whales and retail simultaneously.

The 12-hour chart shows why conviction is building. LINK is up 12.5% this week, riding a short-term uptrend. Between December 7 and 9, price formed a higher low while RSI made a lower low. Hidden bullish divergence again.

This pattern signals trend continuation because it shows selling pressure weakening even as price holds higher levels. For the setup to play out, LINK needs a clean break above $13.72 with a solid 12-hour close.

The bigger barrier sits at $14.19, which rejected LINK earlier this week. Break that level and LINK could stretch toward $14.95. Above that, next major resistance lands near $16.25.

If the market turns risk-off after the FOMC meeting, first support to watch is $12.97 at the 0.618 Fibonacci zone. Losing this level exposes $11.75, which has held as strong support since December 1.

Whales are adding while LINK prints hidden bullish divergence. That creates a setup where even modest liquidity boost from the Fed outcome can extend the current uptrend.

What This Accumulation Actually Means

These aren’t random buys. All three tokens share similar characteristics right now.

They’re consolidating or showing technical setups that historically precede larger moves. They’re all printing hidden bullish divergence on their respective timeframes. And whales are accumulating into weakness or consolidation rather than chasing rallies.

That’s smart positioning. If the Fed delivers the expected 25 basis point cut, liquidity conditions improve slightly. Risk assets typically respond first. Crypto often leads that response.

But here’s the catch. Markets are forward-looking. The rate cut is already priced in at 94% probability. So the real catalyst won’t be the cut itself. It’ll be Fed Chair Jerome Powell’s commentary about future policy path.

If Powell signals more cuts ahead, crypto could rip. If he sounds hawkish or data-dependent, we might see the classic “buy the rumor, sell the news” reaction. Whales understand this. They’re positioning for the scenario where sentiment improves, not guaranteeing it happens.

The technical setups on all three tokens support continuation if conditions turn favorable. But every setup includes invalidation levels. Aster breaks at $0.89. Pippin fails below $0.10. LINK loses structure under $11.75.

Watch those levels. They tell you when whales were wrong.

Rate Cuts Don’t Guarantee Crypto Rallies

One more thing worth noting. Rate cuts help crypto, but they’re not magic.

The last rate cut cycle in 2019 saw Bitcoin consolidate for months before rallying. The 2020 cuts came during COVID chaos when Bitcoin initially crashed before recovering. Context matters more than the cut itself.

Right now, crypto is down 1.1% ahead of the FOMC meeting. That’s caution, not conviction. If these whale buys prove prescient, we’ll see breakouts above the levels I mentioned. If they don’t, we’ll see those invalidation zones tested quickly.

I’m watching all three tokens closely. The accumulation data is real. The technical setups align. The catalyst timing makes sense. But nothing in crypto is guaranteed.

These whales are betting the Fed creates conditions for a year-end rally. Whether they’re right depends on what Powell says Wednesday, not just what the Fed does.

Position accordingly.